NFT stamp collecting is a dud

Whoever says that collectibles are the real use cases for NFTs are dead wrong, at least about stamps

Artwork by Molly Jane Zuckerman modified by Blockworks

Crypto stamp collecting should never, ever catch on.

My dad is a stamp collector. Last month, he expanded his stamp collection with something a little bit new — an NFT stamp, issued by the Austrian post office.

For those who don’t know, stamp collecting is a serious hobby. The most expensive stamp ever was issued in British Guiana in 1857 and sold at Sotheby’s for almost $9.5 million. The cheapest and easiest stamps for you to buy are at your local post office for around $.60. Somewhere in the middle are Crypto Stamps (of cryptostamp.com), which go for 9.90 euros ($10.82) each.

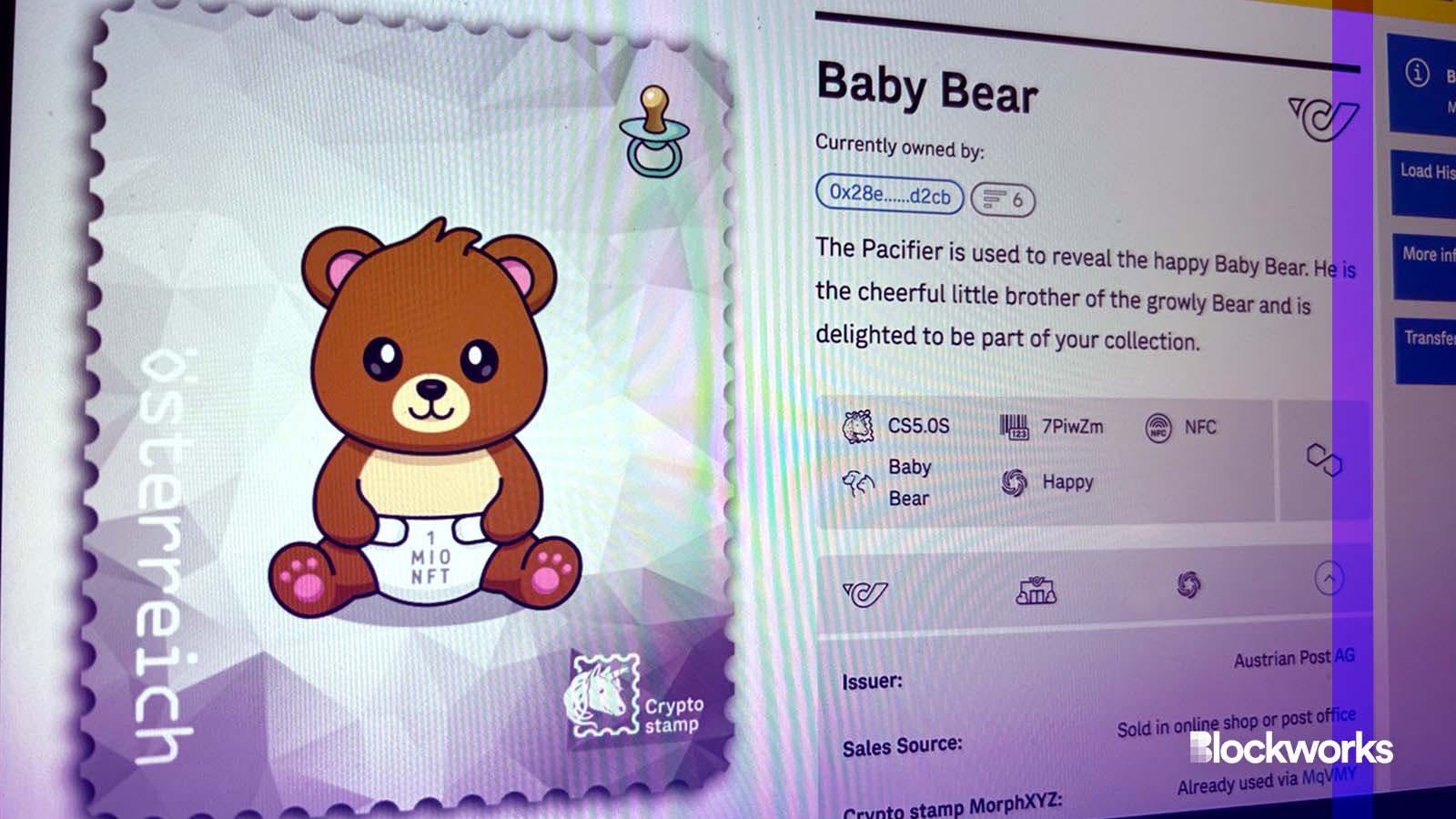

The website for Crypto Stamps, which are issued by the real Austrian post office, looks like the lowest level NFT scam site ever, weird capitalizations, poor English and all.

Case-in-point, under their roadmap for the bear Crypto Stamp that my father purchased, it reads:

This is a real screenshot from the Austrian post office’s Crypto Stamp website (automatically translated)

Regardless of looks, the Crypto Stamp did really arrive in the mail — a physical “twin” stamp for the NFT stamp that would live on the blockchain. You might read this and think, nice! This is a real-world example of an NFT use-case, combining collecting with the blockchain to add value and make use of blockchain’s immutability to improve upon a well-known hobby.

Some stamp collectors, or philatelists, feel the same way. One stamp blog I found wrote the following:

“One fact we have to face is that physical stamps may soon be confined to the same realms as LPs, books and DVDs […] If that happens then crypto-stamps might well hold the key to the future of philately.”

But after setting up my dad’s Crypto Stamp with him, I feel certain that this is all just a load of baloney.

The process of how to activate your Crypto Stamp leaves a lot to be desired. Despite the fact that my father printed out the five pages of instructions from the website and stapled them together (how Web1 of him), the guide on turning the little cardboard stamp (and the safe that evolves the stamp) he received into the mail into a blockchain-based NFT was nonsensical.

My plan had been to sit back, relax and watch an avid stamp collector collect his new NFT stamp.

The complexity of the process meant that I had to jump in — and even my five years of crypto journalism experience plus the several NFTs in my MetaMask wasn’t enough to actually get my dad his Crypto Stamp.

The first hurdle was realizing my dad didn’t know what private keys were. Luckily, I was around to stop him from uploading his Crypto Stamp private keys into the cloud for anyone to steal.

The second, and largest, hurdle was realizing that cryptostamp.com assumed that you already had a MetaMask wallet. No problem, we easily downloaded the browser version.

The third hurdle was that we had to open both the Crypto Stamp Safe and Stamp simultaneously and then click “morph” to turn the NFT from a baby bear to a baby bear holding a pacifier. (What this has to do with Austria’s post office, who knows.)

Read more from our opinion section: The US dollar? Yeah, that’s a Ponzi scheme

Unfortunately, after an hour and a half of playing around with the website, it proved to be absolutely impossible to get the baby bear Crypto Stamp to show up in MetaMask. At first, I thought that the lag was due to slow block times on Polygon’s network — or as my dad put it, “Are crypto miners in Mongolia going, hmmmm, time to make Zuckerman’s NFT stamp?”

Eventually, I realized it was because the website itself must be broken in some fundamental way. Or they didn’t give us enough information to finish the job. Or we didn’t MetaMask correctly. Who knows.

While I’m an out and proud crypto skeptic, I did always think that NFTs had some value if they were used by industries where they could fit right in — like collecting Pokemon cards…or stamps.

The main takeaway from this playful experiment of a stamp collector attempting to collect an NFT stamp is not just that the whole process was prohibitively confusing, but that the NFT stamp itself didn’t seem to spark the same amount of joy as a regular stamp did for a true philatelist.

And while not all stamps are used to mail letters — as my father told me, some post offices specifically put out collectible Elvis or Princess Di stamps to collect that pure profit — an NFT collectible stamp seems to have even less utility than a real collectible stamp. Not only can you not mail a letter with it if you wanted to, you spend hours on a computer trying to make sense of toggling between Ethereum and Polygon on MetaMask.

Both types of stamps were never meant to be mailed, but the NFT version sucked all of the pleasure out of stamp collecting. Adding a digital baby bear stamp to your collection shouldn’t be eons harder than sticking a physical stamp in a book.

Later that night, we checked MetaMask again to see if the baby bear had made over the Web3 airwaves yet, or somehow gotten “stuck in Web2,” as my dad said. Nothing.

My stamp collecting father’s final words on the matter are reminiscent of how many NFT collectors probably feel now that the market has so thoroughly bottomed out — “I had a lot of fun with you, but what do I have at the end?”

Still nothing.

I don’t care much about tech, I don’t care a whole lot about finance, either. I care about writing stories and watching weird things unfold. And that’s why I’ve ended up in crypto.

But because I’m missing that passion for what crypto and blockchain are all about — finance, tech, privacy, yadda yadda — I’m going to write instead about what I am actually interested in. Everything about crypto that has very little to do with crypto.

That’s what this column will be about. All the tangential stories that come out of the blockchain and crypto space, what I think about them, and how I navigate it all as a skeptical former Russian literature major.

It’s precisely my perch as an outsider that lets me do what I do: Opine on all sides of any crypto issue, no strings attached, no skin in the game.

If you want to talk crypto with me, let’s go off topic.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.