Paradigm Researcher Intros Way to Offer NFT Holders Liquidity, Protection Against Price Fluctuation

Theoretical ‘floor perpetuals’ could allow these benefits without requiring owners to give up their NFTs

Awful Hot Ocelots by Chelsea Myers

- As new investing tools around NFTs arise, the need for better education in the sector becomes more pressing, according to Unstoppable Domains CEO

- The biggest problems aspiring floor perpetual protocols will have to solve are index reliability and spot NFT floor liquidity, Paradigm’s David White says

A research partner at San Francisco-based crypto investment firm Paradigm has introduced the idea of a synthetic NFT that tracks the floor price of a given project and can be minted by locking up NFTs from that project.

Dubbed floor perpetuals, these give NFT holders access to liquidity and protection against fluctuations in the floor price without requiring them to give up ownership of their NFTs, Dave White wrote in a paper published last week.

A perpetual contract is one that has no expiry date and no restrictions on when it can be exercised. Like perpetual futures, these floor perpetuals would also provide other market participants with leveraged long and short exposure to NFT floor prices, White explained.

Paradigm backs disruptive crypto companies, protocols, and currencies with as little as $1 million and as much as $100 million, according to its website.

A spokesperson for the firm did not immediately respond to Blockworks’ request for comment.

How floor perps work

White explained in a tweet thread how NFT floor perps could work using a fictional project based on the Awful Hot Ocelots by artist Chelsea Myers.

Though investors could try to fractionalize an NFT, unrecognized ones may be hard to sell shares of, White explained. An investor may also believe the NFT they own is underpriced relative to the floor and might not want to give up any of their relative upside.

To solve for this, an NFT owner could create floor perps and sell them to a market maker at the current floor price. The market maker would in turn sell those perps to traders who want exposure to the NFTs from that project.

If the floor later drops, the original seller could buy them back for that lower price. The value gained from that transaction could offset the likely lowered value of the NFTs, as if the floor had never fallen.

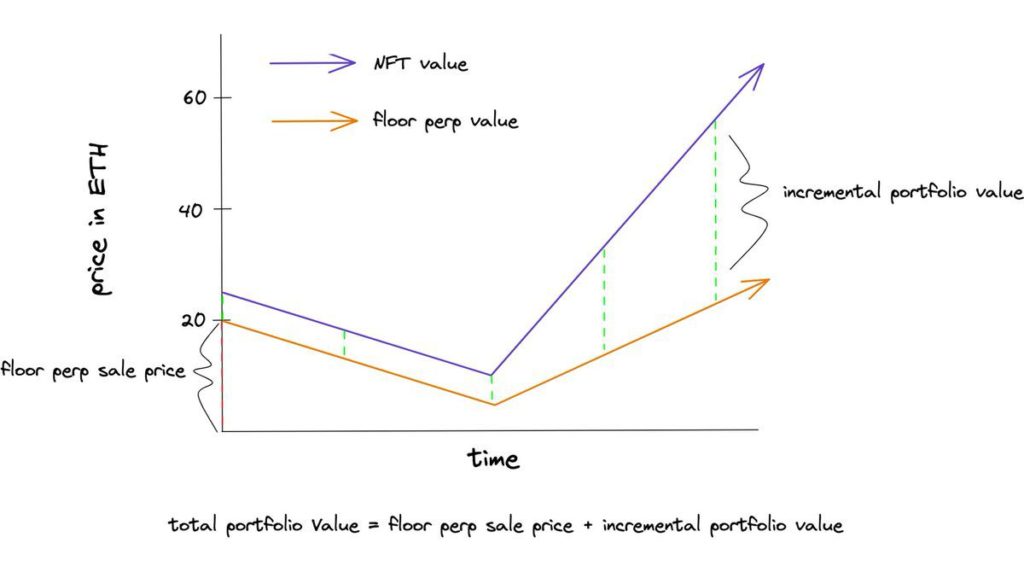

If the floor goes up, buying them back would result in a loss, White adds. But if the NFT price has risen relative to the floor, then the owner can still gain (see chart below).

Source: Paradigm Research

Source: Paradigm Research“Illiquid floor NFT markets and volatile index prices are likely the largest barriers to making floor perps a reality, as the market for floor perps may grow to be many multiples of the size of the present market for the underlying floor NFTs,” White wrote in the paper. “An unreliable index could increase liquidation risk, inaccurately represent collateral liquidation value, or become an attractive target for manipulation.”

A floor perp protocol would have to solve how to better measure floor prices and improve liquidity in the spot floor NFT market, he added. One possibility for a growing floor perp exchange would be to somehow incentivize participation in local spot floor NFT exchanges, White noted.

Booming NFT market

White’s paper comes as the NFT market has boomed in recent weeks. OpenSea, the largest NFT marketplace, hit $3 billion in monthly volume, or 925,000 ETH, in August. A number of CryptoPunk NFTs, a series of 10,000 collectible characters, have sold for multi-million-dollar figures.

Matthew Gould, CEO of Unstoppable Domains, said that as NFT prices and volumes reach all-time highs, it’s natural that new financial products will emerge to allow traders to invest in more sophisticated ways.“

The main challenge here is that as new investing tools arise, the need for better education in the sector becomes more pressing,” he told Blockworks. “With an influx of new NFT investors in the space, my hope is that they do their own research, and that NFT marketplaces, crypto exchanges, and other services provide the resources to help people invest responsibly.”

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.