Empire Newsletter: Privacy coins sacrificed so crypto could run

Plus, is crypto regulation really worth it?

Christophe Licoppe/Shutterstock modified by Blockworks

Rest in Privacy

The world tends to move slowly on crypto regulation — but the cumulative effect on investor bags can be huge.

Privacy coins are, on the surface, a case in point. Rolling bans and delistings over the past six years have placed some of the largest projects on the outs.

The European Union’s Markets in Crypto Assets Act (MiCA) framework, which came into effect last year but will be enforced at the end of 2024, is really a capstone on the governmental anti-privacy coin movement.

Authorities have gone after developers of privacy protocols Tornado Cash, Samourai Wallet and Blender — including arrests and a prison sentence. Regulators and other agencies have instead targeted privacy coins at the business layer.

MiCA outright bars crypto service providers (which includes exchanges and other payment services) from having anything to do with privacy unless the holders can be identified. The same goes for credit and financial institutions.

That has been enough for crypto exchanges operating in the EU to largely drop cryptocurrencies tied to protocols with built-in privacy features. Binance delisted monero earlier this year, having initially pledged to restrict trading in EU countries last year before walking that statement back two weeks later.

OKX dropped a number of privacy coins when it delisted nearly two dozen tokens in December, while Kraken will stop supporting them in Ireland and Belgium next week, after suspending trade and deposits in May. Such delistings carry on from moves made by crypto platforms including Coinbase UK and Shapeshift going right back to 2018.

Other avenues for acquiring privacy coins are drying up alongside their trading volumes. LocalMonero — a platform for selling XMR peer-to-peer without providing identification — announced it was shutting down in May, having operated for almost seven years.

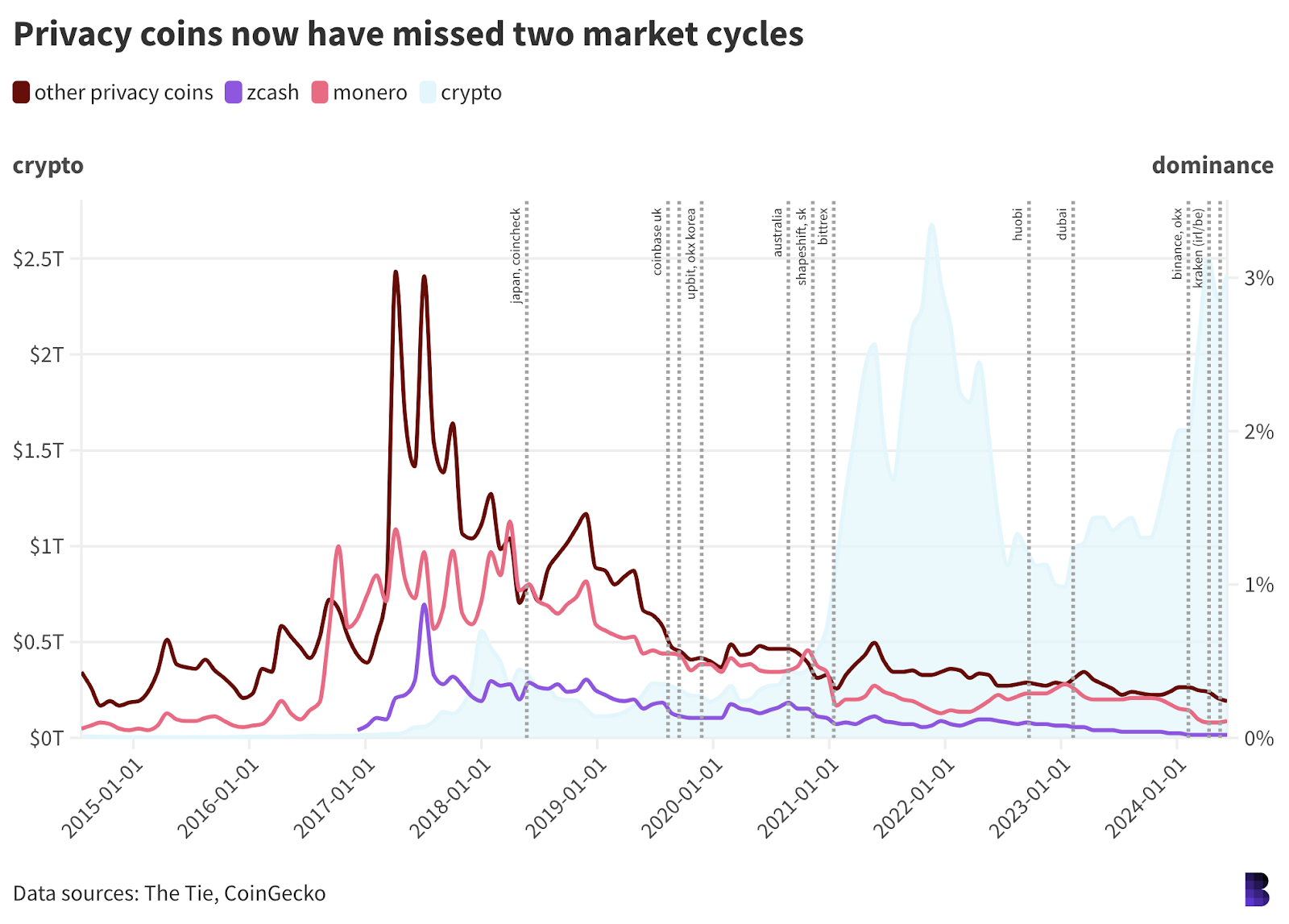

Privacy coin dominance has, perhaps unsurprisingly, shrunk with each market cycle since the first delistings occurred in Japan.

Privacy coins have diminished as regulatory pressure has ramped up

Privacy coins have diminished as regulatory pressure has ramped up

Monero, zcash and a handful of others actually enjoyed their heyday in mid-2017 — about six months before crypto peaked on the back of the ICO boom, topping out at about 5% of the total market.

Now, they make up less than half a percent of the crypto market. Monero (XMR) is the only privacy coin featured in the top-100 right now, also the only one with a market cap above $1 billion.

(For what it’s worth, activity on the Monero blockchain has grown steadily over the past few years, even with all the regulatory pressure. One theory among many is that XMR trading may have been pushed toward atomic swaps in lieu of offchain crypto exchange pairs.)

It could be that the shrinking market share of privacy coins has more to do with monero, zcash and dash falling out of fashion, and less to do with regulators.

Perhaps that has left little room for the monolithic privacy blockchains, powered by a whole separate cryptocurrency, to attract venture capital interest to those ecosystems.

There are exceptions, but interest around the next wave of blockchain privacy has also moved toward baking in zero-knowledge proofs at the protocol level, in many cases through layer-2 solutions.

I worry that it’s only a matter of time until regulators cotton on and rain on that parade, too.

— David Canellis

Data Center

- BTC was cut short from another shot at all-time high by hot US jobs data this morning, quickly sinking below $71,000.

- Open interest on BTC futures at centralized exchanges has meanwhile never been higher, now at $37.73 billion.

- ETH open interest is just below its recent record, with $16.33 billion.

- Base memecoin BRETT has extended its rally by another 24%. It’s now the seventh-largest memecoin behind BONK, worth $1.75 billion compared to $2.11 billion.

- Ethereum’s validator count is back to record highs after gaining 10,000 in the past week.

A new sheriff in town

Watch out, y’all.

We’re just a few weeks away from part of MiCA going into effect over in Europe.

While the broader regulation won’t be enforced until the end of the year, the June 30 deadline will impact stablecoins. Binance said it plans to abide by the new set of regulations and that it’d be restricting access to so-called unauthorized stablecoins.

Here’s the deal: The European Economic Area (EEA) will only allow some regulated companies to both issue and offer their stablecoins to the public, which will be known as regulated stablecoins.

Others will be referred to, at least by Binance, as “unauthorized stablecoins” because they don’t fall under the above category. They’ll also face some restrictions.

“Currently there are few Regulated Stablecoins with limited liquidity that may not be sufficient to support sudden demand across the industry. Over the coming months, we expect to see more Regulated Stablecoins available in the market, which will allow for the market to fully switch to Regulated Stablecoins over time, ensuring that the objectives of MiCA are fulfilled,” the exchange said in the post.

Obviously, not everyone’s happy about these changes. Tether CEO Paolo Ardoino told The Block earlier this week that he’s “concerned” about some of the MiCA requirements.

Other firms, such as Paris-based Lugh, are jumping ship. The firm announced it’s ending the issuance of its stablecoin offering in light of the new regulation.

“Due to the upcoming entry into force of MiCA and in accordance with its commitment to compliance, LUGH announces the cessation of the issuance of its stablecoin EURL and guarantees the redemption of existing EURLs until August 30, 2024,” the firm said on its site.

In all fairness, the firm’s euro-based stablecoin doesn’t hold a candle to the might of Tether’s billion-dollar stablecoin empire, with DeFiLlama pegging its market cap at a mere $34,726.

Any transition from limited regulation to stricter rules is going to be uncomfortable for the firms trying to work around the rules with little to no disruption.

And, because this is actually a smaller segment of the overall crypto market (don’t get me wrong, powerhouses like Tether and Circle are still heavyweights), many other firms have a few more months to get their ducks in a row.

But MiCA is (partially) here. It’s going to set the tone for how crypto is regulated in the EU — where firms are (thankfully) not exposed to the same regulation-by-enforcement approach that US firms are up against.

— Katherine Ross

The Works

- Franklin Templeton enabled USDC conversions on its Benji Investments Platform.

- Scammers appear to have accessed Hulk Hogan’s X account and promoted a fake HULK token.

- Crypto exchange Kraken is in talks for pre-IPO funding, Bloomberg reported.

- Amid GameStop stock surges and memecoin pumps, Roaring Kitty’s YouTube channel has a livestream set for today at noon ET.

- Core Scientific rejected CoreWeave’s $1 billion buyout bid, Blockworks’ Ben Strack reported.

The Morning Riff

Q: Is crypto regulation really worth it?

I go back and forth on this. On one hand, the only crypto stuff that’s interesting at all is that which is impervious to regulators: immaculately conceived and decentralized, to the point there’s no room for the SEC — or anyone else — to stop it.

But going back to the monero example, it’s obvious that regulatory pressure has, at least in part, made it easier for the market to move on to other things. Projects that can be listed on crypto exchanges, for one.

Whether we know it or not, we are all here in the pursuit of financial agency. Nobody can dictate what we can do with our digital assets, and privacy coins were in many respects crypto’s first major stand in support of that vision.

Was their sacrifice necessary? I’m not sure I’d agree. It’s just not clear crypto ever had a choice.

— David Canellis

Yes.

It’s pretty obvious at this point that crypto can’t just operate in a vacuum away from other financial systems. And, if the industry wants to grow, there have to be ways for crypto firms to interact with other companies, whether financial institutions or mom-and-pop shops in small towns.

That means regulation. For crypto to claim its seat at the grown-up table and be taken seriously by other sectors and governments, it’ll have to abide by regulations. The rules will also hopefully garner trust for the types of folks who weren’t wooed by the prospect of bitcoin 10 years ago, but now want to add a little to their portfolios.

No one’s exempt from these laws, and — while there are instances where this may not be the case — regulation is meant to protect consumers. Maybe that’s slightly idealistic, but that’s the goal… to me at least.

— Katherine Ross

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.