Empire Newsletter: The SEC still has it in for Consensys

Plus, Ethereum’s layer-2 landscape

Tada Images/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

The big question

I’ve combed through pages and pages of legalese so that you (hopefully) don’t have to.

Friday saw two different filings: The SEC’s expected suit against Consensys and Judge Amy Berman Jackson’s tossing of most of Binance’s motion to dismiss in the SEC’s case against the exchange.

I want to focus on the former today specifically because of staking.

ICYMI (though I don’t know how you would have, honestly) the SEC finally filed its formal suit against Consensys, one of the main pillars of Ethereum ecosystem development. Consensys, in its own suit against the SEC, said it received a Wells notice focused on staking and swaps, which basically teased what the SEC could say in a filing against the firm.

The filing Friday also shows that the SEC targeted Ethereum staking services Lido and Rocket Pool. Both of which are used by Consensys’ flagship app MetaMask for its staking services.

Interesting timing, considering the SEC had effectively given up its fight to claim ETH as a security only earlier this month by ending a separate investigation into Consensys and approving the 19b-4’s for ETH ETFs.

The SEC is clearly going after staking, and it’s not just Consensys that’s caught in the crossfire. A slew of the hopeful ETH ETF issuers added staking language to their registration statements earlier this year, but have since removed that language following their back-and-forth conversations with the SEC.

Even the two registration statements from VanEck and 21Shares for potential solana ETFs didn’t include staking language.

To be clear, this isn’t the first time that the SEC has targeted staking. We saw it last summer in its suit against Coinbase and it settled with Kraken over staking services last year.

Last summer, Coinbase ended staking services in some states after some state regulators said the services violated multiple securities laws.

But prior to that, Chief Legal Officer Paul Grewal penned a post explaining why Coinbase doesn’t believe that staking meets the expectations of Howey and is therefore not a security.

In a nutshell, he argued that with Coinbase’s staking services, users retain ownership of the staked asset at all times, the assets are staked on decentralized networks and there’s no reasonable expectation of profits.

The SEC, according to the Friday filing, however disagrees with that last point directly.

“The Lido and Rocket Pool staking programs are each offered and sold as investment contracts and, therefore, securities. Specifically, as described in more detail below, investors make an investment of ETH in a common enterprise with a reasonable expectation of profits from the managerial efforts of Lido and Rocket Pool, respectively,” the SEC wrote.

“In Coinbase and Consensys lawsuits, SEC spins staking services as ‘programs’ where stakers allocate funds to a pool managed by an operator w/ discretionary authority who deploys the funds to earn returns for stakers. This is a warped characterization of technical services,” Michael Selig, a partner at Wilkie Farr & Gallagher, posted on X.

And I’ve only just focused on staking. There are other troubles: The SEC also alleged that Consensys operates as an unregistered broker by offering token swaps directly through MetaMask.

These allegations echo a part of the Coinbase suit, except that Judge Katherine Polk Failla handed the firm a little win earlier this year when she said that Coinbase didn’t act as an unregistered brokerage in its own offering.

Consensys, for its part, seems very confident that it’s ready to take on the SEC, much like Coinbase has been. And this is where I remind you that the Consensys suit fell right into that timeline I previously wrote about. If the same schedule repeats, it’s pretty likely that we see suits against both Robinhood and Uniswap sometime this summer.

To [offer to] stake or not to [offer to] stake is now the question on everyone’s mind. Unless you’re the SEC, of course.

— Katherine Ross

P.S. David and I need your help. Fill out this survey and help us produce journalism tailored to you and your interests.

Data Center

- There’s almost 33.29 million ETH ($115 billion) staked to the blockchain, almost 28% of the supply.

- About 25% of ETH staked is through centralized exchanges, led by Coinbase with 4.3 million ETH ($14.9 billion) and followed by Binance and Kraken.

- DEX volumes have fallen for three months in a row, reaching $152.22 billion in June, down from $179.31 billion in May.

- BTC and ETH are both up 2% today, sitting at $62,740 and $3,460, respectively.

- ENS is the top-end’s best performer, gaining 21% over the past 24 hours and 41% in the past week. A new update for the domain name protocol is on the horizon.

Layer cake

A layer-2 a day keeps the Ethereum killers away.

Yet another L2 was announced late last week: MegaETH, a proposed blockchain network that could process transactions in real-time, or at least, fast enough to rival Web2 internet infrastructure.

The team hopes to have a testnet live within a few months, with a mission of producing a network handling 100,000 transactions per second and responding to requests in milliseconds.

“Our goal is to push the performance of Ethereum L2s to hardware limits, bridging the gap between blockchains and traditional cloud computing servers,” says the team.

Ethereum manages about 13 transactions per second while existing L2s Optimism, Blast and Base top out after a few hundred. So, if MegaETH can figure out how to do what it says, then it would truly be a gamechanger.

There are lofty goals and then there’s MegaETH’s target

There are lofty goals and then there’s MegaETH’s target

MegaETH’s $20 million seed round was led by Dragonfly Capital with participation from a slew of other VCs, alongside Ethereum co-founders Vitalik Buterin and Joseph Lubin and EigenLayer’s Sreeram Kannan.

The network is set to utilize both the Ethereum mainnet and EigenLayer’s proof-of-concept data availability layer, EigenDA, to streamline consensus and execution.

At this point, some layer-2 fatigue can be forgiven. There are now 58 different Ethereum L2s live with another 53 in the can, and even an additional 17 layer-3 projects operating in their orbit.

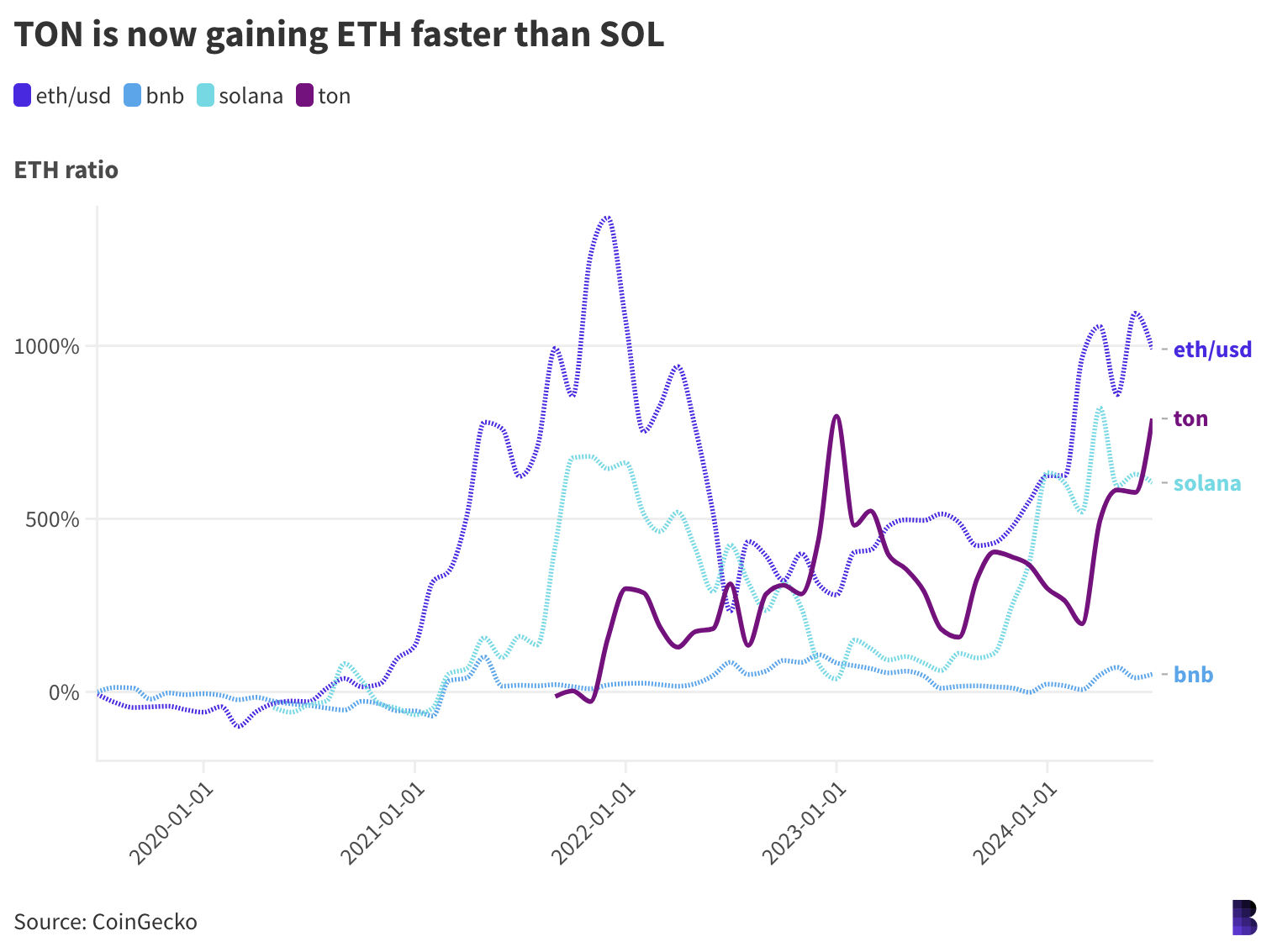

It’s that extensive and well-funded development ecosystem that makes Ethereum so compelling. But while ETH has lost about 12% against bitcoin over the past year — meaning it was better to hold bitcoin than ether over that period — tokens tied to Ethereum rivals haven’t done so hot against ETH.

Nearly two dozen native cryptocurrencies for blockchains are out to eat Ethereum’s lunch. Only six have outperformed ETH since their launch: ton, solana, injective, fantom and bnb.

TON’s market cap is still much smaller than SOL and BNB’s, which accounts for some overperformance

TON’s market cap is still much smaller than SOL and BNB’s, which accounts for some overperformance

An honorable mention goes to sei, which has boosted its ETH ratio by 1.7% since its launch last August.

ETH ratios for the other 15 have, on average, lost 75% since their first trading day. Algorand, internet computer, hedera, cosmos, cronos and stellar have all lost over 85%.

So, while it’s fun to talk about which network could be the first to flip Ethereum, it might pay to remember the speed at which new networks — and funding — are thrown at Ethereum’s scaling challenges. One might eventually stick.

— David Canellis

The Works

- The SEC’s case against Binance can mostly proceed, a judge ruled.

- Sentiment for bitcoin ETPs seems to be changing, Coinshares noted in its flows report.

- Sony Group bought Amber Exchange in Japan, marking its official entrance into the crypto space, Wu Blockchain’s Colin Wu reported.

- Also in Japan, Metaplanet added 20 bitcoin to its stash for roughly $1.2 million.

- Pump.fun’s cumulative revenue surpassed $50 million, The Block reported.

The Riff

Q: What’s the most important thing on crypto’s horizon?

On a technical level, new clients for Ethereum and Solana from Paradigm and Jump Crypto are arguably the most critical developments for Web3 over the short term.

Both offerings are set to move the needle on throughput, decentralization and overall buildability. All things that would help speed up the process of DeFi eating TradFi, as well as boost the odds that crypto produces new killer apps.

At the social level, the US election in November is no. 1. Crypto has yet to take center stage, but it feels inevitable that it will, at some point, even if fleeting.

Prepare for things to get weird before they get better.

— David Canellis

All of these legal cases. We have Ripple coming to the very end of its years-long legal battle, both Binance and Coinbase continue to fight after losing their pushes for a motion to dismiss in their respective cases, and now we have Consensys.

Not to mention, as I wrote above, it’s likely we will see suits against both Robinhood and Uniswap in the next few months.

That’s a lot of legal battles focused on intertwined subjects. Crypto needs clarity, that much is painfully obvious. Until we see more of that — either in the courts or through policy — it’ll be hard to move forward and innovate.

I wish I had a better answer for you, but for now we remain tied up in legal limbo.

— Katherine Ross

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.