The Decline of Crypto Market Liquidity: Causes and Potential for Recovery

FTX’s collapse, exchange fees and the pullback by certain market makers have contributed, and a rebound could hinge on regulation and other macro factors

fortton/Shutterstock modified by Blockworks

Liquidity in crypto markets has gone down in recent months. By a lot.

According to industry watchers, various factors have created a perfect storm of sorts. Predicting details about a potential bounce-back can be tough due to the relative youth of the sector and the uncertainties surrounding regulatory and macroeconomic factors.

Gordon Grant, co-head of trading at Genesis Trading, noted that there has been “a material reduction in spot market and linear derivatives liquidity” over the past year.

He attributed the liquidity drop to the elimination of fiat on- and off-ramps, the pullback by various market makers and the removal of certain incentive programs on major venues.

“The collapse in order book depth pre- and post-FTX is particularly noticeable,” he told Blockworks.

Beimnet Abebe, the director of principal trading at Galaxy Digital, agreed that the collapse of FTX, and its subsequent bankruptcy last November, has contributed to the “definitely deteriorated” level of crypto liquidity.

“FTX was close to 30% of USD volume and 25% of perp volume in mid-2022, and many smaller exchanges have also experienced troubles amid regulatory concerns,” he told Blockworks. “Meanwhile, market makers have downsized or left the space, so top-of-book liquidity has worsened.”

Market-making firms Jane Street and Jump Crypto were set to scale back digital assets trading in the US due to regulatory uncertainty, Bloomberg reported last week.

These changes have caused a shift in volumes from centralized exchanges to futures traded on the Chicago Mercantile Exchange (CME), showing investors are concerned about centralized credit risk, Abebe said.

The average daily open interest for CME Group’s bitcoin futures and options reached an all-time high of 24,094 contracts during the first quarter. The derivatives marketplace is set to expand its crypto product lineup next week.

“They’re willing to pay a premium to trade the CME exchange-listed futures for exposure rather than holding the tokens themselves on an exchange,” Abebe said.

Regulatory crackdown, fees and crypto’s “infancy”

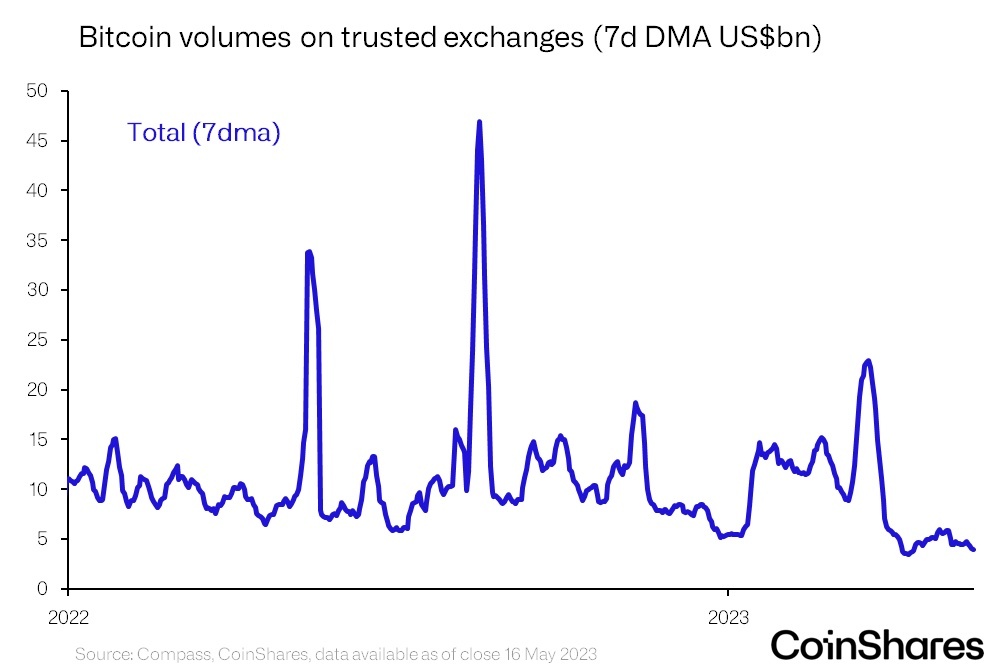

Though the year-to-date average for bitcoin on trusted exchanges is $11.4 billion per day, it was roughly $6 billion on Monday, according to CoinShares Research Head James Butterfill.

The CoinShares data reflects bitcoin on 23 exchanges on which the firm has verified no wash trading occurs.

Source: CoinShares

Source: CoinShares

Butterfill said the drop is due in part to the regulatory crackdown in the US, which he said has made it harder for traders to hold certain stablecoins.

Binance has also reintroduced fees, Butterfill added, which has led to a dramatic drop in stablecoin use. Stablecoin market share has fallen from 35% at its peak to roughly 10% today, he added.

Cristina Polizu, managing director of S&P Global Ratings, said that while some of the decline in crypto liquidity can be attributed to the implosion of FTX and its ripple effects within the crypto lending space, the exact cause is hard to pinpoint.

Crypto markets remain relatively young and behave differently than traditional assets, she added. In addition to supply and demand dynamics, crypto is highly impacted by regulation, market confidence, adoption and its underlying technology.

Frequent and abrupt evolutions in any of these areas — given the sector’s “infancy” — can be expected, and will affect liquidity and volumes, Polizu noted.

“General uneasiness about the crypto ecosystem and its risks and governance is still pervasive, and that’s not very conducive for high volumes of trading and involvement by the market at large,” she said.

Looking ahead

Regulation is expected to play a major part in the fate of crypto market liquidity.

The landscape could worsen if the US regulatory posture toward crypto remains as hawkish as it is now, Grant said.

“At the same time, the international backdrop would be likely to improve if we continue to see a trend of leading financial hubs such as Hong Kong and Dubai pivot materially toward crypto,” he added. “[This creates] a further divide between the world that embraces a freer future for digital assets and one that has taken an increasingly acrimonious stance towards them.”

Coinbase has sought to diversify its business geographically, for example, as it gets set for a potential legal battle with the SEC. The chief strategy officer at Binance — a company sued by the CFTC in March — said the lack of crypto regulations in the US makes it hard to do business in the country.

“We expect volumes and liquidity to improve, as exchanges push to expand overseas,” Galaxy’s Abebe said.

Butterfill said though the initial shock of exchange transaction fees had a big impact, he expects users to get used to it.

“We are already seeing a slow recovery despite daily volumes remaining well below the year average,” he explained. Furthermore, as the US Federal Reserve begins cutting rates, the US dollar is likely to weaken and in turn will improve the attractiveness of bitcoin, likely leading to great trading activity.”

The Fed raised the federal funds rate by 25 basis points earlier this month — down from 0.5% and 0.75% rate increases seen throughout much of 2022. Chair Jerome Powell said the Fed would be “prepared to do more” if necessary.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.