Is Robinhood the Devil in Sheep’s Clothing?

“Vengeance and retribution require a long time; it is the rule.” – Charles Dickens, A Tale of Two Cities One of my favorite things Peter Thiel says is, “Things mean their opposites all the time.” Let’s be honest, as humans, we […]

“Vengeance and retribution require a long time; it is the rule.” – Charles Dickens, A Tale of Two Cities

One of my favorite things Peter Thiel says is, “Things mean their opposites all the time.”

Let’s be honest, as humans, we are all hypocrites in one way or another. BUT, I am utterly fascinated the further out you go on the spectrum of extreme, you get the biggest hypocrites of all.

So who wins the biggest hypocrite-of-the-year award YTD in 2021?!

Survey says…..ROBINHOOD!

In Layman’s Terms, What The Heck Does Robinhood Do?

Robinhood fancies themselves as commission free trading which is giving normal people free access to the stock market. They are the Facebook of the financial world. You think it’s free, but your data ends up being sold to another big business who profits off of it more than you do.

For Zuckerberg, he sells all your data to businesses across the world. For Robinhood, they sell your data to Ken Griffin and other High Frequency Trading shops. You could write a book on the nuances of it, but let’s leave it there for now.

Why Does This Matter So Much?

As Facebook and (anti)social media grew too large, it has created mass hysterias. Neuroscientist and philosopher, Sam Harris, speaks on his podcast about humans losing sense of their rationality. Because of the constant propaganda being thrown on social media, humans are having a hard time deciphering truths and often create false realities.

Humans end up giving their attention to the most extreme personalities (watch the Tekashi69 Documentary on HBO) and the values of balance and a middle class lifestyle go out the door.

In the same way that Facebook has distorted human perception, Robinhood is doing this to capital markets, which might be even scarier. If no one knows the value of things, then how do we attempt to live in a civilized society and trade value for value?

Stan Druckenmiller has said that there should be some sort of hurdle rate for investment into the market. Perhaps this is what he saw coming?

We’ve Scaled America Too Much

One of the words that I am shorting over the next five years is ‘scale’. One of the words that will likely replace it is ‘balance’. With balance, you get real growth and real innovation. You accept the fact you are human and fallible while constantly trying to learn from your failures. With scale, you just want to control things as fast as you can at the expense of the herd.

The Front Lines

I worked as a trader for 12 years before tapping out and realizing my job was getting eaten alive by algorithms & high-frequency-trading. I tried to out-hustle it, but the incentive to make things cheaper for the end consumer to buy stocks inevitably won.

As a free market capitalist, I have to give passive investment, HFT & Robinhood some major props. What they did was brilliant, but I can’t help but ask myself whether we’ve sacrificed social stability in that pursuit of scale.

Behind closed doors, I know they are concerned and they can’t unwind what they’ve built. I get messages from Wall Street friends everyday now who can’t openly speak about it, but know how messed up the capital markets are.

The End Game

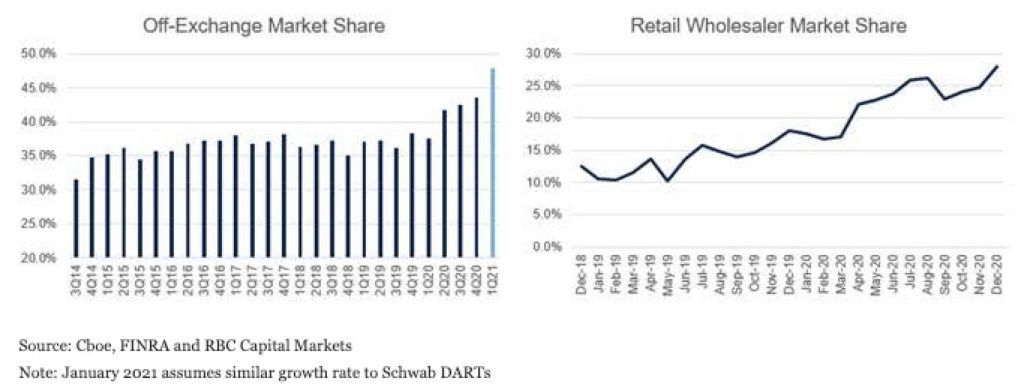

With retail equity and call buying at all time records, liquidity could get funky if pay-for-order flow providers pull back at all. CEO’s at Schwab, TD and Virtu will likely try to distance themselves from that model.

In the interim, Robinhood will likely do a nice round of mea-culpas with the best PR firms on the market and apologize to everyone about the GameStop situation. The big VC’s on Robinhood’s cap table who are obsessed with scale will make their calls into Washington.

Back in Washington, they’ve found a company to crucify who turned out to be even bigger hypocrites than they are. Quite the bi-partisan cause!

Something tells me the politicians found the perfect poster child to ignite the next stage of The Fourth Turning. When Robinhood somehow squeezes out their IPO, it will mark the top in this long-term cycle of inequality, centralization and scale.

Perhaps I’ll get my job back trading in a couple years as people finally give a sh*t about market structure. But hey, I’m kinda enjoying this writing thing now!

This take comes from our Daily Newsletter. Get premium market insights every evening at 7 PM EST. Sign up now.