The Investor’s Guide to Crypto Correlation

Correlation, in the crypto and the traditional finance industry, is the degree in which asset prices move together or against each other

Artwork by Crystal Le

The need to understand how different asset classes behave is a foundational principle for hands-on investing. And when new financial assets like crypto currencies, NFTs and synthetics are created, analyzing price correlation measurements is the first step to understanding their behavior.

Key Takeaways:

- Learning the role of price correlation is an fundamental concept for investors to minimize risk and maximize returns

- The historical correlation between crypto and conventional assets like the nasdaq is more complicated than it may seem

- While bitcoin and Ethereum have historically been closely correlated, investors are watching closely to see if this may be changing post-Merge

The basics: What is crypto correlation?

Correlation, in the crypto and the traditional finance industry, is the degree in which asset prices move together (positive correlation) or against each other (negative correlation). The exact measurement is referred to as the correlation coefficient and always falls between a negative and positive spectrum of -1.0 to +1.0.

To start with: a simple example. The price of commodities like gold and oil rise usually rise while the price of high-risk equities tumble. That’s because in uncertain times, many people and institutions would rather own gold than riskier asset classes such as individual stocks. It doesn’t mean that there’s an inherent strength or weakness with either one of these assets in “normal times,” it simply means different investors have different theses depending on countless factors.

On the other hand, understanding positive correlation can be useful for investors to add exposure to specific areas of interest within their investment portfolio without investing directly in the asset itself. For example, many investors want exposure to digital assets but may not want to hold those assets directly. As a way to accomplish this, they may research the equities with a highly positive correlation to cryptocurrencies and purchase those instead. This offers them the potential upside of cryptocurrencies without holding them directly.

Despite the wide spectrum of goals and personalities between different investors, many of them employ correlation analysis as a key tool to help them hedge exposure to different assets. These smart investors know how useful correlation analysis can be to understand the relationship between assets, thereby reducing risk and maximizing returns.

Positive correlation

Positive correlation refers to assets that move in the same direction. That means when one asset rises, the other rises as well. How much one asset moves in tandem with another one ultimately depends on how strong the correlation is. The correlation coefficient is more than 0. A perfect positive correlation of +1.0 means the two variables have been moving in the exact same direction.

Negative correlation

A negative correlation is a relationship between assets that move in opposite directions. When one increases in value, the other’s value drops. If one sees a correlation coefficient of less than 0, they can safely conclude the two assets are moving opposite to each other.

How do you measure correlation?

Which brings us to how we can measure correlation. There are several ways, but the most commonly used method is the Pearson Correlation Coefficient. This formula is complex. But rather than doing the math ourselves, Bloomberg analysts gave Blockworks a peak at the various correlation measurements through the Bloomberg Terminal. Through this demonstration, it was clear their Correlation tools offer a powerful way for investors to look at correlations between asset classes, individual securities, and entire portfolios or custom baskets of their own choosing.

What does correlation tell us about the crypto asset class?

Since bitcoin’s inception in 2009, crypto assets have largely been uncorrelated to traditional assets, making them ideal for portfolio diversification. This also meant digital assets like bitcoin could be used as a certain kind of hedge against a variety of economic issues since they weren’t affected in the same way as stocks and other traditional assets. The lack of correlation was also attributed to the crypto industry’s position as a nascent asset class, and was thus not on professional investors’ radar.

However, COVID-19 changed all of this in 2020. This is where correlation between traditional and crypto assets started to increase, signifying that the industry is growing up.

This maturity could be driven by the fact that more institutions have entered the crypto space. As such, it follows that the recent interest rate hikes by the Federal Reserve have also further contributed to the positive correlation between crypto and traditional assets (particularly tech stocks) in 2022.

A quick look at the data from the last 6 months will bear this out. It shows that bitcoin and other top cryptocurrencies like ETH have been positively correlated to Nasdaq in a meaningful way.

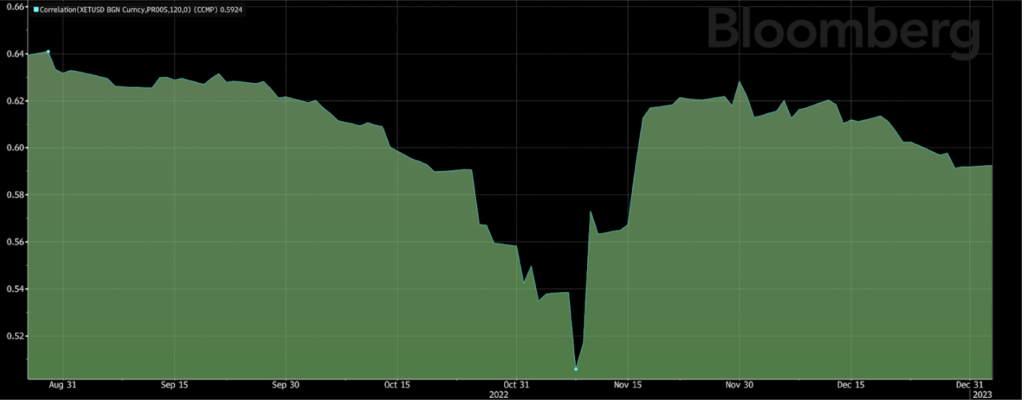

Ethererum’s correlation with the Nasdaq

Ethererum’s correlation with the Nasdaq

Experts viewed this rising correlation as an indication that investors saw bitcoin as a safe haven asset. And yet, a different category of industry experts theorizes that the correlation between cryptocurrencies and traditional assets is rising because retail investors are investing in both and are treating bitcoin like a speculative tech stock, indicated by the rising correlation with Nasdaq.

Are bitcoin and ether digital gold?

One of the stickiest descriptions of bitcoin early on was as “digital gold.” After all, the proof-of-work mechanism that secured the network and unlocked more bitcoin was similar to the way physical gold was mined. Because of this, advocates claimed the asset was one of the best stores of value available, much like gold has been for millenia. But with the tools available to perform correlation analysis available now, it’s possible to put this “digital gold” moniker to the test (at least quantitatively).

Interestingly, there’s been an increasing positive correlation between gold and bitcoin. While this trend has been on the rise since August 2022, it should be noted their correlation still remains below 0.35.

Are bitcoin and ether risk assets?

Before moving on, it would be helpful to briefly discuss the correlation between macro asset classes such as U.S. stocks and bonds. Speaking on correlation, Russell Investments’ Peter Mortensen notes that “the interaction between the returns on stocks and bonds is one of the fundamental building blocks of asset strategy, and the nature of that interaction is not constant.” He goes on to reinforce that the relationship can be inconsistent especially during periods of high volatility and inflation, but it’s still essential for investors to understand those relationships. In the same piece, Mortensen examines the correlative relationships between the S&P 500 and bonds during the period of 1989-2021. He notes that until 1997, the two asset classes were generally positively correlated. But from 1997-onwards, that correlation turned negative.

In light of this, it makes sense that during bitcoin and ether’s comparatively brief history, they’ve both had a low positive correlation to stock market indexes like the Nasdaq or S&P 500. So when investors are sellers in the bond markets, they’re buyers of these indexes and the two major cryptocurrencies. Moveover, it shows that BTC and ETH act like extremely risky assets, which tend to have higher returns.

Are bitcoin and ether safe-haven assets?

Bitcoin and ether have struggled to live up to the oft-repeated claim that they’re either safe haven assets (à la gold), or at the very least hedges against inflation. But this claim falls apart if one simply looks at the two-year period between March 2020-March 2022 where bitcoin showed low correlation to gold. Instead of BTC or ETH, investors have been more likely to run to safety by investing in risk-free treasury bonds over this period. The point is further exemplified by the negative correlation between 10-year treasury bonds and these digital assets.

How correlated is crypto?

Generally, cryptocurrencies are positively correlated with one another. The correlation coefficient is particularly positive between bitcoin and other crypto assets, which is why crypto prices will usually rise across the board when BTC climbs and likewise falls when it tumbles.

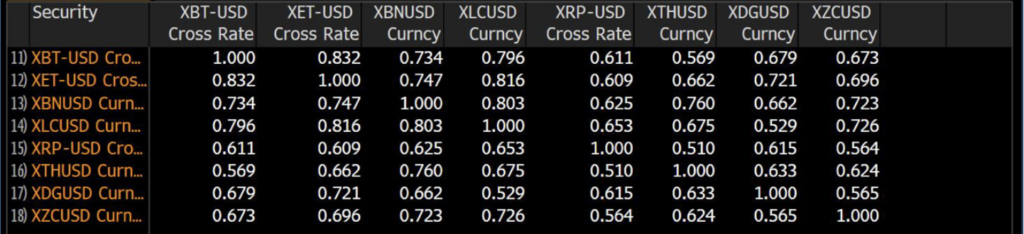

A closer look at some of the top five cryptocurrencies, BTC, ETH, BNB, LTC, XRP, ETC, and DOGE reveal how they are all positively correlated.

The correlation between Bitcoin, Ether, BNB, Litecoin, Ripple, Ether Classic, and Dogecoin over a two-year time frame

The correlation between Bitcoin, Ether, BNB, Litecoin, Ripple, Ether Classic, and Dogecoin over a two-year time frame

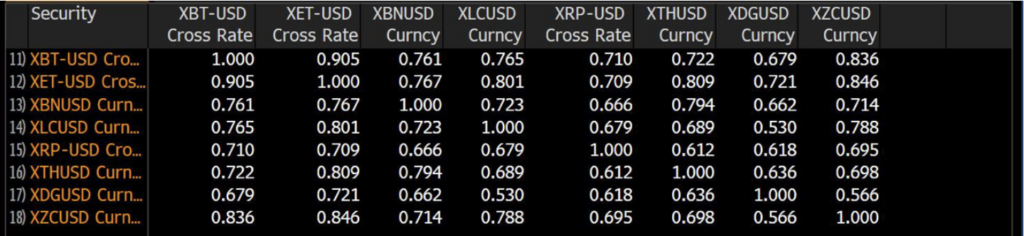

For instance, as of January 9, 2023, the 24-hour correlation coefficient of BTC and ETH was 0.82. Looking at the two-year correlation between the two assets, we can see a similar number at 0.83. The six months correlation however is higher and comes in at 0.90, which would suggest that the correlation between the two assets has only increased over the last few months.

The correlation between Bitcoin, Ether, BNB, Litecoin, Ripple, Ether Classic, and Dogecoin over a six-month time frame

The correlation between Bitcoin, Ether, BNB, Litecoin, Ripple, Ether Classic, and Dogecoin over a six-month time frame

All in all, we can say that the two crypto assets are highly correlated despite serving different needs in the cryptocurrency ecosystem. Ethereum is a Proof-of-Stake (PoS) blockchain for building dapps while bitcoin is a Proof-of-Work (PoW) blockchain that focuses on becoming a payment network and store of value.

Will all crypto remain a high-risk asset class in the future?

Bloomberg’s 60-day BTC and ETH correlation chart displays sudden shifts that coincide with major events. From September 7, 2022, to September 17, the positive correlation fell from 0.89 to 0.83. Ether’s price dropped from 0.084BTC to 0.068 BTC over the same duration.

This decline makes sense since the Merge, which finalized in September, was specific to Ethereum. However, one can’t help but wonder how the Merge (the move to staking) will affect this correlation in the future. So far, though, — more than three months post-Merge, the positive correlation appears to be holding.

The other correlation shift took place in October 2022, dropping from 0.81 on October 17 to 0.77 on October 26. This change coincided with the sharp rise in ETH’s price after the news of a soft Fed pivot. Ether’s price rose from 0.069 BTC on October 24 to 0.077 BTC on October 29.

Pantera Capital’s CEO Dan Morehead opines that bitcoin could decouple from the stock market because it doesn’t have “a similar relationship to the interest rate policy from the Fed.” Conversely, Ethereum, which now offers staking yields much like stocks and treasury bonds, could be more influenced by monetary policy news than bitcoin, resulting in a true decoupling of the two assets.

In November 2022, however, the FTX saga sent the BTC and ETH correlation on a sharp increase, putting into question the theory that ether could decouple from bitcoin and start moving more closely with assets in the traditional market.

Final thoughts

We’ve seen the cryptocurrency space mature in profound ways over the last few years, with institutional adoption, the Merge, and increased regulatory clarity as a few key examples of this growth. That said, this maturity hasn’t changed the volatility of digital assets. The combination of a more-mainstream asset class along with its continued volatility has only made it more important for investors to understand price correlations in these markets. And a reliable way to track these correlations is through an array of analysis tools available on the Bloomberg Terminal. With this resource in hand, investors can make more informed investment decisions, manage risk and capitalize on market opportunities.

This content is sponsored by Bloomberg.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.