The Problem with Crypto Market Caps

Market capitalization is not the best metric to determine the value of a cryptocurrency project, execs say, urging users to “look beyond the hype”

- “Once the speculative fervor dies down, market caps often tend to tank in a big way,” a crypto exec told Blockworks

- Developer activity, dApp usage, user growth and the number of active wallets are better indicators of strength

Market capitalization in the crypto world can be misleading indicators of value, and industry watchers say metrics such as user growth and developer activity should be given more weight.

A cryptoassets’ market cap is worked out by multiplying the number of tokens or coins in circulation by the current market price of a single unit. The metric is widely — but, perhaps, incorrectly — used to assess the performance of a cryptocurrency and how valuable it is.

It’s true that the higher the price, the higher the market cap of the corresponding cryptocurrency, but they don’t account for token lockup periods or supplies held by company insiders.

In the traditional finance world, market caps certainly hold a lot of significance. That’s simply because they represent the dollar market value of equity, which allows investors to weigh a company’s profitability rather than going by its sales figures.

One problem with the metric unique to crypto is that lost tokens end up being counted towards market value, rather than subtracted from the supply. For instance, around 20% of the current supply of bitcoins, or $140 billion, is either lost or stuck in neglected wallets. Should lost tokens be accounted for in terms of current value of the rest?

Growth, usage of protocol are better crypto market indicators

Looking at circulating market caps, more specifically, rather than fully diluted ones, can be deceptive, according to Oskari Tempakka, Token Terminal’s growth lead.

“That’s a metric that a lot of investors look at without taking into account locked tokens, vesting schedules etc. So there might be a really big difference between the circulating and the actual fully diluted market cap,” he told Blockworks.

Tempakka believes digging into developer documents and white papers to estimate token unlocks could have a big effect on the price of a single token. He added that many investors, ill-advisedly, don’t even bother to check market caps, and instead make decisions based on the price of a single token.

More valuable indicators, he says, are what service a particular project has put out there, how much usage it’s seeing and how much fee revenue the service generates.

“The most important indicator of value in your protocol, for me, is a fundamental analysis of what’s happening under the hood from a business perspective,” Tempakka said. “The more organic growth and usage you have, and the more active user growth you have, the higher the valuation of a protocol should be from a fundamental perspective.”

Volatility during market cycles

Market cap figures can also fluctuate wildly during bear and bull cycles, due to changing market sentiment, and fail to reflect deeper insight such as volume of transactions, number of users or activity on the network.

“In bull markets, you often see protocols explode in value because of speculation. But once the speculative fervor dies down, market caps often tend to tank in a big way,” Daryl Kelly, founder of NFT platform LTD.INC, told Blockworks. So this metric says very little about whether people like using whatever crypto protocol is in question, including a particular DeFi or metaverse project, he added.

Blockchain developer numbers are another good metric

Kelly thinks developer activity is a more useful indicator of the strength of a crypto or project.

“Just look at Ethereum and Solana. The amount of developer activity on these networks is immense, and it’s only growing,” he said, adding that this criterion suggests sufficient demand from users on these blockchains to build more applications for everything from DeFi and NFTs to crypto games.

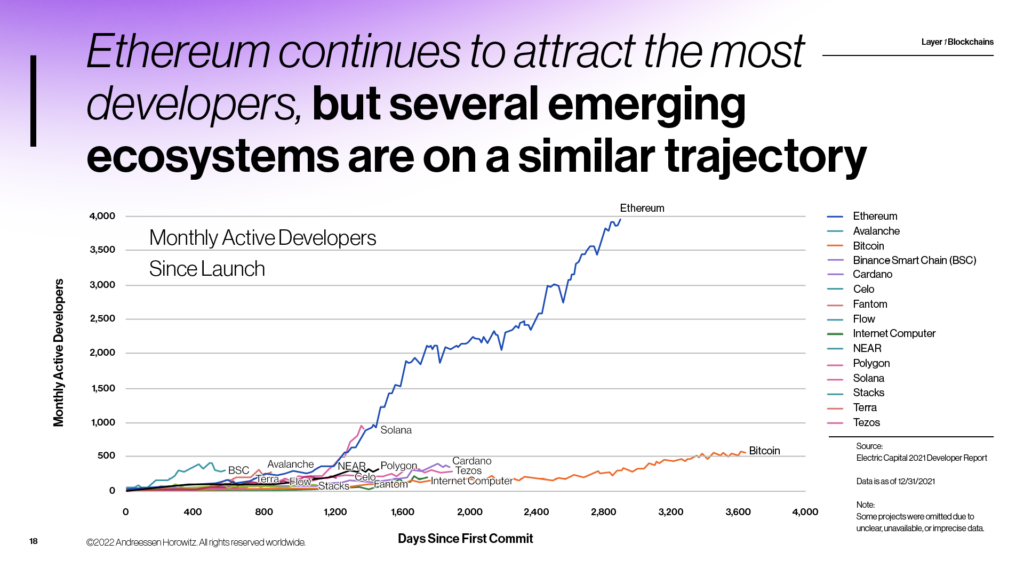

A State of Crypto report published by a16z in May shows Ethereum managed to attract 4,000 monthly active developers, handily beating those of other protocols.

Image Source: a16z

Image Source: a16zSantiago Portela, CEO of FITCHIN, agreed that market caps are a flawed metric, pointing out that Solana’s doesn’t reflect the blockchain’s strength.

From a pricing perspective, Solana may be perceived as performing badly. But it’s a different story when considering the volume of NFTs transacted on the blockchain. This month, trading volumes on Solana-based marketplaces like Magic Eden and Metaplex hit their highest level since May.

“It tells me that adoption is increasing in that network and that there are builders behind it — indeed, these are the key aspects to truly understand the strength and resilience of the ecosystem,” he said.

But not everyone believes market caps are a weak measure. Nischal Shetty, CEO of Indian crypto exchange WazirX, said they can be a helpful tool to gauge the strength of various protocols. But he agrees that hype during bull markets can lead market caps for obscure protocols to explode beyond the utility that they offer.

More reliable metrics — aside from developer numbers — include user growth, the number of active wallets and dApp (decentralized apps) usage, according to Shetty.

“A reason behind Ethereum’s success is that it has a large number of applications built on it that in turn attract users. And this user growth, moreover, attracts more developers. So, in this case, you have a virtuous cycle in which developer activity and user growth feed off of each other. That’s why I think it’s important to look beyond the hype, including market capitalization,” he said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.