A new framework for token market transparency

Introducing the Token Transparency Framework, a publicly available token disclosure standard

Artwork by Reid Hannaford

Today, the crypto market operates without a single, standardized disclosure framework.

Because of this, the market is left without key information about token supply and vesting schedules, insider incentives, and basic financial data in a fast-moving environment. This information gap fuels mistrust and, ultimately, results in the misallocation of investor capital.

In an effort to close that gap, Blockworks is proud to release the Token Transparency Framework. Blockworks led this effort with our partners Felipe Montealegre of Theia, Louis Thomazeau of L1D, and Cosmo Jiang of Pantera.

This framework provides token projects with the ability to communicate a basic set of information to the market.

Designed as a one-time filing, the Token Transparency Framework focuses on 18 criteria, including:

- Supply schedules

- Market maker and exchange listing agreements

- Related party transactions

- Revenue streams

- The relationships between equity and token

- Foundation token allocations

- Offchain entity structures

- Financial disclosures

More available information means the industry can accelerate toward optimized best practices. Beyond the token issuers themselves, key players in the market directly benefit from this effort:

- Professional investors access streamlined due diligence processes.

- Market makers gain a simplified method to evaluate counterparty risk.

- Centralized exchanges can accelerate listing velocity via structured data and disclosure.

- Retail participants receive otherwise obfuscated information.

The Token Transparency Framework represents an opportunity to improve capital allocation in the industry by helping projects signal credibility, allow investors to better underwrite risk with standardized disclosure of information, and prevent bad actors from profiting off ambiguity.

Blockworks views a grassroots disclosure framework as complementary to SEC Commissioner Hester Peirce’s Safe Harbor 2.0 and SEC Chair Paul Atkins’ views on DeFi. Effective self-regulation better positions the industry for future success.

To this end, the Blockworks team met with the SEC on June 13 to discuss the framework and solicit feedback.

The Initial Cohort

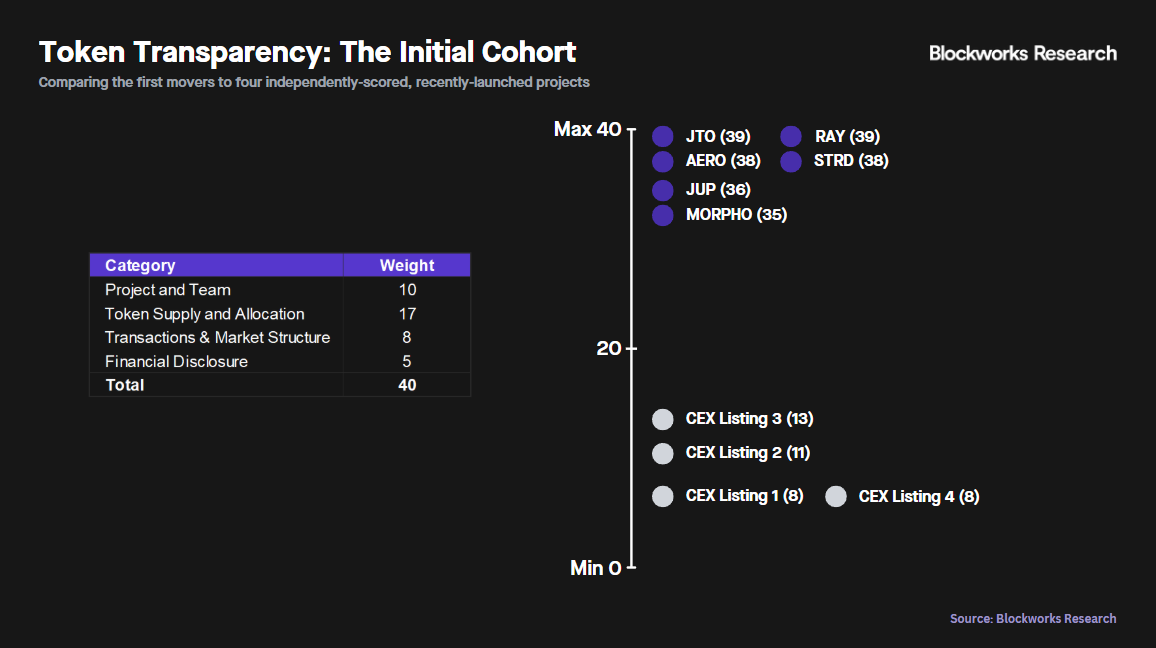

The framework is now live with an initial cohort of project submissions, including Jito, Aerodrome, Raydium, Stride, Jupiter and Morpho. Completed submissions are publicly available on the Blockworks website, and we encourage other token projects to reach out and apply.

I have immense respect for all teams that participated in the initial round of disclosures. There is no precedent for transparency; these are the first movers that set a new bar.

The transparency scores of the initial cohort all exceed 35, showcasing high visibility into each project’s operations. This will serve as a credible signal in a field of noise that will show the market these players are long-term oriented.

We were excited to see this push previously inaccessible information to the market, especially in responses related to the relationship between token and equity, any advisory billings to the foundation, and market maker agreements.

To put the scores of the initial cohort into perspective, we independently scored four recently launched projects that we believe have taken advantage of the lack of disclosure in this industry. The transparency scores of the problem group range from 8 to 13 — a stark contrast to the initial cohort. Yet, each of these tokens was still listed on a centralized exchange.

Note, these scores are just for comparative purposes, as we did not reach out to these teams for additional information outside of what is already publicly available.

Framework Details

The framework’s criteria are divided into four categories:

- Project and Team

- Token Supply and Allocation

- Transactions & Market Structure

- Financial Disclosure

Investors gain visibility into the operations of businesses and limit the risk of manipulation and abuse through transparent disclosure of these criteria. Negative events across the market in recent months prove the need for a standardized transparency standard.

Each criterion is weighted 0–3 by materiality. Then, it is calculated and aggregated into a “transparency score” that reflects the project’s transparency.

Importantly, this score is not a quality assessment on the team or project. Rather, it is a measure of the project or team’s overall transparency.

The responses, scores, and the framework itself will all be open source and publicly available to access.

Blockworks calls on the community to provide feedback on the criteria, for projects to complete the framework, for exchanges to use the framework as a resource in the listings process, and for investors to leverage the framework for due diligence.

We view this as a working document subject to future improvements and iteration. For a deeper conversation, reach out at [email protected].

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.