Atlanta Home Tokenized on Ethereum, Nets $214,882 in Under 3 Minutes

The sale marks the first step in a new partnership between RealT and Roofstock

Roofstock modified by Blockworks

With US single-family home values hovering in a middle-of-the-road range on a year-over-year basis, crypto companies are looking to carve out a slice of the US real estate pie — even as digital assets themselves remain deeply depressed over that same period.

In the latest instance, fintech and single family-focused sales company Roofstock has sold off a Georgia home to RealT via a tokenized Ethereum-based NFT, representatives for both companies told Blockworks on Tuesday. It marked the first collaboration between the two companies.

The first round of the transaction was facilitated by OpenSea, with RealT imposing “heavy restrictions” around the float of the initial fractionalization offering, according to Remy Jacobson, the co-founder at RealT and one of two chief executives at the businesses. A second round will follow later.

Read more: The Crypto Native’s Guide to Real Estate Investing

It’s not the first such instance of an NFT-enabled property sale for Roofstock, which has a Web3-focused division that aims to make inroads into the property sector.

The process is similar to Roofstock’s previous tokenized real estate sale of a home in Alabama last month.

“RealT acquires properties sourced by Roofstock into C-Corps which then sell tokenized shares to investors,” the spokesperson said in an additional statement. The idea is to use the tokenized equities originated in the US to provide blockchain-based exposure to investors in other countries.

A spokesperson disclosed metrics behind the fractionalization of the NFT by RealT:

- 670 unique token holders snapped up a total of 722 orders

- The blockchain transaction process took two minutes and 46 seconds

- The average ETH-based purchase equated to about $298.

The partnership relies upon creating a separate Wyoming LLC tied to each single-family asset the company has available for sale in its inventory, which acts as a shell for a corresponding wallet holding the buyer’s NFT on Ethereum “that has [its] token ID associated with the smart contract,” said Sanjay Raghavan, vice president of Web3 initiatives at Roofstock.

“The property in question can then be bought and sold on various NFT marketplaces, resulting in instantaneous sale and settlement,” the statement said.

Each buyer holds a “soulbound” NFT, according to Raghavan, a non-transferrable token, meaning that the underlying blockchain mechanics are permissioned in nature.

Each property NFT, as a result, “gets marked with a KYC flag,” Raghavan said, and the prospective owner “can go to OpenSea or any other marketplace where the asset is listed and purchase the NFT.”

Ether collected through RealT’s tokenization offering this week partially divides ownership of the property acquired for 218,000 USDC on OpenSea.

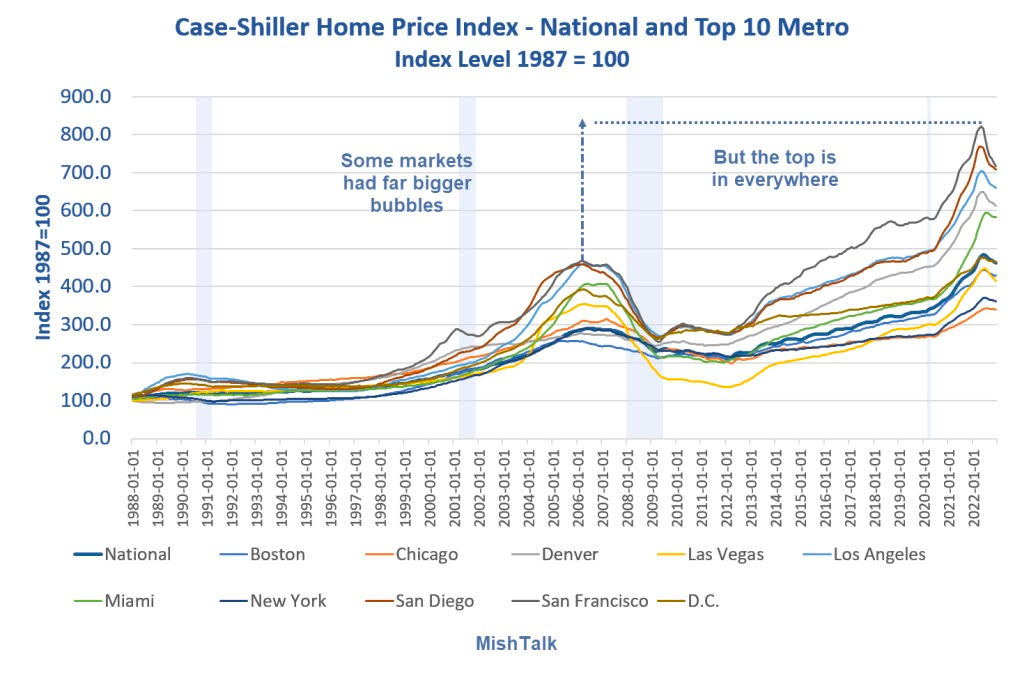

The process facilitating the sale of the Atlanta-area home — which has two bedrooms, 2.5 bathrooms and a total of 1,524 square-feet — is being billed as the beginning of a partnership between the two companies, which is kicking off at a time when US regulators are keeping a close eye on crypto. And when murmurs of a real estate bubble waiting to burst have been percolating.

Both executives said they’re putting in place measures to ensure compliance with the relevant US authorities as the outlook for digital asset oversight remains largely mixed.

“Blackrock is saying tokenization is the future, and you can be sure the SEC is listening,” Jacobson said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.