Tron’s fee gamble

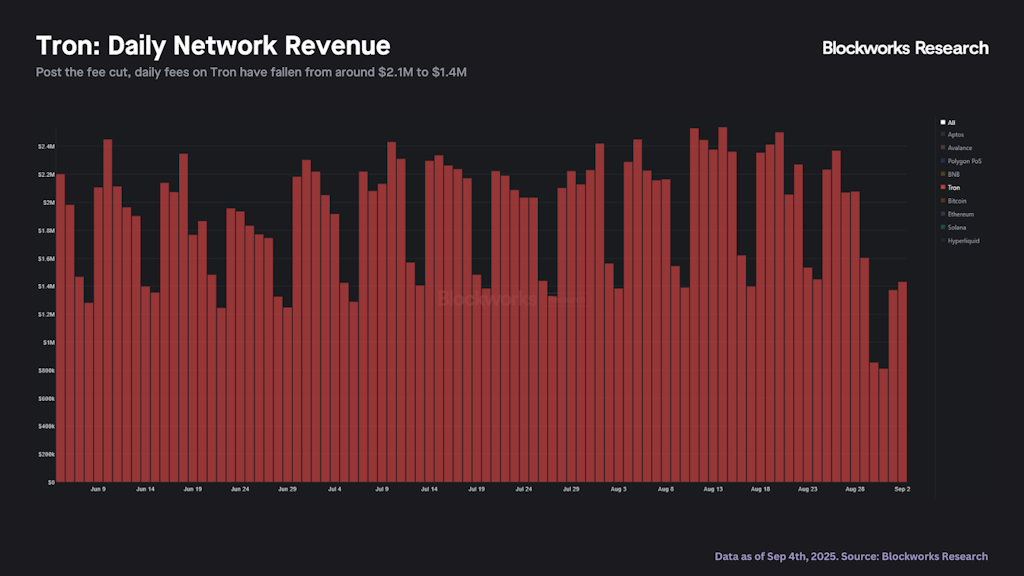

Tron slashed fees by 60% as Plasma looms, threatening its USDT moat

HFA_Illustrations/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Tron cut transaction fees by 60% last Friday. While this looks like a move to improve accessibility, the real driver is almost certainly the looming launch of Plasma, which will enable zero-fee USDT transfers.

Tron’s moat has always been its distribution. Users continue to transact on Tron despite much cheaper alternatives, a sign of the deep merchant and banking ties it has built, especially in Latin America. The fact that Tron is now lowering fees could suggest this moat is being threatened.

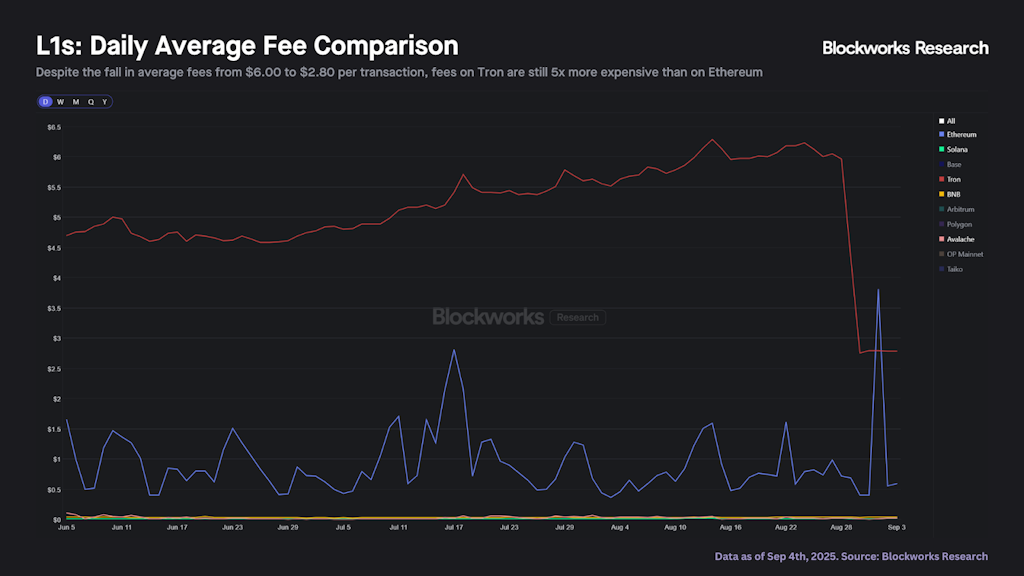

The stakes are high. Around 90% of Tron’s revenue comes from USDT transfers. Even after the recent cut, average fees sit at $2.80 per transaction, nearly 5x Ethereum’s $0.60. Over the past month, Tron’s USDT supply has fallen 1.4%, representing around $1.1 billion of outflows. At the same time, Plasma’s pre-launch campaigns have already attracted $2 billion in USDT deposits.

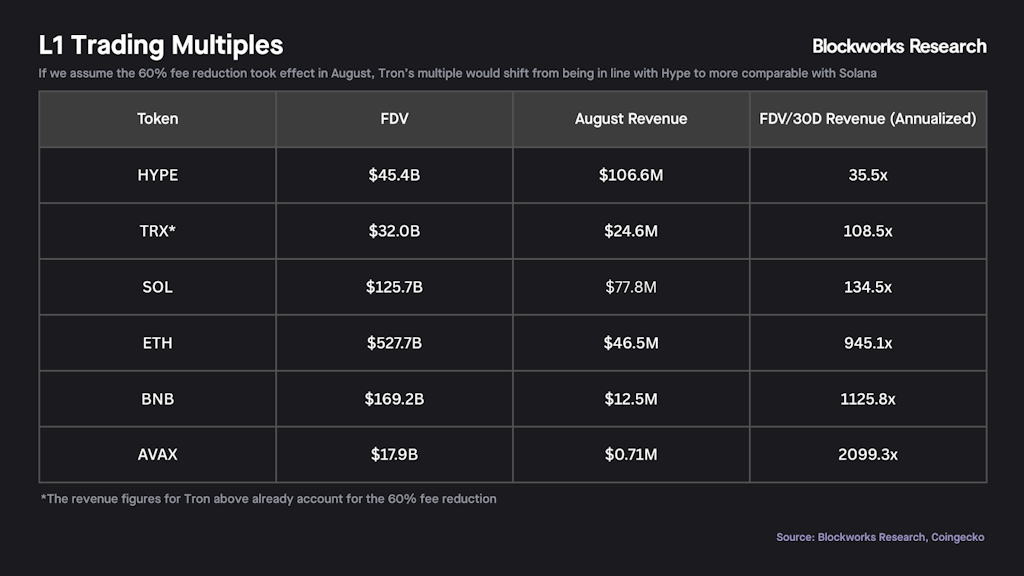

Financially, Tron remains solid. On August numbers, the fee cut would drop it from the third to the fourth largest chain by revenue, though it would still generate twice as much as BNB. Its FDV/Fees multiple would shift from roughly Hype’s 36x to Solana’s 135x, a level still well below the broader L1 group.

For the first time, Tron faces a serious challenger in its core market. Only time will tell if the fee cut is sufficient to keep Tron competitive and sustain stablecoin volumes on the network.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.