Big crypto week ahead? What to watch for in the ‘Uptober’ homestretch

An expected Fed rate cut and possible crypto ETF developments set to headline October’s final week

Artwork by Crystal Le

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

As we detail what to watch on this week’s crypto/macro front, let’s first look back to some telling economic data.

Friday’s CPI report showed overall and core inflation increased 3% over the 12 months ending in September. This impacted risk assets, with S&P 500 futures rising to a new record and bitcoin reclaiming the $111,000 level. BTC continued to climb early Monday, hovering 6% higher than a week ago by midday.

The “softer-than-expected” CPI print “reinforced the Fed’s dovish pivot,” according to 21Shares crypto investment specialist David Hernandez.

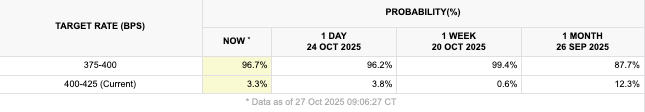

CME Group’s FedWatch tool — using 30-day fed funds futures prices — put the chance of a 25bps interest rate cut this week at 96.7%, as of Monday morning. The chance of two 25bps cuts by the end of the year stood at roughly 94%.

We’ll be listening to Jerome Powell’s press conference Wednesday.

“Any potential easing aimed at supporting a softening labor market is unlikely to change the broader momentum: capital continues to flow toward Bitcoin, recognizing its growing role as a resilient anchor asset in an increasingly complex financial landscape,” Xapo Bank’s Gadi Chait said in a statement.

BTC’s return for October was barely in the green just after Noon ET. If it holds throughout the week, the “Uptober” narrative would be satisfied for a seventh-straight year:

The latest BTC bounce came two weeks after a historic wave of liquidations rocked crypto markets. This event “dramatically reduced excess positioning across major centralized venues,” Hernandez noted.

“With positioning cleaned up and macro easing now confirmed rather than speculated, the foundation for upside looks materially stronger,” he added.

Not everyone is bullish about BTC’s near-term outlook.

Ledn CIO John Glover noted Friday that, according to his Elliott Wave Theory analysis, the bull run that started in November 2022 has been completed. He suspects a correction (Wave IV) — to be completed in mid-to-late 2026 — resulting in BTC dipping to somewhere between $84,000 and $100,000. It would then go up from there, his chart shows:

“Welcome to the Bear Market of 2025/26!” Glover added in an email.

Looking beyond BTC, we continue to be on crypto ETF watch. We’re hearing rumblings that the government shutdown does not mean we won’t see any movement on altcoin ETF proposals.

Asset manager Bitwise filed a Form 8-A for its proposed Solana Staking ETF, and the firm tweeted “Big week incoming” this morning. The firm declined to comment.

As we keep an eye on ETF updates, we also have Coinbase’s Q3 earnings on our radar. That’s set for Thursday, after the market closes. Executives have been transparent on past earnings webcasts about the exchange’s priorities.

JPMorgan analysts last week updated its Coinbase stock grade to “overweight.”

“We see Coinbase exploring a Base token, which we see accelerating the growth of development on the Base blockchain, but has the ancillary benefit of enabling Coinbase to equitize the success in what is the largest L2 on multiple metrics,” analysts wrote in an Oct. 24 note. “We also see Coinbase further exploring its USDC payouts.”

The bank’s COIN price target for December 2026 is $404 — a roughly 10% increase from where it was midday Monday ($366).

So a busy week appears certain. Time will tell how “big” it will be.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.