Venture Capital Seeds NFT Trading Tooling Firm Mintify

Blockworks exclusive: Arca leads $1.6 million investment in the “Bloomberg Terminal for NFTs”

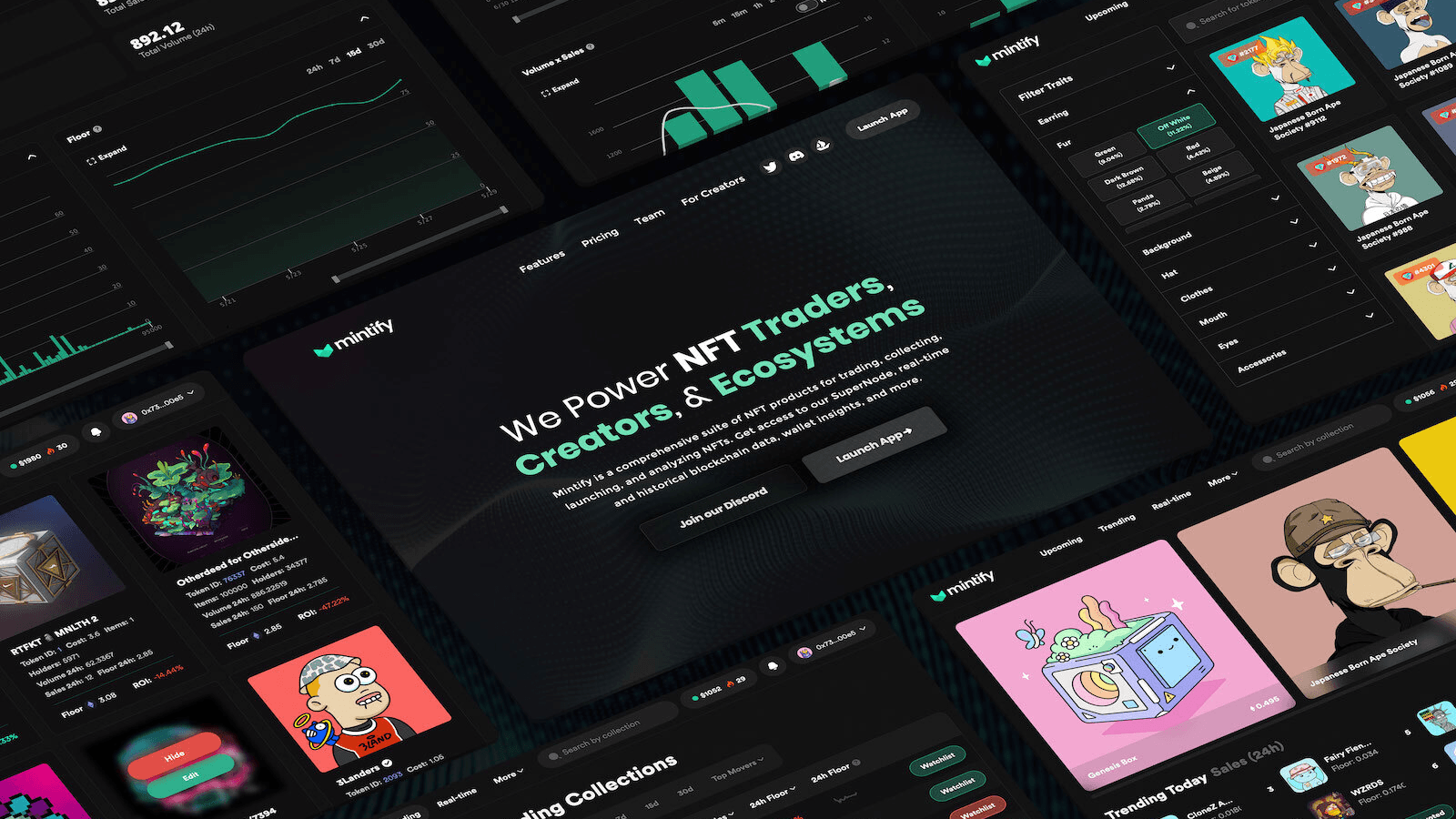

Source: Mintify

- The NFT market possesses a total market cap of more than $11.3 billion, says Nansen

- “Many of the decentralized economies being built will run on NFT technology,” says Mintify founder

Capitalizing off growing interest in refining NFT trading opportunities for professional money-makers, digital collectibles analytics startup Mintify has raised a seed round.

Digital assets-focused investment manager Arca led the $1.6 million round. The corresponding valuation was not disclosed.

Current NFT trading marketplaces from OpenSea to SudoSwap tend to be limited in terms of functionality, real-time data and scope that professionals crypto investors can use to craft and deploy NFT trading strategies. Mintify’s bet: a Bloomberg-like trading terminal built from the ground up for NFTs, ProDash.

Arca’s Endeavor Fund, Alchemy Ventures, Psalion, as well as GSR and Fasanara also participated in the fundraise.

Mintify’s founder and CEO, Evan Varsamis, believes their trading terminal can provide software and data access at a caliber comparable to Bloomberg’s and its role in the stock market.

“Our goal is to bring tools to market that are familiar to users of existing trading platforms while exposing them to new and powerful NFT based economies and markets,” Varsamis said.

A major issue with current NFT marketplaces, according to Varsamis, is that they are built using technology that is not interoperable with other chains and thus locked into specific blockchain ecosystems and unable to support multiple blockchains.

There are a few other multi-chain NFT aggregators like Mintify that focus on pro traders, such as Blur.io and Curio. There isn’t, however, a single interface that aggregates all NFT collections and economies across marketplaces, liquidity and chains.

“NFT marketplaces are competing with one another across and within the same chain ecosystem, creating competition and fragmentation of NFT liquidity,” he said.

Venture capital firms like Arca appear to be bullish on the NFT market that, despite recent waning monthly trade volumes, still has a total market cap of at least $11.3 billion, according to Nansen.

“Following the dynamic rise to relevance of non-fungible assets in the last 24 months, there has been a glaring need for infrastructure tooling,” said Sasha Fleyshman, a portfolio manager at Arca, in a statement. “The ecosystem has grown at a rate such that the product lines have far outpaced the rails needed to efficiently facilitate the market.”

Asked what Mintify’s vision of future markets looks like, Varsamis said:

“We believe many of the decentralized economies being built will run on NFT technology. Whether it’s on-chain music, Web3 game assets, metaverse property or representations of real-world real estate, these verticals will create serious economic activity based on the NFT standard.”

The Mintify terminal is starting with Ethereum support and has plans to introduce more chains and layer-2s in the coming months.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.