Ray Dalio: China’s CBDC Could Appeal to American Investors

“We haven’t been in a competitive environment because the dollar has been the world’s reserve currency,” said Dalio, the founder and co-chief investment officer of Bridgewater Associates, the world’s largest hedge fund, which manages about $150 billion.

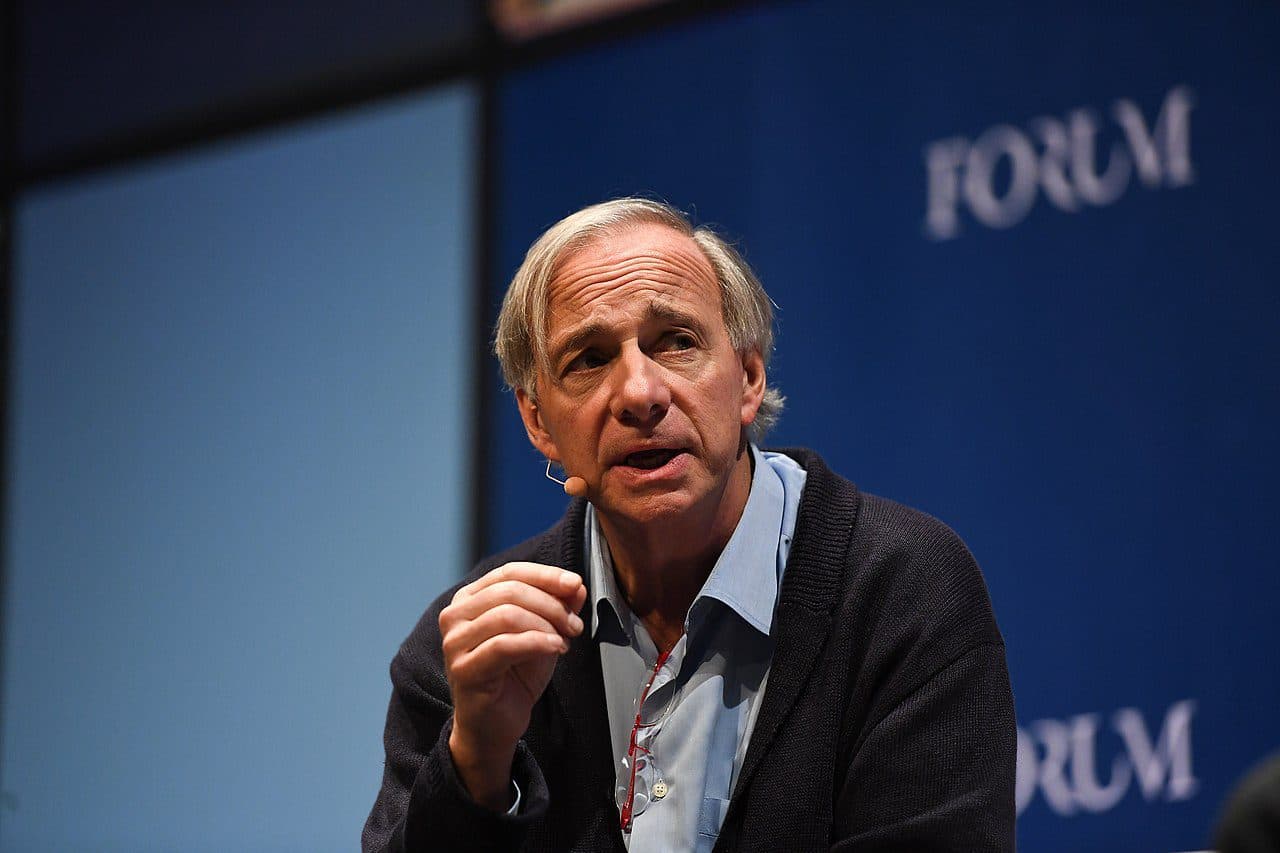

Bridgewater Associate’s Ray Dalio; Source: Wikipedia

- China’s central bank digital currency become increasingly competitive on the world stage

- Right now, the US is producing a lot more debt and creating a supply and demand imbalance thanks to the fiscal stimulus

China is taking the lead in creating a central bank digital currency (CBDC) that’s going to become increasingly competitive on the world stage and could appeal to international as well as American investors, Ray Dalio said at a virtual bitcoin conference Friday hosted by Texas A&M University.

“We haven’t been in a competitive environment because the dollar has been the world’s reserve currency,” said Dalio, the founder and co-chief investment officer of Bridgewater Associates, the world’s largest hedge fund, which manages about $150 billion.

“I’m not saying that this shift is going to happen quickly. But given the already overweighted nature of portfolios around the world,” and the death of the 60/40 portfolio, “the central bank will be put into a very difficult position of either having interest rates rise a lot or having to monetize, as it’s been happened before.”

Specifically, the Fed would have to buy the debt the Treasury sells, a principle of Modern Monetary Theory.

Dalio began making positive comments on bitcoin in December, and called it “one hell of an invention” earlier this year. He’s also said he’s considering digital assets as investments for new funds that would offer clients protection against the debasement of fiat money.

Right now, the US government is producing a lot more debt and creating a supply and demand imbalance thanks to the fiscal stimulus, he said.

If the demand for US debt isn’t there, the central bank “mechanistically is in a position where they will either see interest rates rise, and having the rationing of that debt—which is negative for the economy and nature of the financial assets—or they will print money and buy that debt. I think they’re going to print money and buy the debt.”

The supply and demand problem won’t just be in dollars or in bitcoin. The biggest point he made in his session was classic investing 101 advice: diversify and balance.

“I would worry for investors who are either anti-bitcoin or pro-bitcoin,” he said, adding that we’re in a “a very major classic fiat monetary crisis of sorts,” and that investors should hold a “properly balanced” diversified portfolio of assets that can protect them against it.

“Individuals should not be so focused on the magical thing,” he said. “[If] you put too much into it, I don’t think you could look at past returns and consider them indicative or even the volatility indicative.”

For more of Ray Dalio’s thoughts on bitcoin you can read his 17-page client note on it here.