Shaking Off Bears, Investors Drive Year’s Biggest Crypto Inflows

Last month’s $474 million inflows into crypto investment products represented the most money piled into such funds over the year to date

Source: Shutterstock

key takeaways

- Though outflows from ether-focused products have totaled $315 million year to date, such offerings notched inflows of $138 million last month

- ETH is becoming “the gateway for institutional capital,” according to Genesis Global Trading’s head of derivatives

Investors, shaking off volatile trading session after trading session, are once again bullish on crypto, according to a new report.

Flows into cryptocurrency investment funds and related products in July marked a reversal from June, good for the strongest monthly inflows this year, according to a Monday report from digital asset-focused investment manager CoinShares.

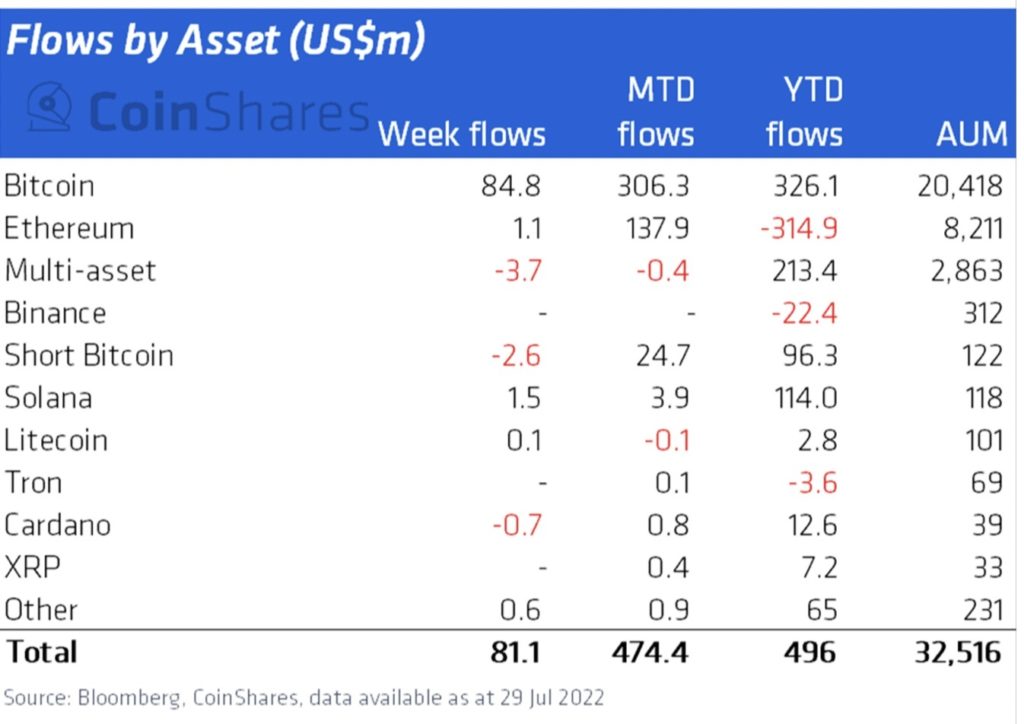

Net inflows totaled $474 million last month, according to the report, including $81 million last week, capping off a fifth consecutive week of inflows. Crypto products notched net outflows of $481 million in June.

Year-to-date inbound investments stand at $496 million, CoinShares data indicate.

Bitcoin (BTC) products saw $326 million of inflows over the first seven months of 2022 — including $306 million in July — while multi-asset products have notched $213 million year-to-date. Solana (SOL) and short bitcoin offerings this year have tallied $114 million and $96 million, respectively.

Though short bitcoin products had about $25 million of net inflows last month, Solana and multi-asset products were roughly flat in July.

Source: CoinShares

Source: CoinShares

Multi-asset investment offerings underwent outflows for the second consecutive week, suggesting investors are becoming more targeted in their investment, James Butterfill, CoinShares head of research, wrote in a blog post.

Though net outflows from Ethereum-focused investment products have totaled $315 million so far in 2022, the trend reversed in July, when such crypto offerings recorded inflows of $138 million.

That tendency, which Butterfill said “stood out the most,” comes ahead of the Ethereum mainnet’s expected merge with the Beacon Chain proof-of-stake system in the coming months.

Risk-off crypto narrative may be priced in

Ethereum has recently undergone a number of test merges, designed to work out the kinks of the network’s pending switch to proof-of-stake from its longstanding proof-of-work iteration.

“We believe it is due to improving investor confidence in The Merge being implemented this year,” Butterfill told Blockworks. “I expect flows into Ethereum to continue, and into bitcoin as we start to see a softer Fed in the face of growing economic weakness in the US.”

Ether (ETH) is becoming “the gateway for institutional capital,” according to Joshua Lim, head of derivatives at Genesis Global Trading. It is more attractive than bitcoin to some investors due to BTC’s association with collateral liquidations following the bankruptcy of Three Arrows Capital, as well as miner liquidations.

“We believe the ETH sound money thesis — as ETH becomes deflationary [versus] BTC’s supply overhang — makes it the more attractive inflow candidate going into The Merge later this year,” Lim told Blockworks.

Despite rising bullish sentiment toward digital assets, last week’s trading volumes for crypto investment products totaled $1.3 billion — compared to this year’s weekly average of $2.4 billion, according to CoinShares.

Dan Gunsberg, co-founder of Hxro Network, said there has been a “general exhausting of the bear cycle” over the past month, as well as what appears to be the beginning of a bottoming process.

“It seems that the general risk-off narrative has largely been baked in at this point,” Gunsberg told Blockworks. “All things being equal, I would not be surprised to see a retest of previous support levels in BTC, ETH, SOL and other liquid alts followed by a period of consolidation throughout the remainder of the summer.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.