Singapore’s QCP Capital Predicts Market Volatility from EIP-1559 Upgrade

EIP-1559 adds a form of ‘rent control’ for Ethereum gas fees, and lessons the control miners have as network stakeholders

Blockworks exclusive art by Axel Rangel

- EIP-1559 will send gas fees to the network as a token burn, instead of to the miners

- This would solve one of the biggest pain points with Ethereum, the gas fees, but the majority of miners oppose it

One of the most significant updates to the Ethereum codebase, EIP-1559, is scheduled to be implemented in the coming days and while there’s a growing consensus that this is ‘bullish’ for the value of ether, Singapore-based QCP capital cautions that this might cause some short-term market volatility.

“With EIP-1559, users can expect lower gas fee volatility due to a restructuring of the transaction process. Moving forward, gas fees will be quoted by the protocol as a fixed price, with a base fee as a foundation,” QCP wrote in a note published on their telegram channel. “Of more interest might be the introduction of a fee-burning mechanism, where the aforementioned base fees are taken aside and burnt. This has created a bullish narrative on the street for ETH becoming more ‘bitcoin-like’ due to a curtailing of ETH supply.”

What is EIP-1559?

EIP-1559 is a set of adjustments to the codebase of Ethereum that would fix the protocol’s biggest pain point: gas fees. These are the fees, currently paid to the miners, which act as server-like nodes, that allow for transactions to flow through the network. This in itself is a $1 billion industry, according to reports.

Miners say that these fees are necessary to support their overhead, as it costs a significant amount to run these nodes at scale. However, network users complain that the high gas fees — driven by the demand from DeFi — makes it difficult to use for the casual trader.

With EIP-1559, there would be a form of ‘rent control’ on fees, where the fee is set algorithmically and is no longer sent to the miners but rather to the network itself and is “burned”. This burning process destroys the token, creating a deflationary effect to preserve the token’s value.

QCP says the introduction of this mechanism will cause greater volatility as they believe the total supply over time now becomes impossible to determine due to the base fee changing in tandem with network congestion.

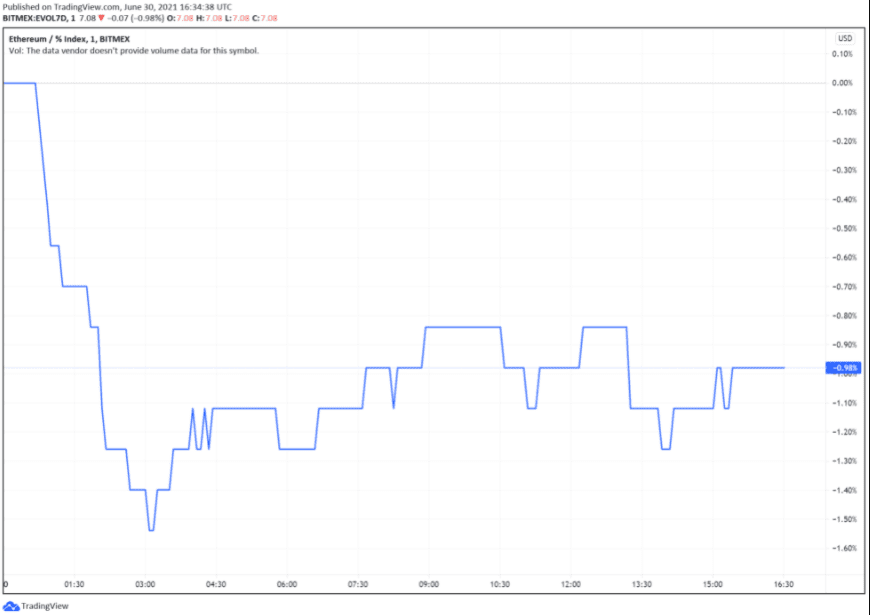

Currently, BitMEX’s measure of seven-day volatility with the price of ether is stable, down 1% on day.

Ether is trading at $2,100, down 5% on-day, but up 14% on-week, according to CoinGecko.