Uniswap Delegates Consider Liquidity Mining to Kickstart Ethereum Layer-2 Adoption

The Ethereum mainnet has become unusable for normal users, but getting them to jump to layer-2 is a challenge

Blockworks exclusive art by Axel Rangel

- Newcomers are coming through EVM chains, like Fantom, Avalanche, or other layer-1 protocols like Solana, which have spent hundreds of millions of dollars to attract developers and users

- In order to succeed, there needs to be greater incentives and smoother migration for users to onboard to layer-2 centralized exchanges and applications through initiatives

Earlier this week, the Uniswap community approved a governance proposal to deploy Uniswap v3 contracts on to Polygon’s proof-of-stake chain.

The approval arrived through an on-chain vote of over 72.6 million for the proposal and only 503,009 against it, Uniswap tweeted. Since then, Polygon’s MATIC token has spiked near all-time highs to $2.65 at 9:50 am ET on Wednesday.

“Uniswap is going to launch on Polygon with yield farming and on there the farming governance tokens will be MATIC,” a source familiar with the matter, who’s not authorized to comment publicly said. “So they’ll pay for the liquidity mining when it launches, but you won’t get UNI tokens, you’ll get MATIC,” the source added.

While this proposal succeeded, other ones are awaiting a chance for success.

Uniswap is a decentralized exchange — a protocol for trading and automated liquidity provision on Ethereum. And as Ethereum gas fees remain high, Uniswap users are considering alternative ways for applications to onboard to faster and cheaper layer-2s like Optimism or Arbitrum.

In early November, a Uniswap user who goes by the name litocoen, proposed an initial temperature check post on the Uniswap Governance forum page for Uniswap to consider launching a liquidity mining campaign on layer-2 through its $6.7 billion treasury.

“Uniswap governance should start incentivizing liquidity on its Arbitrum and Optimism deployments to kickstart adoption of Ethereum Layer-2 and prove that its decision to bet on Optimistic Rollups was the right one,” litocoen wrote.

The Ethereum mainnet has become unusable for normal users, who can start with $200 but lose half of their portfolio on a day when gas fees are high, he added.

As a result, newcomers to crypto are not being onboarded through Ethereum, but through chains running compatible Ethereum virtual machines, or EVM, like Fantom, Avalanche, Binance Smart Chain or other layer-1 protocols, which have spent hundreds of millions of dollars to attract developers and users.

In order to succeed, there needs to be greater incentives and smoother migration for users to onboard to layer-2 centralized exchanges and applications through initiatives like the liquidity mining campaign previously mentioned, litocoen noted.

“Users are waiting for subsidies and more applications to use, centralized exchanges and application developers on the other hand are waiting to see user adoption first to justify the integration efforts,” he wrote. But as both wait for the other to make the move, layer-2 applications are slowly competing for a space in the market.

If it happens, it would be the first time Uniswap taps into its treasury to provide liquidity mining since the initial program that accompanied the launch of its UNI token.

“The real problem that Arbitrum and Optimism have in attracting any sort of any material activity, is because they don’t have tokens themselves,” the source close to the matter said. “They don’t do what Polygon is doing with MATIC tokens, so it’s really on Uniswap if they really want to scale through Arbitrum and Optimism, the work is on Uniswap to do it themselves,” the source commented.

“It’s all about incentives, that’s where capital and liquidity will go.”

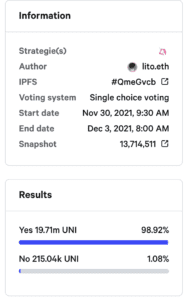

Snapshot vote results

Snapshot vote resultsAfter the post was validated by over 25,000 UNI participants, it reached the next stage for a Consensus Check at the end of November. UNI is Uniswap’s token, which users can delegate to others (or self-delegate) to vote on the protocol’s governance. To date, the circulating supply consists of about 628 million UNI, which is about 63% of total supply, according to CoinMarketCap.

Among token holders, 98.92%, or 19.71 million UNI, voted yes, while 1.08%, or 215,040 UNI, voted no for the consensus check on whether or not Uniswap should incentivize liquidity on Optimism and Arbitrum. The poll took place from Nov. 30 to Dec. 3, 2021.

While the majority of votes were in favor of the proposal, some found the idea to be a waste of funds.

“Liquidity mining is a great way to bootstrap liquidity onto a freshly launched project, but it proves to be quite parasitic in the long run,” user Buckerino wrote.

“Liquidity is loyal only to the person who pays. Why should UNI token holders bear this burden? What do they get in return besides the fact that they will get utterly diluted?” the user commented.

The ultimate goal of the proposal is to make participation in a liquidity mining program as easy as possible, litocoen wrote. It would also aid in further decentralizing the protocol, as UNI tokens would be distributed to as many people as possible, he added.

“In other words, to give users who weren’t able to participate in earlier liquidity mining schemes on Ethereum mainnet a chance to do it on L2. We should not only optimize for liquidity but also fairness,” he added.

The Uniswap protocol (of which there are three generations, version 3 being most recent) is autonomous, immutable on Ethereum and not registered in any jurisdiction.

Uniswap Labs, the company responsible for the protocol’s development, was not available for additional immediate comment when requested by Blockworks.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.