Asia’s Liquid Exchange Adds USDC on Stellar as Global Stablecoin Demand Jumps

During Q1 2021, $869 billion in stablecoin transactions occurred globally, making it the category with the highest transaction volume and demand during that time frame, data from Chainalysis showed

Dennelle Dixon, Executive Director of Stellar Development Foundation. Source: Stellar Development Foundation

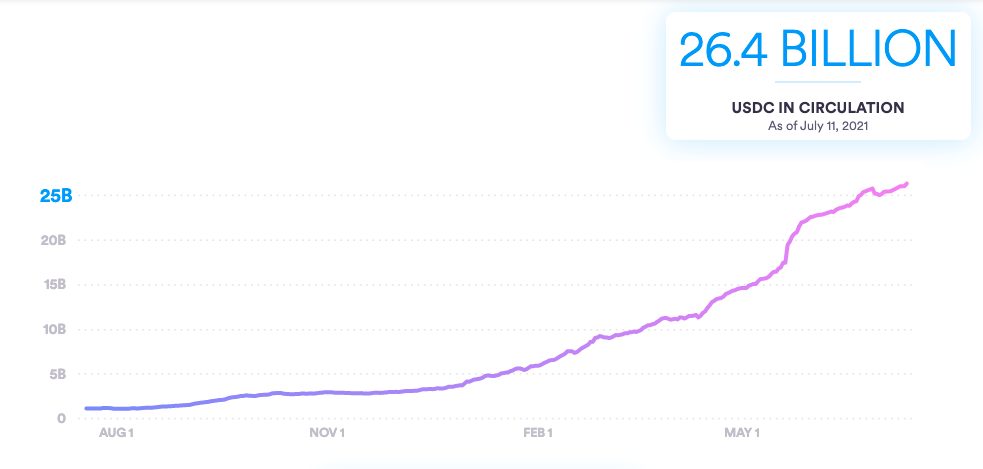

- As of July 11, USDC hit a peak of $26.4 billion in global circulation with $832 billion transferred on-chain, according to Circle data

- Through Stellar’s network, users could move their value in seconds, rather than minutes, to maintain better liquidity of their assets, the company said

Asian cryptocurrency exchange platform Liquid Group, Inc. and Stellar Development Foundation (SDF) announced its joint venture to provide USD coin (USDC) issued on Stellar via Liquid’s exchange for faster and cheaper transactions, the companies said Tuesday.

SDF’s open-source network, Stellar, has a community of over 5.3 million accounts and has processed more than 1.5 billion operations since 2015. In October 2020, Stellar was announced as an official blockchain for USDC, said CEO and executive director of the SDF Denelle Dixon in an interview with Blockworks.

Liquid is a global fintech company licensed in Japan and Singapore and is home to a cryptocurrency exchange platform that facilitates about $300 million in daily trade transaction volume across all assets.

“Liquid is the first major exchange to support Stellar USDC and can act as a hub for end-users to get in [and] out of crypto assets,” Dixon said. “Offering Stellar USDC will allow Liquid to access new geographies via additional Stellar-based stablecoin assets.”

USDC is a type of digital asset referred to as a stablecoin, which is redeemable to 1 USDC for $1 U.S. dollar, giving it a stable price. As of July 11, USDC hit a peak of $26.4 billion in global circulation with $832 billion transferred on-chain total, according to Circle data.

Source: Circle USDC data

Source: Circle USDC data

Separately, stablecoins are the most traded asset in cryptocurrency transactions in Asia and are often used to move value between exchanges, Dixon said.

In general, stablecoin usage is especially high in East Asia due to Chinese government’s ban in 2017 of direct exchanges of Chinese yuan for cryptocurrency. 33% of trading activity in 2020 was attributed to stablecoin transactions, according to a report by Chainalysis.

During Q1 2021, $869 billion in stablecoin transactions occurred in the market globally, making it the category with the highest transaction volume and demand during that time frame, data from Chainalysis showed. In comparison, both ether and bitcoin had lower transaction volumes at $840 billion and $623 billion, respectively.

For crypto exchanges like Liquid, this means transactions are confirmed faster and at a lower cost than before, Dixon said. Through Stellar’s network, users could move their value in seconds, rather than minutes, to maintain better liquidity of their assets, the company said.

Today, the cost of a transaction using Stellar USDC is less than a penny and Liquid’s customers can now choose which network they want for USDC withdrawals. If users pick Stellar, they can save an average of $12-$15 on each transaction when compared to other networks affected by pricing surges, Dixon said.

“Liquid focuses on increasing cryptocurrency adoption by introducing a technologically superior alternative to traditional payment rails,” said Liquid’s Chief Operating Officer Seth Melamed. “By allowing Liquid customers to send USDC over the Stellar blockchain, transaction time and network fees are reduced significantly compared to the original Ethereum USDC token.”