Bitcoin’s Plunge on Ukraine Invasion Undermines Status as ‘Digital Gold’

Market slide suggests investors don’t yet see the leading cryptocurrency as a safe haven in times of crisis

blockworks exclusive art by axel rangel

- Increasing institutional investment in bitcoin tightens its correlation with stock movements

- Lack of understanding of bitcoin’s fundamental properties may be hindering its adoption as a risk management tool

As Russian troops poured across the border into Ukraine this morning, bitcoin’s price plunged. Gold, meanwhile, surged, although it pared its gains by early afternoon in the US.

The sharp divergence, which echoes movements in light of other recent news, such as the potential for increased interest rates, have shown bitcoin to have a stronger correlation with equities like tech stocks than it does with gold or other safe haven assets.

Safe haven assets have always been considered hedges against market turmoil or currency devaluation. One of the biggest selling points bitcoin proponents have made is that it could be an even better hedge against inflation or market uncertainty than gold. But how and why?

The case for bitcoin as digital gold

The theory behind bitcoin’s being the digital version of gold is based on its supply and disinflationary nature. Those who help run the Bitcoin network are rewarded with bitcoin for their service, and the amount of bitcoin they earn is cut in half every four years. This means that the rate at which new bitcoin enters circulation is steadily decreasing until these rewards run out, leaving a total of just 21 million bitcoin that will ever exist.

Bitcoin proponents argue that gold is not verifiably finite — it could even be mined from asteroids in the future — and it is less divisible, easier to counterfeit, harder to transport and easier to seize.

While we can’t be sure that humanity will be mining gold or other precious metals from asteroids in the future, it is true that bitcoin is more divisible, easier to transport, harder to seize and arguably harder to counterfeit than gold — although this is mainly due to its intangible and digital nature.

Bitcoin’s performance as a safe haven asset

While bitcoin has started falling, gold has increased amid the market turmoil, leading many to dismiss the narrative of bitcoin as a gold replacement and safe haven asset.

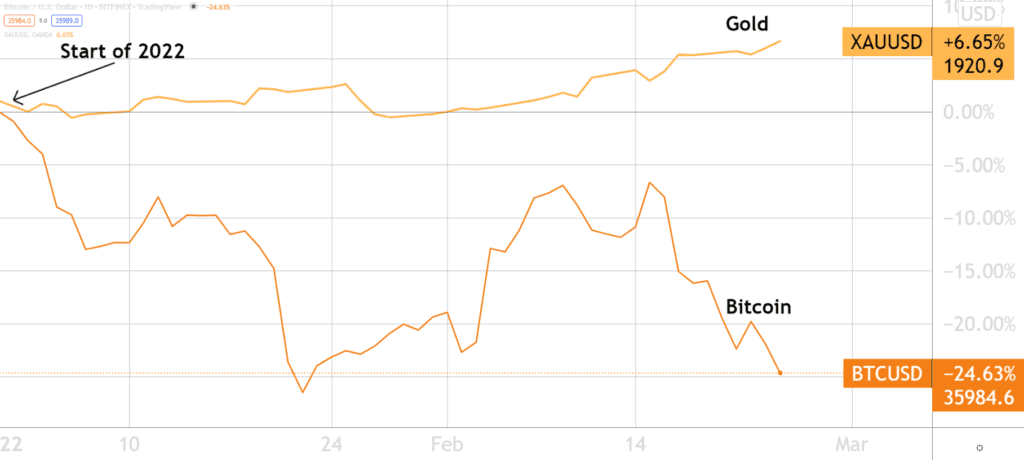

When 2022 began and reports on inflation showed record-breaking increases, bitcoin’s narrative as a safe haven asset weakened. Bitcoin fell further while gold maintained its course.

Bitcoin and gold in 2022 | Source: TradingView

Bitcoin and gold in 2022 | Source: TradingView

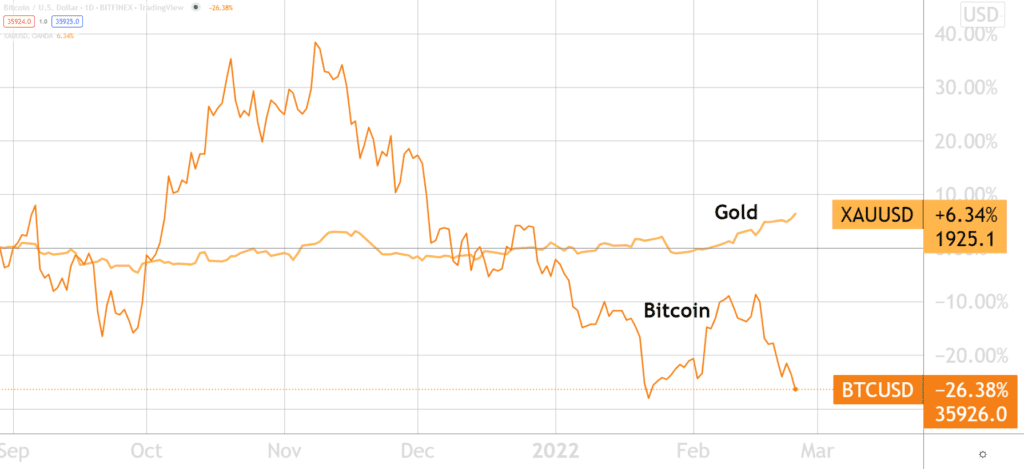

Bitcoin and gold since September 2021 | Source: TradingView

Bitcoin and gold since September 2021 | Source: TradingView

Bitcoin continued to fall as news came to light that Russia was ramping up its presence at Ukraine’s border. The record-breaking inflation and geopolitical tensions in Eastern Europe fit exactly into the narrative of what safe haven assets are supposed to protect against. Even though bitcoin had been touted as one of these assets, perhaps even the best of them all, it provided no protection.

So why isn’t bitcoin behaving like gold?

As more investors have added bitcoin to their portfolios, the psychology around the asset seems to have shifted from a libertarian, censorship-resistant inflation hedge to a purely speculative technology play.

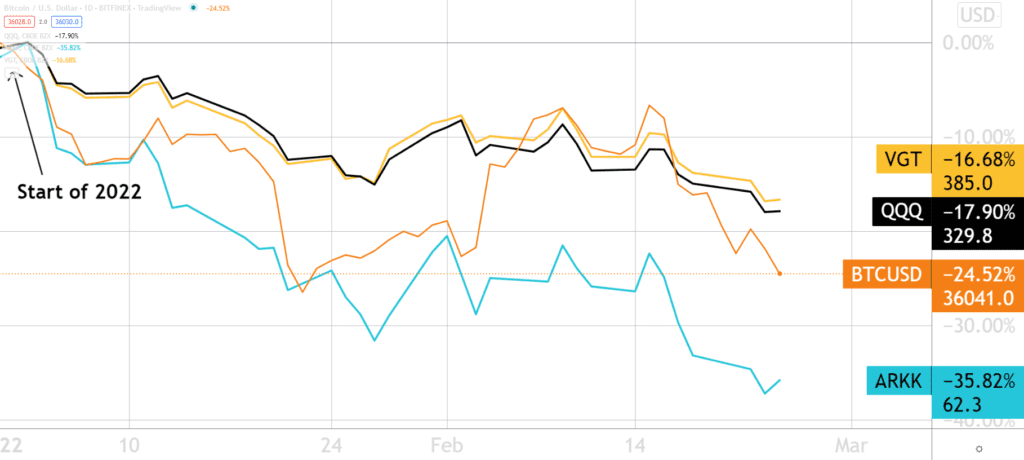

While it was always a speculative investment, its correlation to risker tech stocks and ETFs has become far more prominent than its correlation with safe haven assets lately.

Bitcoin and major tech ETFs in 2022 | Source: TradingView

Bitcoin and major tech ETFs in 2022 | Source: TradingView

Many outspoken bitcoin supporters still argue the cryptocurrency should provide a hedge against inflation and societal turmoil due to its qualities such as scarcity and censorship resistance. Yet, bitcoin continues to look less and less like a safe haven.

Potential reasons for bitcoin’s divergence include fears of over-regulation and an overall lack of education about the asset class. Some reports estimate that one-third of all cryptocurrency investors know little to nothing about what cryptocurrency is or how it functions. Until that changes and investors get clarity on regulations, bitcoin’s potential role as a safe-haven asset is likely to remain elusive.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.