Bitcoin Slides Below $35K Amid Putin’s Call for ‘Full-Scale Invasion’ of Ukraine

The cryptocurrency fell almost 9% over a 24-hour period, with many leading digital assets trading at their lowest levels since Jan. 24

An armored personnel carrier in Ukraine | Source: Shutterstock

key takeaways

- Putin warns other countries: Meddling with Russian affairs will lead to “consequences they have never seen”

- While crypto and stocks drop, gold is up 2.6% on the day and WTI Crude Oil is up 7.3%, trading at $99 a barrel

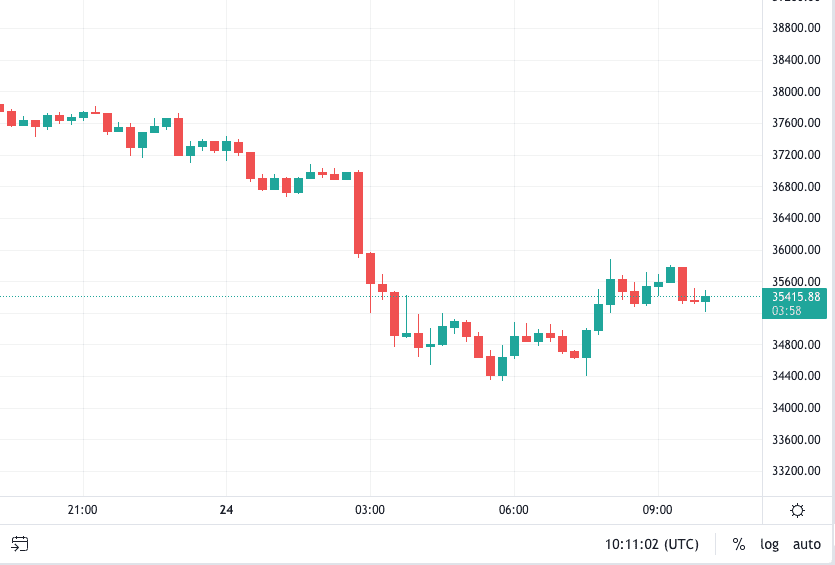

The price of the world’s largest cryptocurrency by market value fell beneath the $35,000 psychological support line late Wednesday evening amid Russian President Vladimir Putin’s calls for a military campaign inside Ukraine.

Bitcoin fell almost 9% over a 24-hour period, according to Blockworks. Many leading digital assets are trading at their lowest levels since Jan. 24.

Putin, appearing on live television at around 10:00 pm ET, said he had ordered the Russian military to move in on Ukraine’s Donbas region. Reporters in the Ukrainian capital, Kyiv, and the Black Sea port city of Odessa also observed explosions.

Russia declared Wednesday the Ukrainian territories of Donetsk and Luhansk of the Donbas region as independent amid strong condemnation from Western powers. Putin said the decision to move into those areas comes as a response to threats posed by Ukraine.

The Russian president warned other countries that any attempt to meddle with Russia’s affairs would lead to “consequences they have never seen,” ABC News reported.

Shortly before Putin began his address, bitcoin’s price began to tumble below $36,600 and continued falling to a low of $34,322, exchange data shows. A flood of seller volume on the hourly chart can be seen tracking its descent, with little resistance coming from bitcoin buy action.

Putin’s remarks came at 10:00 pm ET or 3:00 UTC.

Putin’s remarks came at 10:00 pm ET or 3:00 UTC.

Earlier on Wednesday, Pentagon spokesperson John Kirby said Russian forces were continuing to amass along Ukraine’s borders and were putting themselves “in an advanced stage of readiness to act and to conduct military action.”

A sell-off among stocks and crypto was seen Wednesday, extending the trend in lower prices as the S&P 500 and Nasdaq closed -1.84% and -2.6% respectively.

Ukraine’s foreign affairs minister tweeted Thursday that Putin had launched a “full-scale” invasion against his country and that cities within the region were “under strikes.”

Investors have continued to closely monitor developments in Ukraine, with both traditional and digital asset markets responding sharply. Eyes are now fixed on the US and its allies, awaiting their response to the mounting crisis.

Gold continues to hold water and is up 2.6% on the day — above $1,950 per troy ounce — while WTI Crude Oil is up 7.3% and trading at $99 a barrel. Meanwhile, crypto assets are floating around in a sea of red with Cardano, Avalanche, Polygon and Dogecoin taking the hardest hits in the top 20 by market value, down between -15% and -17% on the day.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.