Ex-ETH Miner Hive Blockchain Eyes Buying Opportunities Post-Merge

Firm among those starting to mine Ethereum Classic following blockchain’s transition to proof-of-stake

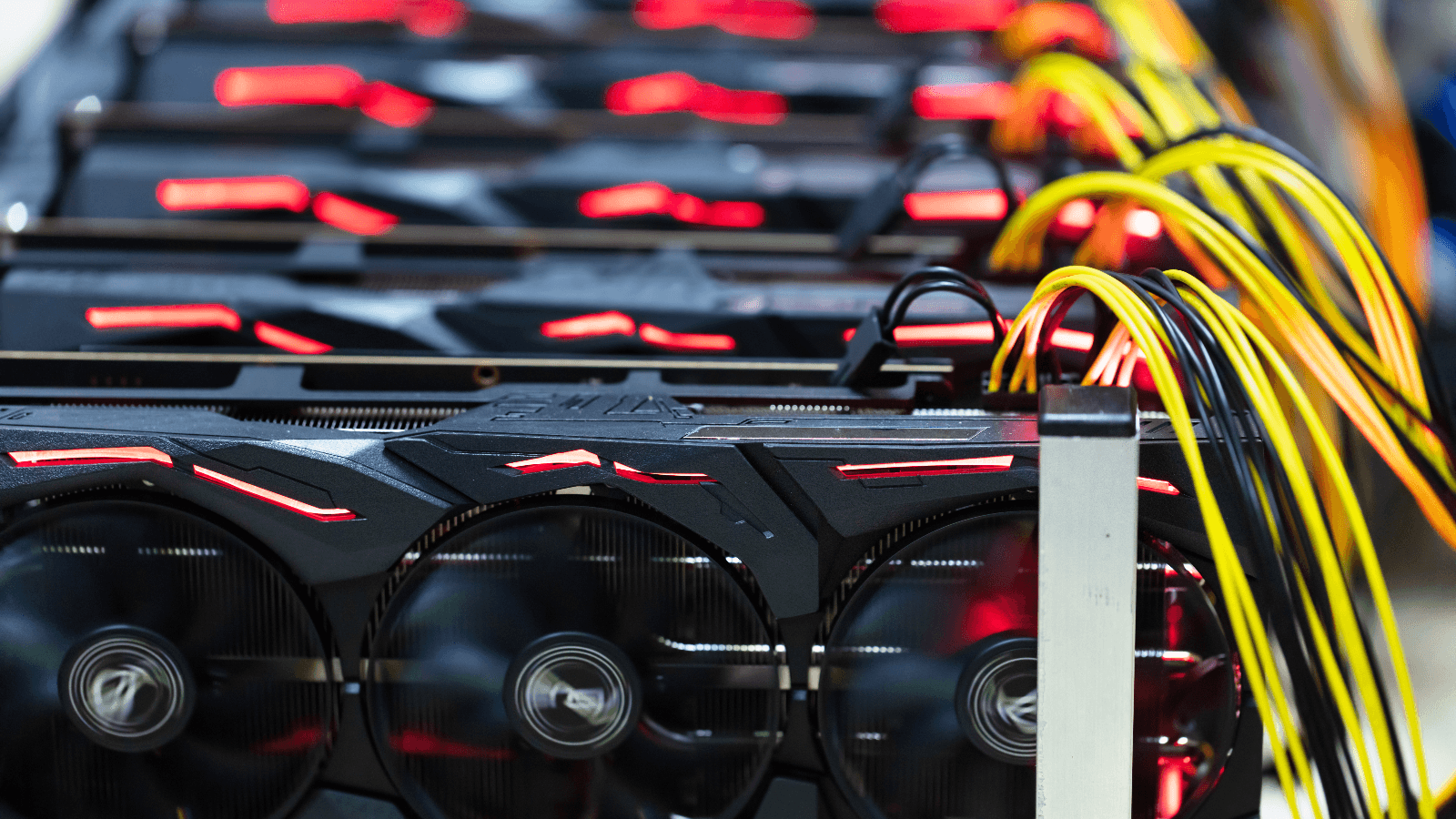

Source: Shutterstock

key takeaways

- Hive seeks to grow its bitcoin mining hash rate by 50% over the next six months, executive chairman says

- Ethereum Classic’s hash rate, formed in 2016 as a result of The DAO hack, roughly tripled following the Merge to about 215 terahashes per second (TH/s)

Ethereum’s switch to an underlying proof-of-stake consensus model has forced ether mining operations to pivot, which industry watchers said could trigger a wave of acquisitions.

Though some of the bigger Ethereum miners will be fine, White Rock Management CEO Andy Long told Blockworks, they will likely be looking for ways to acquire extra hash rate quickly.

Hive Blockchain Technologies, previously the largest publicly traded miner of ether (ETH), mined 821 bitcoins (BTC) and 7,675 ETH during the year’s second quarter. It has sold ether in recent months to buy new application-specific integrated circuits (ASICs) for bitcoin mining, including as part of an agreement with Intel Corporation.

Hive Executive Chairman Frank Holmes told Blockworks that the company has the cash to complete payments on Intel miners and is seeking other opportunities amid an oversupply of machines.

“We’re of the opinion that there’s going to be some great buys for equipment and for everything over these next six months,” Holmes said.

Hive entered into an at-the-market equity offering agreement earlier this month to sell up to $100 million of company shares to support the growth of its mining operations. The executive said the firm did so “in the event that something comes up that it can buy something 10 cents on the dollar.”

Hive and Hut 8 pivot after Merge

Hive Blockchain Technologies said last week it was analyzing mining other coins with its fleet of graphics processing units (GPUs).

“Anyone who’s mined with GPUs has been thinking about this from the start,” Long said. “What [ether miners] do have is a lot of power…just like bitcoin firms, so it’s just a case of being able to deploy the hardware quickly.”

Holmes said Thursday after the Merge that it has switched over to mining Ethereum Classic (ETC) and would be holding those assets amid what he expected to be a few weeks of “choppy waters.” The company is assessing other coins to mine, such as ravencoin (RVN).

The hash rate of ETC, formed in 2016 as a result of The DAO hack, roughly tripled following the Merge to about 215 terahashes per second (TH/s), as of 3:00 pm ET, according to Coinwarz.com. RVN’s hash rate also saw big growth Thursday, rising to 18.8 TH/s at that time.

Hut 8 Mining CEO Jaime Leverton told Blockworks in an email the company is watching to see how proof-of-work digital assets will ultimately be affected.

Hut 8 Mining CEO Jaime Leverton | DAS New York 2022

Hut 8 Mining CEO Jaime Leverton | DAS New York 2022“While Ethereum mining made up a very small portion of our operations, we are working with our mining pool as the hash rate migrates away from the Ethereum network to begin mining the next most profitable proof-of-work digital asset,” she added. “We have long been bullish on bitcoin and other proof of work assets, but we are also very committed to building out the infrastructure in our data centers to support the nascent blockchain and Web3 spaces.”

Hut 8’s 180 Nvidia GPUs that were mining ether are set to pivot to offer artificial intelligence, machine learning or visual effects rendering services.

Mining M&A coming?

Long said the top ETH miners will survive, due to strong balance sheets and operations.

“I think there’s more of a challenge for the small, microcap miners who have more or less funded their businesses from scratch with debt and now maybe are struggling or only just making the debt payments,” he said. “And then they’ve got to figure out how to replace the hardware in a year or two from now, and you’re just on this endless treadmill.”

Eric Chen, CEO of Injective Labs, agreed a number of miners will likely struggle to evolve their operations, which could present a number of acquisition opportunities for larger players.

The executive added, however, that hawkish rhetoric from the Federal Reserve, coupled with what he called a “dismal” macro environment, has led to a major downfall in mergers and acquisitions (M&A) activity across the board.

“The newer miners who have not lived through the past Ethereum fork will likely be impacted the most…due to their relative inexperience compared to the more veteran miner factions,” Chen said.

Crypto mining executives said during a panel at Blockworks’ Digital Asset Summit on Tuesday that M&A may not be a good option for larger miners right now — despite smaller players potentially wanting to sell.

“What I’ve noticed is that most of the transactions that have happened…it’s about assets and it’s about horse trading as opposed to mergers,” Argo Blockchain CEO Peter Wall said during the panel.

He pointed to Riot Blockchain’s acquisition of Whinstone from Northern Data last year, as well as CleanSpark’s deal last week to buy a Georgia bitcoin mining facility from Mawson Infrastructure Group.

“All of us have baggage, all of us have management teams and some of us have debt,” Wall said. “And so if you’re able to acquire either infrastructure or rigs and leave out all the rest of the baggage, it becomes more interesting.”

But Leverton said that even asset-based deals with other firms can be “tricky,” as the price of machines has plummeted in recent months.

“There are more machines than we can possibly plug in in the next six to nine months,” she said. “If you paid $70 or $80 per tera hash for your equipment — and you’ve got some leverage on that — I’m not going to take your debt for overpriced machines, when I can just buy machines straight-up for $20 or $25 per tera hash.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.