Market Recap: Fed Holds Rates Near Zero, For Now

Fed Chair Jerome Powell spoke on the Fed’s policy changes and revealed that rate hikes were on the horizon but would remain unchanged for now

Jerome Powell, chair, Federal Reserve, Blockworks exclusive art by Axel Rangel

- Fed Chair Jerome Powell’s remarks on the Fed policy caused some volatility in the markets

- The Fed’s statement notes that it will keep the Federal Funds rate between 0% and 0.25% until further notice

Today

Fed Chair Jerome Powell held a press conference today regarding the Federal Open Market Committee's (FOMC) meeting about policy changes in light of increased inflation. Markets were significantly volatile with bitcoin jumping as much as 5.3% in the moments leading up to the meeting only to fall into the red after the meeting.

In a similar fashion, the S&P 500 jumped as much as 0.70% just before the meeting only to drop in the negative later in the day.

[stock_market_widget type="accordion" template="chart" color="#5679FF" assets="BTC-USD,SPY" start_expanded="false" display_currency_symbol="true" api="yf" chart_range="1mo" chart_interval="1d"]

Traders and investors had been anxiously awaiting the Fed's plans for the federal funds rate. While the Fed had already announced that it would stop asset purchases by March, many expected the Fed to begin increasing rates immediately given increased inflation. Instead, Powell revealed that the Fed would keep interest rates the same for the time being.

"The committee left the target range for the federal funds rate unchanged, and reaffirmed our plan announced in December to end asset purchases in early March. In light of the remarkable progress we've seen in the labor market and inflation that is well above our 2% longer-run goal," said Powell during the press conference.

Though rates will remain unchanged right now, Powell did mention that the Fed would look to increase them along the same timeline that it intends to cease asset purchases.

“I would say that the committee is of a mind to raise the federal funds rate at the March meeting, assuming that conditions are appropriate for doing so,” said Powell

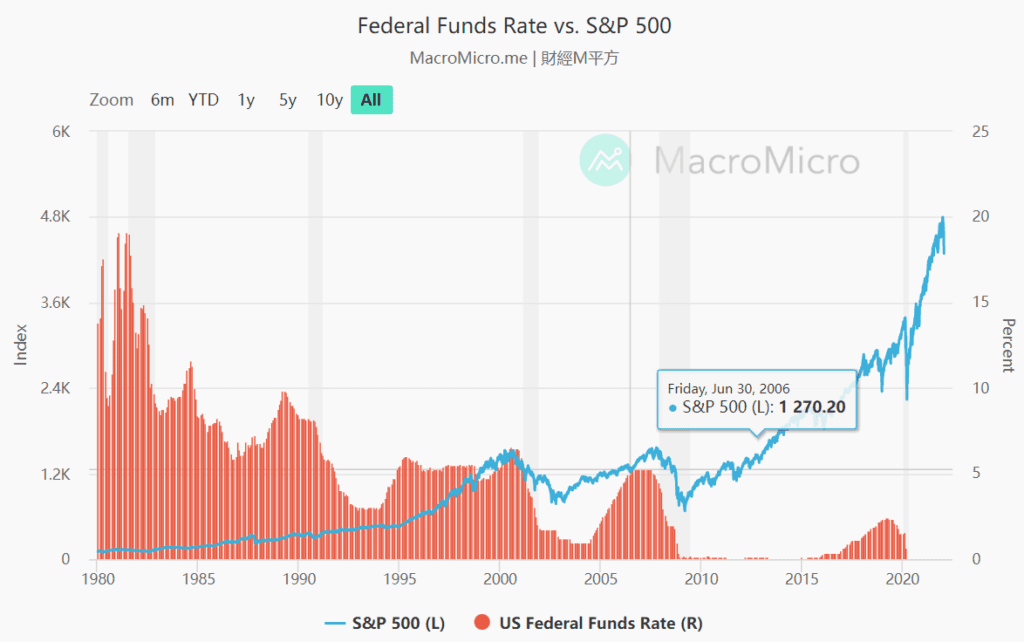

An increased federal funds rate following a period with very low rates has historically correlated with down markets. This is because lower rates add more capital to markets while higher rates dry up capital, clenching down on the amount of risk investors are willing to take and how much they want to be exposed in the market.

Source: MacroMicro

Source: MacroMicro

Top stories

Story: Fed Market Reaction: Stock Correlation Weighs More on Bitcoin Than Interest Rates

- Markets marginally rebound on signals that rate hikes may come in March

- If bitcoin’s correlation to equities persists, a greater sell-off might follow a short-term pop

Story: Coinbase: DeFi Growth Spikes as Crypto Shifts to Web3 Technologies

- The total value locked across layer-1 protocols jumped 1,237% from $18.7 billion at the beginning of 2021 to about $250 billion by year-end, according to DeFiLlama data

- Uniswap accounted for the lion’s share of volume with $779 billion traded on its protocol

Story: FTX.US President: Crypto Derivatives are 2022 Priority

- FTX.US’s first external funding round, which included participation from Paradigm, Temasek, NEA and Multicoin Capital, values the company at $8 billion

- FTX.US could look to acquire companies as a way to access their users, gain licenses, president says

Story: Is Facebook’s Diem Stablecoin Falling Apart?

- Meta’s Diem Association, formerly known as Libra, has been plagued by regulatory and social backlash

- The association is seeking to sell assets to pay back investors, sources familiar with the matter reportedly say

Story: CoinShares Launches Polkadot, Tezos ETPs With Staking Rewards

- The Polkadot and Tezos products are designed to share staking rewards of 5% and 3%, respectively, per year

- Products join four other physically backed Coinshares ETPs that invest in bitcoin (BTC), ether (ETH), litecoin (LTC) and XRP

Story: Twitter’s New NFT Verification Tool Does Not Confirm Authenticity

- A Twitter spokesperson told Blockworks that users can click on a profile picture to see whether the NFT collection has been verified with OpenSea

- All Ether-based NFTs that have a recorded transaction on the blockchain will be displayed on Twitter profiles

Tomorrow

Upcoming earnings reports to watch out for tomorrow are Mastercard (MA) and Visa (V), both of which have become more involved in the cryptocurrency space in the last year.

Mastercard is expected to report earnings before market open while Visa is expected to release earnings after market close. Investors should expect volatility to remain high for the foreseeable future as the Fed gears up to hike rates.

[stock_market_widget type="accordion" template="chart" color="#5679FF" assets="MA,V" start_expanded="false" display_currency_symbol="true" api="yf" chart_range="1mo" chart_interval="1d"]

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.