Bitcoin Network Transaction Volume Surpasses AmEx, Research Shows

In a new report, cryptocurrency investment firm NYDIG found the Bitcoin network surpassed $3 trillion in transactions last year

Source: Shutterstock

- Bitcoin’s transaction volume has increased by 100% annually over the past five years, a new report says

- Consumer spending has slowed amid rising inflation and new Covid variants

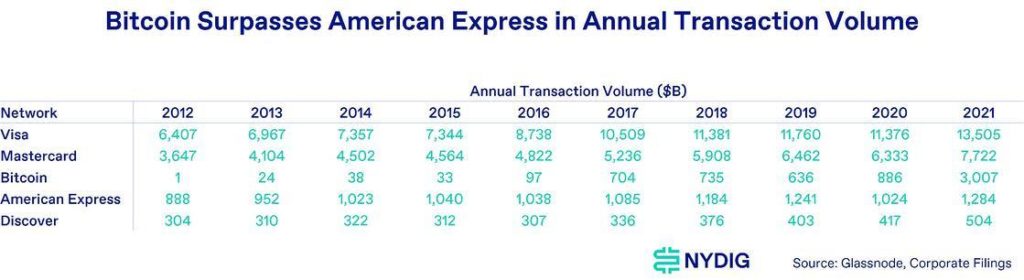

Bitcoin eclipsed $3 trillion in payment transactions last year, surpassing American Express and Discover, according to data from cryptocurrency investment firm NYDIG.

“Bitcoin has jumped into the number three spot in this ranking through significant growth in transaction volumes,” NYDIG researchers wrote in the recent report. “That transaction volume growth, while not always even year-to-year, has kept up at a torrid pace when looking at 5-year compound annual growth rates.”

Bitcoin’s transaction volume has increased by almost 100% annually over the past five years, data show.

NYDIG’s report comes as consumer spending starts to rebound after the pandemic-induced slump, but it is unclear if the trend will continue, given inflationary pressure and rising concern over new Covid variants.

AmEx announced record cardholder spending in its fourth quarter earnings report. Cardholders spent $368.1 billion in the last quarter of 2021, up from $285.9 billion in 2020.

Discover also reported increases in transactions, with debit card spending up 18% year-over-year, according to its fourth quarter earnings report.

While analysts had previously predicted consumer spending to increase through 2022, shifting monetary policy has created uncertainty. Consumer spending was down 0.6% in December, a surprising drop, considering seasonal spending trends. The trend could mean bitcoin is due for a rally, some researchers believe.

“On the one hand, the US Federal Reserve has a mandate to control inflation, but it also has a mandate of stable prices. It is very challenging to see how the Fed can control both at present,” researchers from CoinShares wrote in a recent report. “Consequently, we see there being a high risk of a Fed policy error (waiting too long and then raising interest rates too aggressively), with the USD then selling off, both of which are likely to be supportive of Bitcoin and other real assets.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.