Risk-On Appetite Falters: Bitcoin Trades Like Big Tech

Bitcoin, once touted for its uncorrelated nature, is starting to trade more like stocks

Source: Shutterstock

- As investors embrace a risk-off approach, bitcoin is trading more in sync with equities

- The correlation will fade and bitcoin will rise, though, analysts say

Amid growing concerns about inflation and looming rate hikes from the Federal Reserve, bitcoin has been moving more in sync with stocks than ever before.

An imminent end to the Fed’s ultra-easy monetary policy days has investors reconsidering their appetite for risk.

“The same players who pursued significant risk-on sentiment are now moving towards a risk-off approach as the Fed gears up to change course on interest rates,” said Josh Olszewicz, head of research at Valkyrie Funds.

Though bitcoin is trading more in tandem with the tech-heavy Nasdaq, traders expect the association to weaken over time.

“Markets tend to increasingly correlate on the down side, and eventually this trend may decouple, just as it has in years prior,” said Olszawicz.

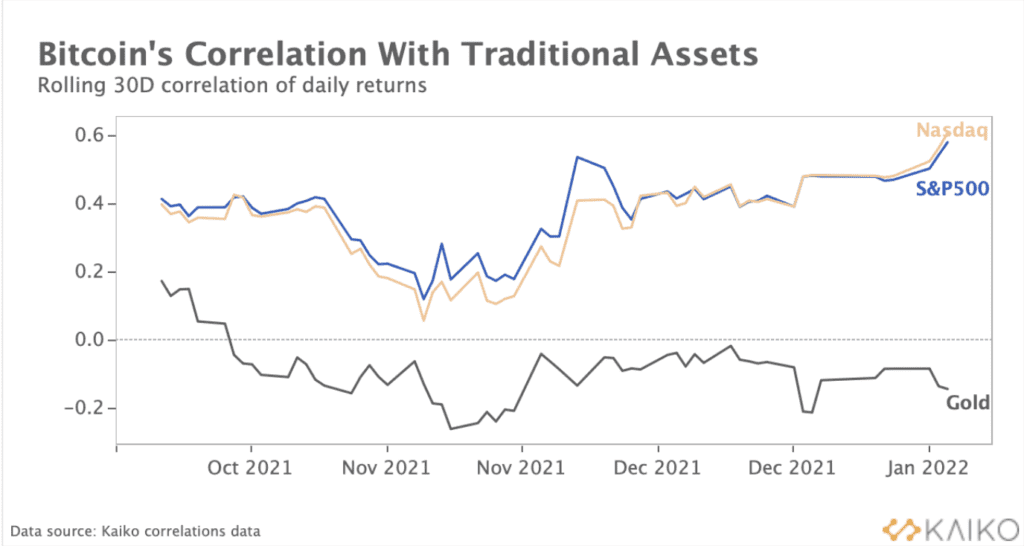

The correlation coefficient between bitcoin and the Nasdaq broke 0.60 earlier this month, the highest level in more than a year, according to a report from crypto data firm Kaiko. The digital currency is also trading more closely to the S&P 500. A coefficient of 1 means the assets are moving in tandem, while a -1 signals the opposite.

Bitcoin has dropped more than 20% on the year. The Nasdaq has lost close to 14% over the same period. Cathie Wood’s ARK Innovation ETF (ticker ARKK), which has top holdings in Spotify, Tesla and Zoom, is down more than 30% year-to-date/

“Bitcoin should remain as a sound money alternative while some players in the tech sector are likely to be better priced according to their fundamentals,” Olszawicz said.

Once the current sell-off rebounds, bitcoin should start to trade in a less-correlated way, analysts project.

“The ‘don’t fight the Fed’ mantra pertains to all risk assets, notably equities,” said Mike McGlone, senior commodity strategist at Bloomberg Intelligence. “Cryptos are among the riskiest most speculative assets, but bitcoin is the least risky crypto.”

Bitcoin’s increasing adoption will help, too, McGlone added.

“I expect bitcoin to come out ahead in this market risk-off period as the benchmark crypto transitions to global digital collateral, which is a minor fraction of most portfolios,” McGlone said. “That’s changing, and 2022 may mark a key transition period.”

[stock_market_widget type=”accordion” template=”chart” color=”#5679FF” assets=”BTC-USD,^IXIC,^GSPC,ARKK” start_expanded=”false” display_currency_symbol=”true” api=”yf” chart_range=”1mo” chart_interval=”1d”]

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.