Blockchain Data Analytics Platform Nansen Closes $75M Series B Round

The company analyzes billions of on-chain data points and thousands of entities on blockchains like Ethereum, Polygon, Binance Smart Chain, Fantom, Avalanche and Celo

Source: Nansen

- Round comes six months after its $12 million Series A, since then the platform’s user base has risen over 400%

- Nansen expects 10% of its annual recurring revenue growth to be generated by its institutional segment this quarter, as its use cases grow

Blockchain data analytics platform Nansen raised $75 million in a Series B round, the company’s CEO and co-founder Alex Svanevik said to Blockworks.

The round was led by Accel, GIC, Andreessen Horowitz (a16z), Tiger Global, SCB and 10X. Other angel investors and venture capitalists also participated in the round.

This Series B comes six months after it raised $12 million for its Series A in late June. Within that time frame, the company has expanded with 55 new employees across 28 countries and its user base has increased over 400%. In total, Nansen has raised $88.2 million, Svanevik said.

“To accelerate Nansen’s next phase of growth, we intend to use the fresh capital to hire more team members across product, engineering, operations, finance, sales, and marketing,” Svanevik said. “Furthermore, we are now in a position to make strategic acquisitions that are complementary to Nansen,” he added. The funding will also be used to expand the platform’s features and multichain integrations internationally.

Its platform integrates on-chain data with a database of activity and movement across 100 million blockchain wallets, so that users can monitor real-time insights and transactions. Nansen also analyzes billions of on-chain data points and thousands of entities on blockchains like Ethereum, Polygon, Binance Smart Chain, Fantom, Avalanche and Celo.

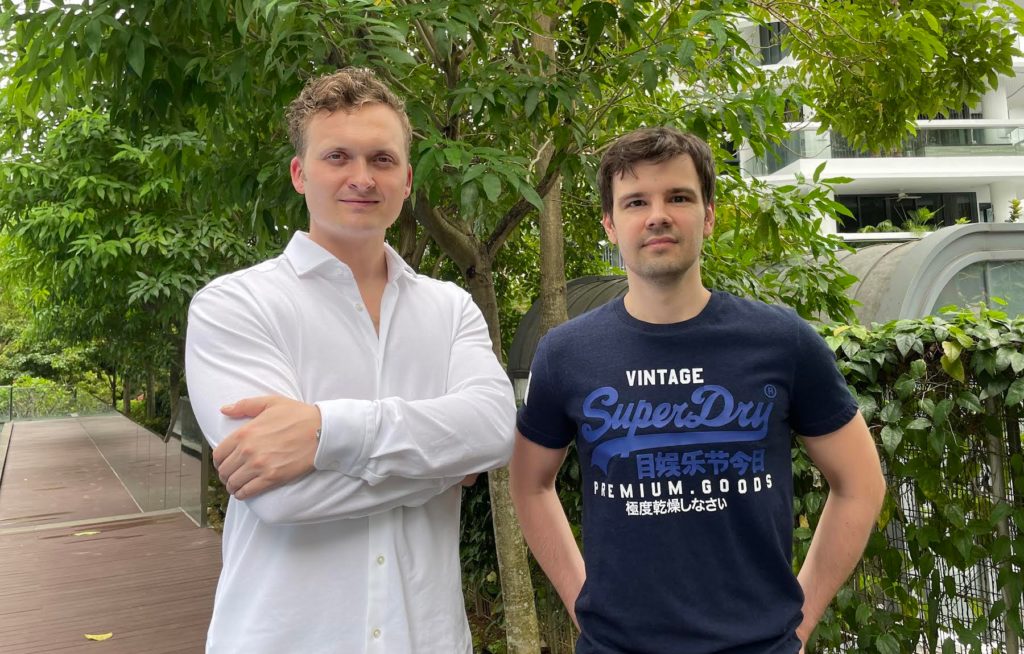

Alex Svanevik and Evgeny Medvedev, co-founders of Nansen

Alex Svanevik and Evgeny Medvedev, co-founders of Nansen

The one-year-old company has experienced rapid growth and user adoptions among retail investors and institutional investors including Three Arrows Capital, DeFiance Capital, Genesis Block Ventures, Not3Lau Capital, Polychain, YBS Capital and Acheron Trading.

Additionally, the platform is used by crypto teams at Axie Infinity, Polygon, and Lido, and has had over 20 times increase in subscribers over the last year, it said.

“95% of Nansen users were individual innvestors before our Series A and the creation of an institutional team at the end of the summer,” Alexandre Caillol, the company’s head of institutional sales said to Blockworks.

“During Q4 2021, the team has met 100+ institutions from crypto-native [or crypto-curious] asset managers and banks, to DEXes and NFT-syndicated investment communities,” Caillol added.

During this current quarter, Nansen expects 10% of its annual recurring revenue growth to be generated by its institutional segment as its use cases grow beyond being a tool for “retail yield farmers and legendary NFT collectors,” Caillol said.

Going into 2022, Svanevik said the company plans to introduce new product lines such as Nansen API and Nansen Query, which will allow institutional clients to access its on-chain data programmatically.

“Nansen is building institutional-grade tools to support the future of finance, and we’re hiring actively for it,” Caillol said.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.