BTC Hovers Near Critical Support: Markets Wrap

The broader crypto market continues to experience bearish price action as the market prices in tighter monetary policy from the Fed

Blockworks Exclusive Art by axel rangel

- Less accommodative Federal Reserve policy brings bearish price action to BTC

- Market participants are now pricing in a high chance of three to four rate hikes in 2022

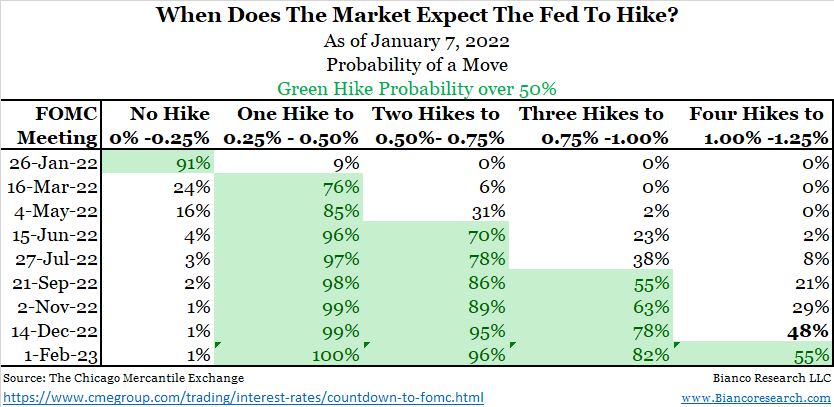

The market is now pricing in a good chance of three or four rate hikes in 2022.

Yields on government bonds have been soaring higher as the market expects a less accommodative US Federal Reserve.

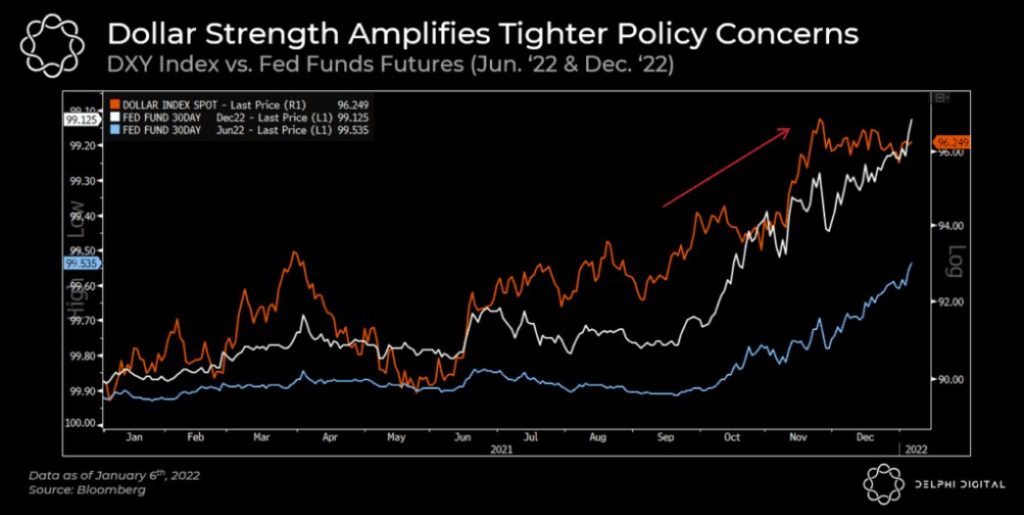

The US dollar has shown strength over the past few months, a headwind for digital assets.

Latest in Macro:

- S&P 500: 4,670, -0.14%

- NASDAQ: 14,942, -0.05%

- Gold: $1,801, +0.36%

- WTI Crude Oil: $78.43, -0.60%

- 10-Year Treasury: 1.755%, -0.014%

Latest in Crypto:

- BTC: $41,737, -1.80%

- ETH: $3,076, -3.80%

- ETH/BTC: 0.0737, -1.98%

- BTC.D: 40.91%, +1.36%

Tighter fiscal and monetary policy

Volatility has been in full force as of late with the market expecting three to four rate hikes by the end of 2022 and fewer asset purchases by the Fed in the face of higher inflation, which in theory would lead to less dollar liquidity.

Source: Bianco Research

Source: Bianco Research

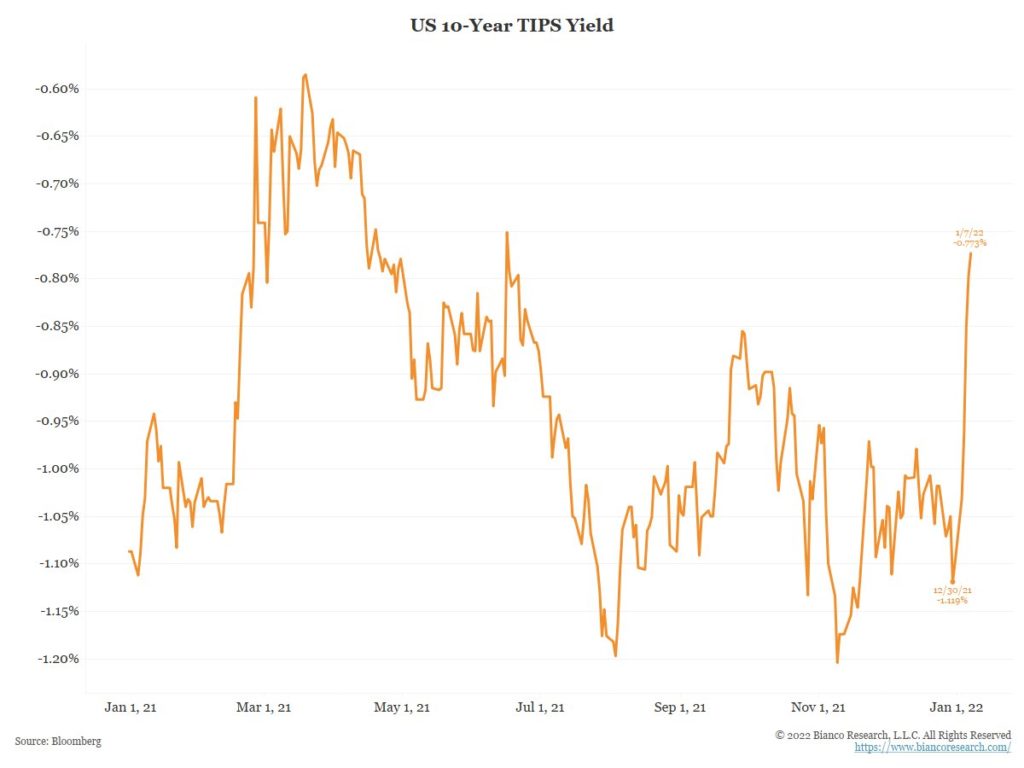

The US 10-year TIPS yield surged last week, which could be bond market participants waking up to the reality that the Fed may be less accommodative in 2022.

Jim Bianco, President of Bianco Research, wrote, “Simply put, the bond market saw one of its worst weeks in history because bond market players finally ‘got it’ that the Fed is going to end liquidity. This kicked off a big the scramble to get out and not be the ‘bond bag holder’ when the Fed printer is turned off.”

Source: Bianco Research

Source: Bianco Research

“Meanwhile, growing expectations for higher rates + tighter liquidity conditions (coupled with a relatively strong economic outlook in the US vs. other regions) has helped breathe life back into the US dollar,” wrote Kevin Kelly, Co-Founder of Delphi Digital.

Source: Delphi Digital

Source: Delphi Digital

BTC note

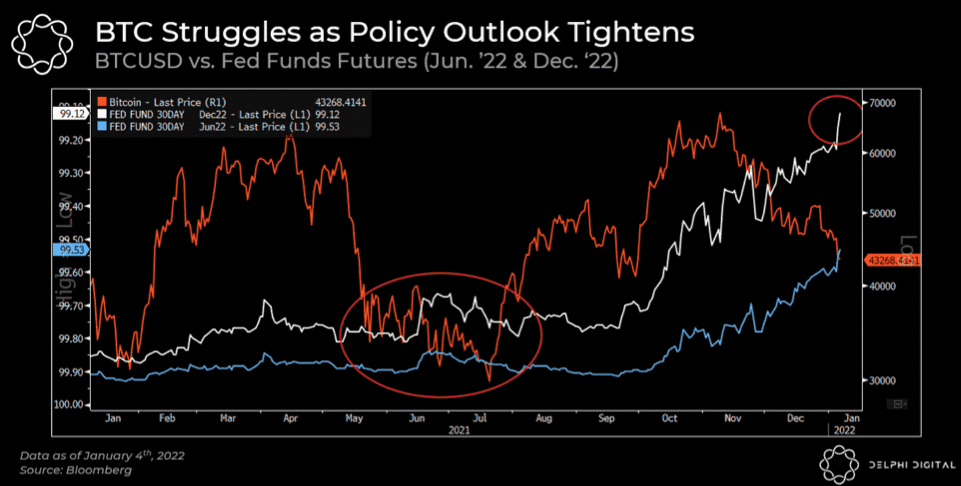

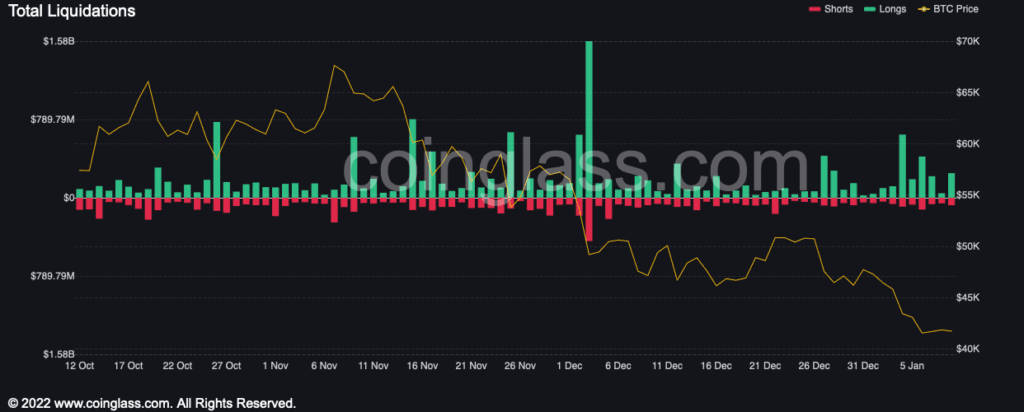

BTC dropped as low as $39,692 earlier today, according to data from CoinGecko. The aforementioned expectations of “tightening” by the Fed in conjunction with the inherent amount of leverage used in digital asset markets are likely to blame for the bearish price action.

Source: Delphi Digital

Source: Delphi DigitalBillions of dollars of long positions have been liquidated since the December 4th crash, according to data from Coinglass.

Source: coinglass.com

Source: coinglass.com

NFTs

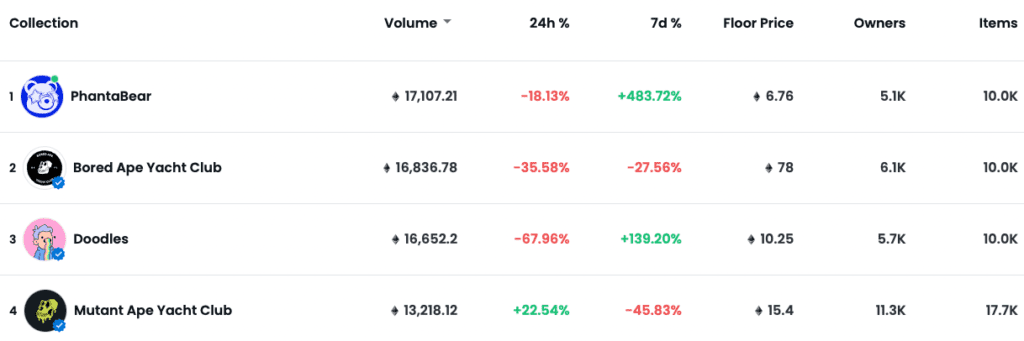

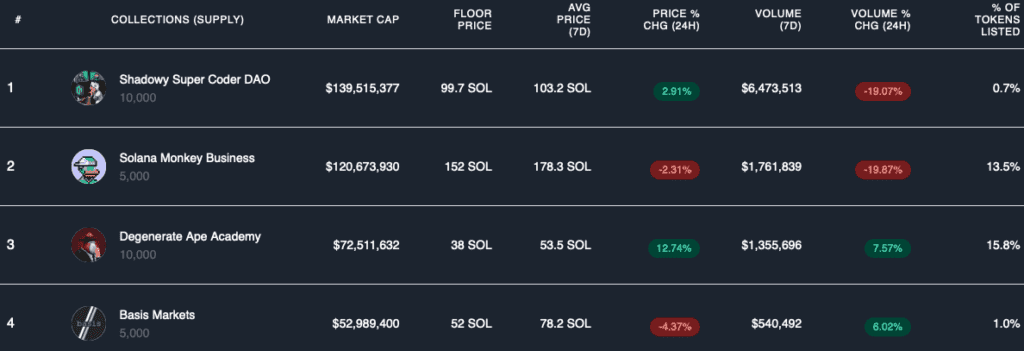

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.