Digital Artist S. Preston’s Entrance into the NFT Space

Renowned creator among sports fans partnered with Candy Digital to launch MLB Stadium Series last month

Digital artist S. Preston: Source: the artist

- NFTs have allowed S. Preston to offer one-of-one versions of his artwork to collectors for the first time, he told Blockworks

- Candy Digital has so far sold more than 4,000 of his NFTs that depict “minimalist” snapshots within MLB ballparks

A digital artist known as S. Preston had been selling his prints for a decade. He now has his name on a range of non-fungible tokens released by Major League Baseball as the NFT market has boomed.

Preston told Blockworks in an interview that he first heard about NFTs in 2020 during the coronavirus pandemic. Amid the growing popularity earlier this year of digital collectible platform NBA Top Shot, which began its public beta testing phase last October, the artist began making calls to see how he could enter the space.

Canadian blockchain tech company Dapper Labs secured $305 million in private funding – some of it from Michael Jordan – to scale NBA Top Shot in March. The trading card site had reportedly tallied $500 million in sales at the time since it went public.

“That’s when I think in the sports world, every league’s ears perked up,” Preston said. “…I saw this double world of these memorabilia collectors and then the NFT OpenSea world of NFT collectors, and I kind of felt like I fit in between.”

Morphing prints to NFTs

Preston announced on March 2 to his Twitter followers, which now total more than 21,000, that he had minted his first NFT. The black ink and copic marker illustration was inspired by mixing Wendy Peffercorn, a lifeguard in the baseball film The Sandlot, with Taylor Swift’s 1989 album cover. The NFT can still be purchased for 0.2 Ether.

But he saw a bigger opportunity to enter the NFT market through Major League Baseball and the National Hockey League, for which he has been a licensed artist for years. Preston is also established with the NFL and NBA, Looney Tunes and LucasFilm, he noted, and is known by some fans for his drawings of Disney princesses dressed in sports gear.

Preston soon connected with Candy Digital, which launched in June with the backing of Fanatics Executive Chairman Michael Rubin, Galaxy Digital founder and CEO Mike Novogratz and digital media entrepreneur Gary Vaynerchuck.

Candy partnered with Major League Baseball to release, on July 4, an NFT of Lou Gehrig’s famous “Luckiest Man” speech that he delivered on July 4, 1939, after being diagnosed with ALS. The digital collectible company would announce additional products in the coming weeks, including the MLB Stadium Series, by S. Preston.

The stadium artwork, which he first created about 10 years ago, launched his career, he told Blockworks. The collection was included in the permanent archives at the Baseball Hall of Fame in Cooperstown, N.Y.

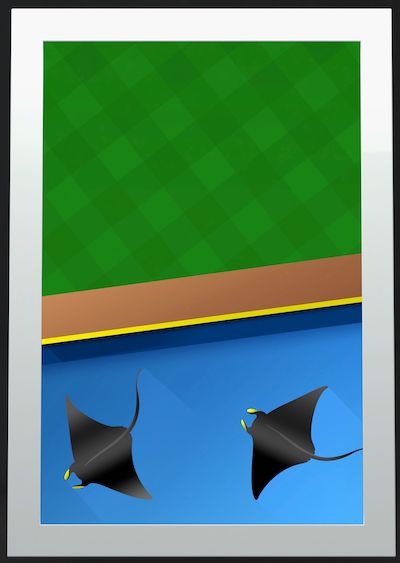

S. Preston’s NFT of Tropicana Field, home of the Tampa Bay Rays, one of the 30 NFTs in his MLB Stadium Series; Source: S. Preston

S. Preston’s NFT of Tropicana Field, home of the Tampa Bay Rays, one of the 30 NFTs in his MLB Stadium Series; Source: S. PrestonFocused on minimalism, he explained, the art — sold for years as prints — focuses on triggering an emotion or connection to the team rather than being overly intricate.

The first two stadium NFTs — portraying Preston’s take on Fenway Park’s green monster and Citi Field’s home run apple — launched on Aug. 9, and the remaining ones continue to launch weekly through the end of September.

A one-of-one “Gold Edition,” which goes to the highest bidder, includes the NFT, a ceremonial first pitch, two tickets, a stadium tour, a meet-and-greet, and an S. Preston print. Additional “Steel Edition” NFTs are available to anyone during the designated auction period for $100.

“S. Preston has established himself with sports fans and art lovers alike via his unique minimalist perspective at the intersection of sports branding and graphic arts,” Candy Digital CEO Scott Lawin told Blockworks in an email. “Connecting and engaging with the next generation of fans and collectors through new digital realizations of his work is exciting to see and represents the future of fandom.”

His Yankee Stadium NFT garnered the highest auction price so far, selling for $33,000, according to a Candy Digital spokesperson. With nine of the 30 ballpark NFT collections already auctioned off, as of Sept. 2, more than 4,000 Steel Editions have been sold, the representative added.

Physical art versus NFTs

As a graphic artist, Preston noted that he had never before been able to offer a one-of-one work for collectors, and NFTs have changed that.

“That was always a hole in my career [as] people asked for the highest collectible version of my art,” he explained. “These are my one-of-ones. These are my originals. This is it.”

The NFT market has boomed in recent months. OpenSea, the largest NFT marketplace, hit $3 billion in August monthly volume, or 925,000 ETH, following the public sale of its Bored Ape Yacht Club (BAYC) collection.

Despite the growing popularity of the space, Preston said many collectors only want to buy art they can display and thus struggle with the concept of NFTs. The next stage of growth for NFTs comes when that thinking evolves, he added.

“Art is not its utility value on the wall,“ Preston said. “If you buy a Mickey Mantle rookie card, you’re not going to want to put that on the wall. The more you pay, the more you want to put it in a shoebox or put it in a vault. It’s an investment, but it’s also collecting. It’s the value of ownership.”

What’s in store?

Preston estimates that he would make a lot more revenue from his work on NFTs in three to five years from now when he expects some of the apprehension and negativity around the space to dissipate, but says he likes being an early contributor to the space.

“I think the boom comes when the Fanatics and Amazons and eBays of the world settle into what chain they’re going to use and create those giant marketplaces,” he said. “It’s exposure at this point. We know it exists, we know its functionality and all those things, but once the marketing engine gets behind it … I think that’s when everyone starts jumping on board.”

Preston plans to continue working with Candy Digital to take some of his existing artwork and perhaps create them as NFTs with video to support it, similar to the Lou Gehrig release. He said he also plans to mint NFTs to be sold alongside some of his original pieces, noting that he is currently working on illustrations of Looney Tunes’ Tasmanian Devil.

The 49-year-old artist said he expects to continue being a physical artist first.

“I think in 10 years or 15 years when NFTs really become the MP3s of the art world,” he noted, “ the younger artists who grew up with an iPad and an Apple Pencil are the ones who will really benefit from the growth of the NFTs.”

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.