El Salvador Went All-In on Bitcoin, Will Other Countries Follow?

El Salvador made history with its quick rollout of bitcoin as legal tender, but there is question over when, if ever, other countries may follow suit.

Source: Shutterstock

- BitMEX CEO says five more nations will adopt bitcoin by the end of 2022

- El Salvador was quick to roll out bitcoin payments, but some question their practicality

Since the announcement that El Salvador would establish bitcoin as legal tender in June, speculation has swirled around which other countries may follow suit.

Some believe El Salvador’s hasty rollout indicates that building an effective payment system may take time, others see Latin American nations accepting the world’s largest cryptocurrency by the end of next year.

“There’s a lot of noise, there’s a lot of attention around crypto, and there are several exchanges across the region, and particularly in Mexico, Colombia, Brazil, Argentina,” said Anabel Perez, CEO and co-founder of NovoPayment. “But I think we’re in the early stage of seeing the impact of crypto in Latin America economies.”

Two days after El Salvador President Nayib Bukele declared that bitcoin would become legal tender on June 5, the Bitcoin Law was passed. The Law included the controversial Article 7, under which businesses are required to accept bitcoin for all payments.

The timeline was sped up intentionally, said Jack Mallers, founder and CEO of Strike, who announced El Salvador’s news at the Bitcoin 2021 conference in Miami after working with authorities to implement blockchain payments.

During a podcast interview, Mallers shared that authorities said, “We can do this slowly, or we can just put it on the people and people will learn. If they’re forced to do it, they’ll learn and they’ll learn quickly.”

Despite some hesitancy from citizens and business owners, the law went into effect in September. Some believe we can expect to see other nations, particularly those in Latin America, join El Salvador in the coming months.

“My prediction is that by the end of next year, we’ll have at least five countries that accept Bitcoin as legal tender,” BitMEX CEO Alexander Höptner wrote in a recent blog post. “All of them will be developing countries.”

Höptner went on to cite remittances, rising inflation, and political motives to appear progressive and “new age” as reasons for developing nations to go all-in on bitcoin.

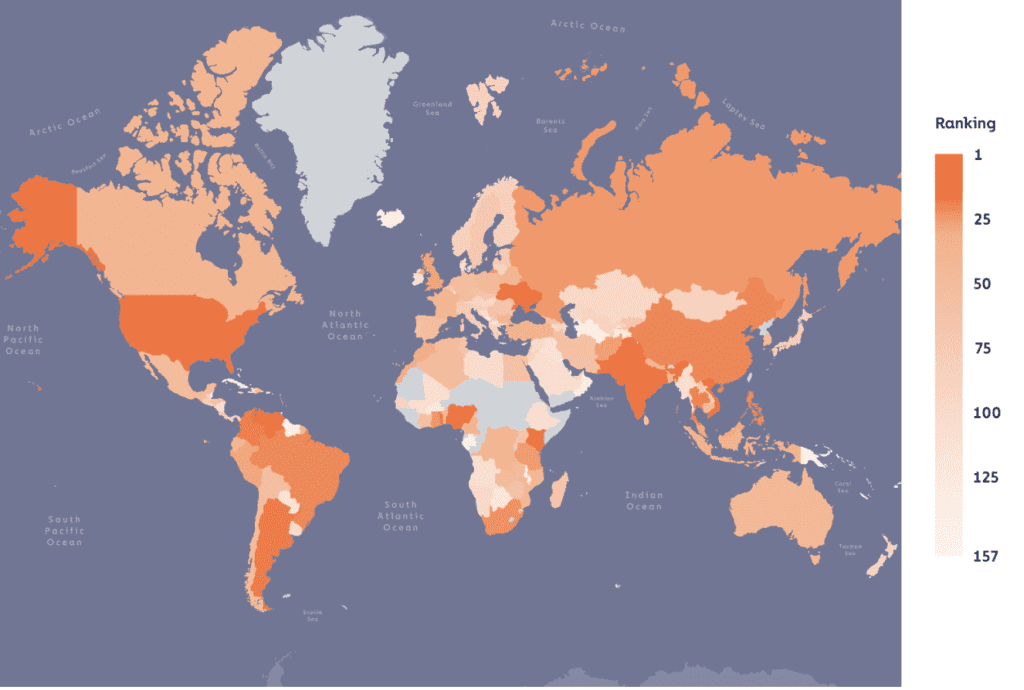

Source: Global Cryptocurrency Adoption Index | July ‘20 – June’21; Source: Chainalysis

Source: Global Cryptocurrency Adoption Index | July ‘20 – June’21; Source: ChainalysisEl Salvador is unique given that US dollars — which, like bitcoin, are also legal tender in the Central American nation — are not printed by its own central bank, Perez pointed out.

“There’s something that sometimes we don’t take into account, and that is the role of the central banks. There are certain markets in which the role of the central bank is not as critical as other markets because they don’t print currency. They just import money like in the case of El Salvador,” said Perez. “When the monetary authority doesn’t play a big role in the arbitrage, this type of model works when currencies can coexist, for example, the US dollar and crypto assets as a means for payments.”

There are ways that blockchain technology can benefit citizens in Latin America and across the world, Perez said, also pointing to remittances, but it’s going to take time. The main issue, she said, is the lack of infrastructure.

“We need more infrastructure in place to make the connection between digital assets and the real world,” she said.