Empire Newsletter: Solana patch targets congestion woes

During the first week of the year, Solana raked in less than 3% of the total fees across 11 major blockchains

dRender/Shutterstock modified by Blockworks

The great monolithic hope

As Solana users wait to see whether a new patch makes it any easier for transactions to go through, it’s clear there’s a lot riding on it.

Besides Bitcoin, Solana is arguably the poster-boy for monolithic blockchains. Much of Solana’s thesis rests on the notion that it’s decentralized to the point that it can’t be easily compromised, while being fast and cheap enough to handle everything that degenerates can throw at it (like memecoins).

If Solana can do all that without suddenly becoming hyper-expensive — as has been the case with Ethereum and Bitcoin when onchain activity is high — then it must be valuable.

Solana Labs wants to achieve that while keeping the overwhelming majority of transactions entirely on mainnet. Co-founder Anatoly Yakovenko has been outspoken about the importance of doing so from a user experience perspective.

The thinking goes like this: Why risk fragmenting Solana’s user base — and all that liquidity — by spreading them across multiple blockchains, each with their own set of apps and risk profiles? It’s not like that turned out great for Cosmos.

Scaling by tinkering with the base layer may be more effective in the long run. One part of this week’s v1.17.31 patch, for instance, aims to make it easier for high-quality Solana validators — those with more SOL staked than others — to post transactions by penalizing low-quality validators, or those with ultra-low SOL stakes.

The apparent idea is that largely ignoring low-quality Solana validators might allow the larger network to prioritize legitimate users, namely over the memecoin-trading arbitrage bots that have flooded the network these past few months.

Tracking the efficacy of the new update is difficult, as is the impact of transaction-heavy projects like Ore suspending operations as fixes take shape. The number of failed transactions in each block is more-or-less steady, but that doesn’t at all reflect Solana’s actual congestion.

Solana’s spam problem can only really be measured by the number of transactions that are “dropped,” or ones that are submitted for validation but never actually reach the chain. Only the individuals running validator nodes themselves have that data — and few if any actively report those figures. All other evidence is anecdotal, and there’s still the odd X post indicating some degree of dropped transactions.

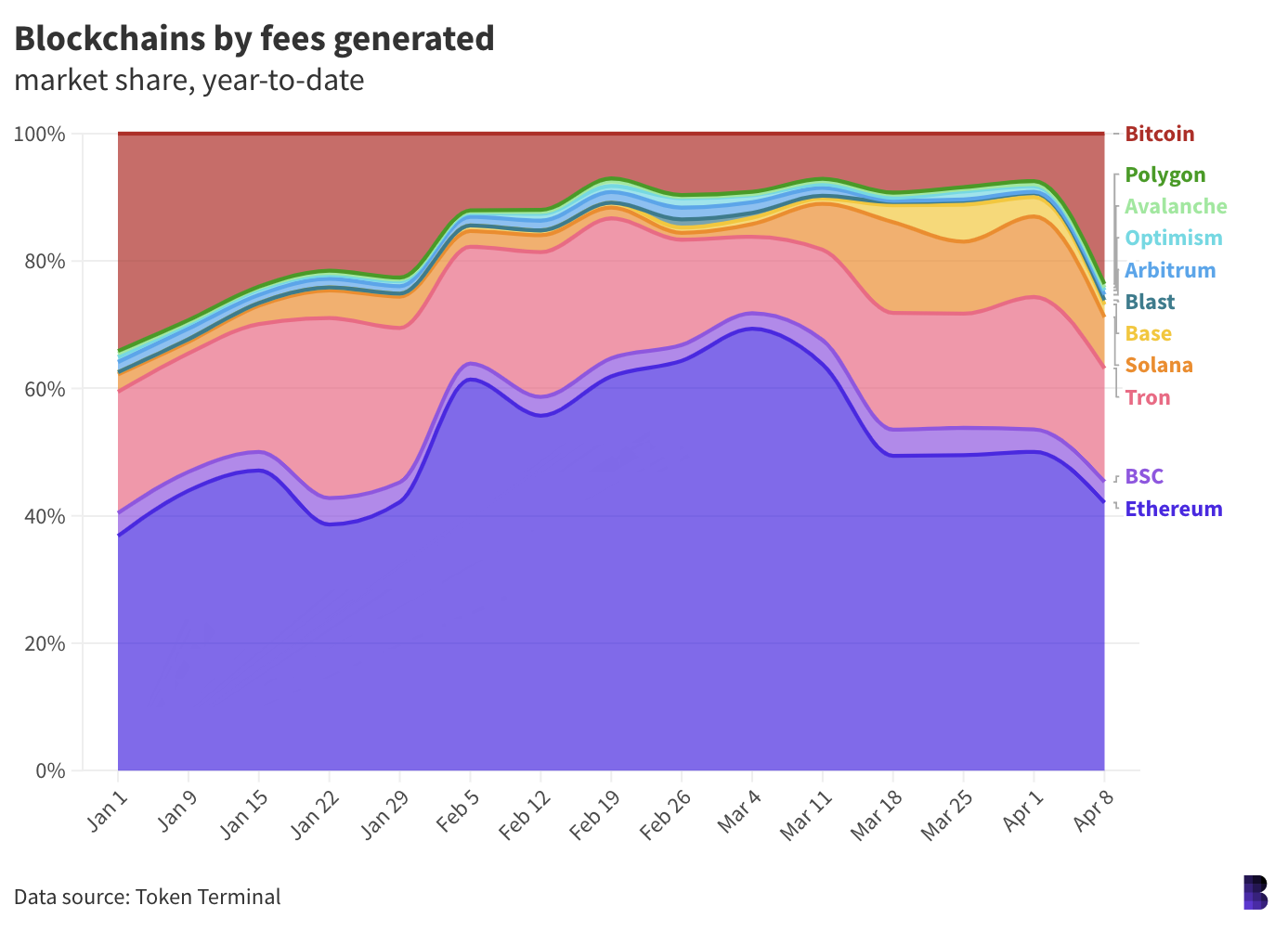

Solana, in orange, took over a decent chunk of the blockchain fee market as memecoin mania set in

Solana, in orange, took over a decent chunk of the blockchain fee market as memecoin mania set in

Perhaps tracking fees paid to use the Solana network offers some insight into how users operate. During the first week of the year, Solana raked in less than 3% of the total fees across 11 major blockchains, including Bitcoin, Ethereum, Polygon PoS, Tron and BSC, as well as layer-2 networks Base, Arbitrum and Optimism.

During the third week of March, when peak memecoin mania reigned, Solana users paid almost $24.4 million to transact — more than 14% of all fees brought in by the analyzed blockchains. Only Ethereum and Tron generated more fees in that week.

Solana’s share of those fees has shrunk ever since — now down to 8% after falling to $13.75 million last week. Tron and Bitcoin, meanwhile, are seeing comebacks.

Overall, users of these networks have paid more than $2.42 billion in fees in 2024 so far, according to Token Terminal data.

Crypto moves fast, and Solana has indeed moved quickly to mitigate the poor user experience.

But if it can’t stick the landing soon, its share of those fees may very well diminish, alongside the monolithic thesis.

—- David Canellis

Data Center

- Out of the blockchains above, Solana is so far fourth for fees generated in 2024, with $129.9 million leading into this week.

- Ethereum, Tron and Bitcoin are leading, with $1.32 billion, $440.6 million and $342.25 million, respectively.

- Ether is again slightly inflationary, adding 1,617 ETH ($4.92 million) to the supply over the past seven days.

- Uniswap, Lido and PancakeSwap are the top three protocols for fees this week, with $32.5 million, $23.7 million and $11.8 million, per DeFiLlama.

- More than $6 billion in fresh stablecoins have been added onchain in April, adding up to a total $156.92 billion.

No pain, no gain

The halving is set to take place this weekend, dropping mining rewards down to 3.125 BTC per block.

In 2020 — the last time bitcoin underwent the quadrennial event — the price dropped nearly 20% right before the rewards were lowered, falling to $8,106 from a top of $9,876 in the halving run-up.

Obviously, this halving looks quite different. Not only did bitcoin carve out new all-time highs, but newly launched spot ETFs opened new doors. Global events are impacting bitcoin’s price, too — just last weekend, Iran attacked Israel and bitcoin dropped nearly 10% before slightly regaining.

Before this month, bitcoin notched a seven-month streak of gains. But as Hashdex CIO Samir Kerbage points out, “corrections are part of the process of recovery and bull market cycles.”

Kerbage thinks that bitcoin could see a pullback to the mid-$50,000 range, which would fall in line with past halving cycles. Bitcoin’s previously seen mid-cycle corrections of 30%.

The range given by Kerbage is slightly more positive than other potential outcomes. JPMorgan analysts, for example, believe that bitcoin could drop to around $40,000 post-halving.

The pullback could “point to a very bullish consolidation after a huge leg up over the past two quarters, similar to what BTC experienced from April to September of last year,” Kerbage said.

A correction now doesn’t change an overall positive outlook for bitcoin through the end of this year, Kerbage added, echoing what other analysts have called for. Standard Chartered, for example, believes bitcoin could top $150,000 by the end of this year.

— Katherine Ross

Trading like a tech stock

You’re probably focused on this week’s Bitcoin halving. But keeping an eye on the macro landscape isn’t a bad idea right now.

Stocks and cryptos may have recovered from Fed Chair Jerome Powell’s market-moving comments yesterday, but we are not out of the woods when it comes to macro headwinds.

The Dow, S&P 500 and Nasdaq indexes were all in the green during pre-market trading this morning after a disappointing close. Equities took a turn yesterday afternoon after Powell once again indicated that persistent inflation means any and all interest rate cuts will have to be put on the back burner.

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Powell said.

Crypto traders didn’t seem to like the comments either. But as of this morning, bitcoin and ether had posted modest recoveries. Bitcoin is still hovering around $63,000, though; it has a long way to go to reach the new all-time high that bulls are hoping will come after the halving.

March’s CPI print last week showed inflation is still elevated, coming in at 3.5% year over year. It’s a far cry from the 2% target central bankers want to see. Plus, a remarkably healthy labor market and retail sales show the US economy is on solid ground.

A booming economy isn’t bad news — unless you were betting on interest rates coming down. If things keep up, we won’t see a rate cut until the fall, if we even get one this year.

Powell, never one to spook markets if he can help it, hasn’t totally abandoned his earlier outlook that a couple rate cuts will come this year. But markets are increasingly thinking we’ll only see one decrease before 2025.

Central bankers will meet six more times before the end of the year, with the next meeting scheduled for May 1.

CME fed futures data shows a 2% chance of a rate cut in May, which is actually up from the estimate yesterday afternoon of a 0.4% chance.

— Casey Wagner

The Works

- The SEC is blocking third-party messaging apps such as WhatsApp and iMessage for employees.

- NFTs are getting the boot from PayPal’s purchase and seller protection programs starting May 20.

- One US senator wants to combine stablecoin rules with marijuana banking regs, according to Bloomberg.

- Snap is adding a watermark to AI-generated images on its platform, TechCrunch writes.

- New Zealand’s central bank is undertaking a public consultation on CBDCs as part of a “multi-year” digital cash project.

The Morning Riff

What do Norway and Arkansas have in common?

If you guessed “looming restrictions on the bitcoin mining industry,” congrats!

Norway’s government is developing data center-centric legislation that would allow them to potentially push crypto mining facilities out of the country, according to Norwegian media outlet VG.

Terje Aasland, the country’s energy minister, reportedly believes that crypto miners are an “unwanted” energy consumer.

Down in Arkansas, meanwhile, legislators are responding to what appears to be local backlash around crypto mining. Specifically, there’s heartburn over a law passed last year that, according to critics, shielded mining firms from local regulations.

Allegations that industry essentially crafted its own rules abound, the Arkansas Times writes, spurring a new round of lawmaking in the state legislature to rework or repeal that earlier measure.

Let’s hope those mining firms have their houses in order ahead of the halving.

— Michael McSweeney

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.