Ethereum ‘Hard Fork’ Means Lower Gas Fees and Higher ETH Pricing

Days before the London Hard Fork and EIP-1559 is scheduled to be enabled, options data from Derebit suggests Ether will hit $5000 by the end of the year, if not by the close of September

Blockworks exclusive art by Axel Rangel

- EIP-1559 introduces ‘rent control’ on gas fees, and periodic token burning to limit the available supply of ether creating pricing pressure

- While there is a lingering threat of disillusionment from miners and app developers should the upgrade fail to deliver promised improvements, all metrics show its full steam ahead

This week the Ethereum blockchain is set to undergo a significant transformation or “hard fork” as it’s called in the open source world.

In software parlance, a hard fork is a split in the underlying base code of the software that takes it a different direction than before. Common in the blockchain and Web3.0 world, a hard fork allows groups with a different vision to take software in a different direction from the founders’ vision. In the Ethereum world, nodes on the blockchain get to vote on whether to approve the fork.

The London hard fork (a.k.a. EIP-1559) upgrade set for Aug. 4 not only promises something akin to rent control for Ethereum’s notoriously high gas fees, but it will also limit the supply of ether tokens which should create pricing pressure.

Pricing pressure is pushing some researchers to predict an increase in ether pricing — anywhere from $5,000 to $10,000.

Progress so far

So far, the much-anticipated EIP-1559 upgrade as part of the ‘London’ hard fork appears to be going smoothly and options data shows investors are anticipating pricing gains to kick in as early as the fall.

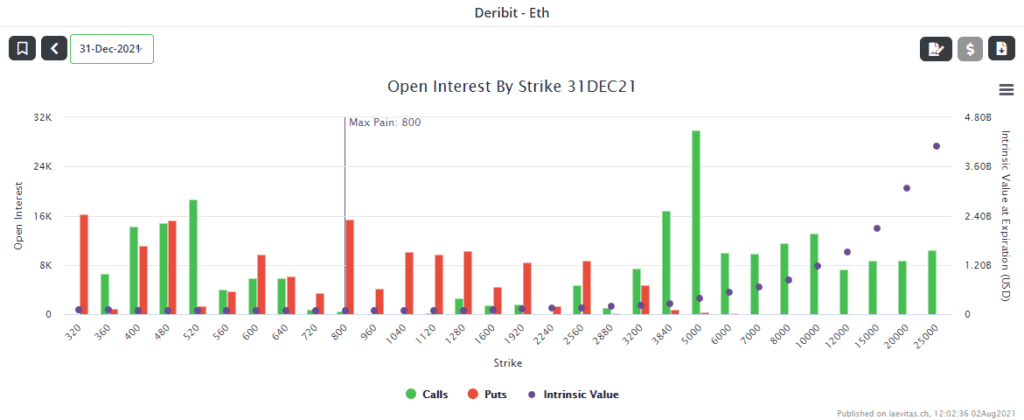

According to pricing data aggregated from Derebit, a significant amount of support via open interest if forming for options calls with a strike price of $5,000 with a contract expiry of December 31. Support is also rising around the $8,000-$10,000 mark as well.

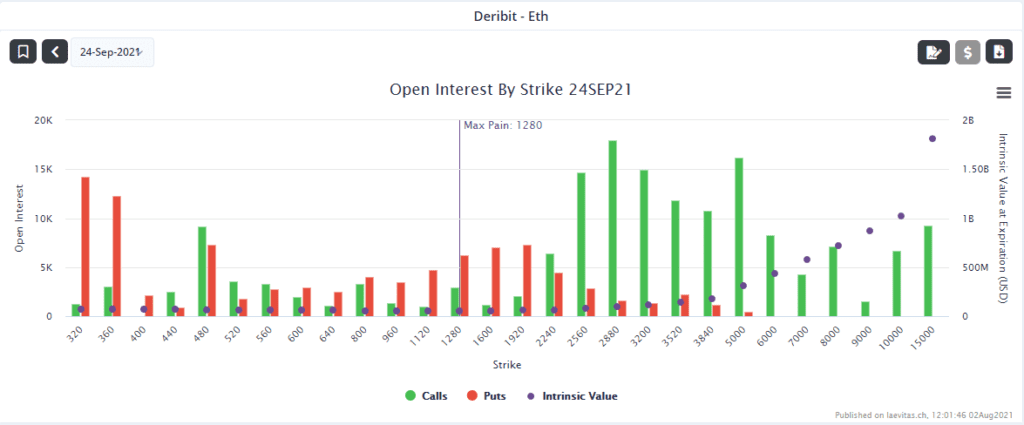

For contracts that expire on September 24, significant support between the $3,200 and $5,000 mark also exists.

As demand on the Ethereum blockchain has rapidly increased due to the success of decentralized finance (DeFi), the blockchain itself has become strained.

With this strain, gas fees have become astronomical; at times costing more than a wire transfer. Going forward, there will be much more price predictability within the market with gas fees quoted as a fixed versus moving price. In addition, a portion of these fees will be burnt or destroyed, thereby creating a mechanism of extra scarcity within the network putting upward pressure on price.

Jeff Prestes, a Senior Blockchain Engineer at Hermez Network, a layer 2 solution provider that allows for low-cost funds transfer via Ethereum says “everything is set” on their end for the fork.

Prestes told Blockworks that he’s looking forward to the transition over as it will mean that gas fees become cheaper and more predictable.

Even though EIP-1559 will significantly reduce the gas costs, they won’t be free, which is why Hermez Network — a gas-fee friendly payment protocol built on top of Ethereum (this is known as ‘layer 2 infrastructure) — and similar platforms will still have a use case because there will be continued demand to optimize transactions around network congestion so that users get the lowest possible gas fees.

The value of scarcity

While bitcoin is well known as ‘digital gold’, Lucas Outumuro, head of research at Into the Block, said that EIP-1559 will “fundamentally change” the way we value ether.

In a Twitter thread, Outumuro argued that ether’s value is more closely related to the volume of transaction activity which isn’t the case with bitcoin. And with this transaction activity, value is created through fee generation.

But, Outumuro noted, all this value-add through fee generation still leaves ether with 40% of the market cap of bitcoin — because of bitcoin’s inherent scarcity. Without the burn mechanism set to be introduced from EIP-1559, this is simply something that ether doesn’t have.

“One reason for BTC’s relative premium is its fixed supply, potentially making it better suited as an asset to store value long-term than one with endless supply With EIP-1559, ETH is taking the first step towards reducing issuance, with supply projected to peak Feb 2022,” he tweeted, adding that the on-chain activity thriving in NFTs, gaming, and DeFi makes it the store of value for the decentralized economy.

The London hard fork is set to be implemented on August 4 between 13:00 UTC and 17:00 UTC.

Currently, the price of ether is trading at $2,627.53, according to CoinGecko.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.