Fund giant-crypto exchange collab another bid to ‘reimagine’ finance

Combining Franklin Templeton’s tokenization expertise with Binance’s trading infrastructure could speed crypto adoption, companies say

ranklin Templeton CEO Jenny Johnson | Cole Burston/Fortune/"Fortune Global Forum 2023″ (CC license)

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

I started covering Franklin Templeton half a dozen years ago while on the asset management beat at a B2B finance pub. I wasn’t aware of the term TradFi back then and knew little about crypto.

The $1.6 trillion money manager is still very relevant to my transformed beat. You might remember my July interview with Sandy Kaul, during which she said all Franklin Templeton products are likely to end up onchain.

She promised there’d be more to come. Sure enough, the financial giant said today it would team up with Binance on digital asset initiatives and solutions.

The companies were vague, noting they’d share more details later this year. But essentially, they are combining Franklin’s tokenization muscle with Binance’s trading infrastructure and investor reach to bring offerings with “competitive yield generation and settlement efficiency.”

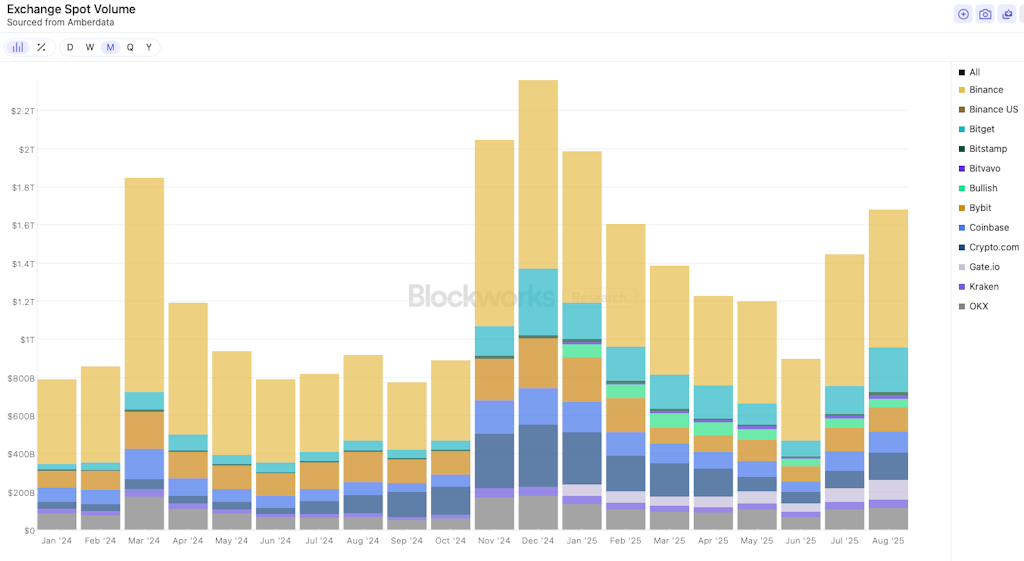

Blockworks Research data shows Binance’s prevalence in crypto today — with the definitive edge over competitors in spot volume, for example:

As Franklin Templeton’s Sandy Kaul said in a Wednesday statement: “We see blockchain not as a threat to legacy systems, but as an opportunity to reimagine them.”

And so we’ve seen the company migrate more into the crypto segment in recent years. It was one of the dozen or so issuers that lined up to launch a bitcoin ETF in January 2024. But well before that — in 2021 — Franklin launched a money market fund that used the Stellar blockchain to record transactions. A share of the fund is represented by one BENJI token, which the firm made accessible in digital wallets through an app.

I recall Franklin exec Roger Bayston telling me in mid-2023 how BENJI can essentially act as a stablecoin while also generating income. That conversion was about a year before BlackRock launched a similar yield fund (aka BUIDL), which spurred tokenized treasury momentum.

BUIDL quickly surpassed Franklin’s product in assets under management, with the totals now standing at ~$2.2 billion and ~$740 million, respectively.

Speaking of BlackRock, today’s news kind of reminded me of the world’s largest asset manager teaming up with Coinbase in 2022.

The bottom line is this trend of TradFi and DeFi worlds coming together is in no way slowing. That means I’ll have to be cautious about not reusing headlines — whether one from earlier this week or months back.

Franklin Templeton CEO Jenny Johnson has said she thinks we’ll see more financial market infrastructure transformation in the next five years than we’ve seen in the last 50.

Translation: It’s a rad time to be a crypto/finance journalist and reader.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.