Lightspeed Newsletter: Worldcoin’s reputation predicament

The challenge for Worldcoin lies in demystifying the technology and clearly articulating its incentives

Worldcoin co-founder Sam Altman | photosince/Shutterstock modified by Blockworks

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Hello earthlings.

It’s finally Friday, and the weekend is our oyster. Similar to an oyster, Worldcoin may have an unsettling exterior, but once you get past the crusty gray shell, you’ve got something nice on the inside. I suppose oysters don’t look that nice on the inside either, but you get the point:

You SHOULD give a damn ‘bout your bad reputation

Last week, the Worldcoin Foundation announced that World ID would be coming to Solana, thanks to a grant awarded to the Wormhole interoperability protocol.

While some cheered the announcement, others expressed derision, skepticism and fear.

The irony is palpable. World ID, an initiative designed to verify unique human identities and prevent Sybil attacks, may be one of the first truly viable solutions for managing online reputation.

However, the project faces its own trust and reputation challenges among members of the very communities it is designed to serve. These stem mostly from its use of biometric data to confirm that each user maintains only a single account within its ecosystem.

Worldcoin’s method requires interested users to seek out one of the company’s scanning kiosks, or Orbs, to conduct a high-resolution scan of their irises. Scans are used to create a unique identifier for each registrant, which can be used across various platforms to confirm individual authenticity and establish local permissions without revealing any personal information.

Among other uses, systems like World ID could help prevent social media scams and rug pulls, aid airdrops with more equitable circulation, fairly distribute UBI, identify wash traders, permanently exorcize bad actors, prevent fake product reviews and ratings, solidify content attribution, improve the fairness of onchain governance, and on and on. It also has the potential to act as a sort of faceless solution to KYC. Imagine: No more need to trust shadowy companies with photos of your driver’s license, or submit sensitive documents to multiple entities every time you need to verify your identity.

If a user is banned for bad behavior, they cannot simply create a new account, ensuring that negative actions have lasting consequences. Removal could also mean losing the ability to collect rewards within blockchain ecosystems, making social degeneracy a financially expensive gambit.

The Worldcoin Foundation indicated to Blockworks that preserving privacy while maintaining user accountability is growing in importance “as AI-powered bots are becoming more ubiquitous, increasing in sophistication and undermining trust online.” However, for some folks in cryptoworld, the idea of scanning and using biometric data in this way taps into some deep-seated concerns over the potential for misuse, surveillance and other forms of exploitation.

The Worldcoin Foundation suggests that much is misunderstood in these superficial assessments of its technology. It insisted to us that “World ID is a privacy product,” going on to explain that its whole purpose is to help users “access applications and services without disclosing any personal information or data.” Worldcoin’s documentation shows that Orb scanners do not actually store images used for biometric assessment, unless requested by the user for personal use. Instead, Orb scanners generate a cryptographic hash from the scan. This hash is a one-way process, meaning it cannot be reverse-engineered to recreate the original biometric data.

This design guarantees that even if the hash were stolen or shared, it would be effectively useless for unauthorized purposes. The Worldcoin Foundation confirmed to us that “an Orb-verified World ID does not link to identifiers like name or email. It is deliberately delinked from wallet transaction data and using World ID does not reveal whose World ID is used.”

In recent months, the Worldcoin Foundation has also implemented personal custody features to certify that all biometric data used during the World ID verification process is stored only on a given user’s device. Similarly, ID holders have the option to un-verify their World ID and permanently delete their data from its system. The foundation has said publicly that parties interested in verifying these claims are welcome to scrutinize its open source codebase.

There are also alternative proof-of-humanity solutions out there, some of which benefit from greater decentralization and are likely preferable for stalwart cypherpunks. Projects like Bright ID, Privado ID, Idena and Civic offer different approaches to verifying human identities while maintaining user privacy and autonomy. Such projects come with trade-offs in terms of ease of use, however.

Bright ID’s social verification method mandates active participation and social interactions with others in its network, which might not be practical at scale. Privado ID uses zk proofs to preserve privacy, but isn’t an enforced system across all user addresses. Idena requires participants to engage in frequent “ceremonies” to validate their identities, which can be demanding and inconvenient for some. Civic offers a more streamlined approach but faces challenges due to the necessity of linking multiple personal data sources for a complete identity profile.

We have options, but the challenge for Worldcoin and similar initiatives now lies in demystifying the technology and clearly articulating its incentives.

If the Worldcoin Foundation can successfully ensure that the public understands and trusts the mechanisms behind these technologies, we may find ourselves in a digital environment where reputation is everything. A world where scams and malignant behaviors are prohibitively expensive, both socially and financially. One where treating each other with kindness and respect not only becomes the norm, but also the most rewarding approach on Solana and across Web3.

— Jeffrey Albus

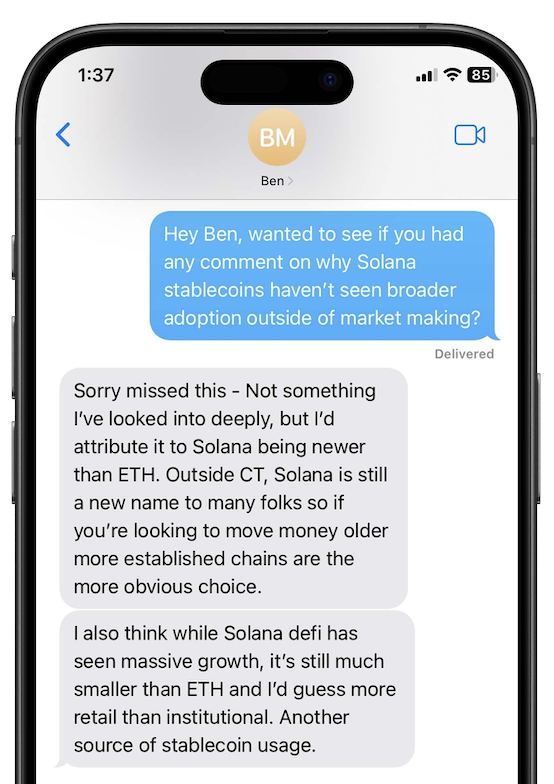

One Good DM

A message from Ben Mills, co-founder of Meso:

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.