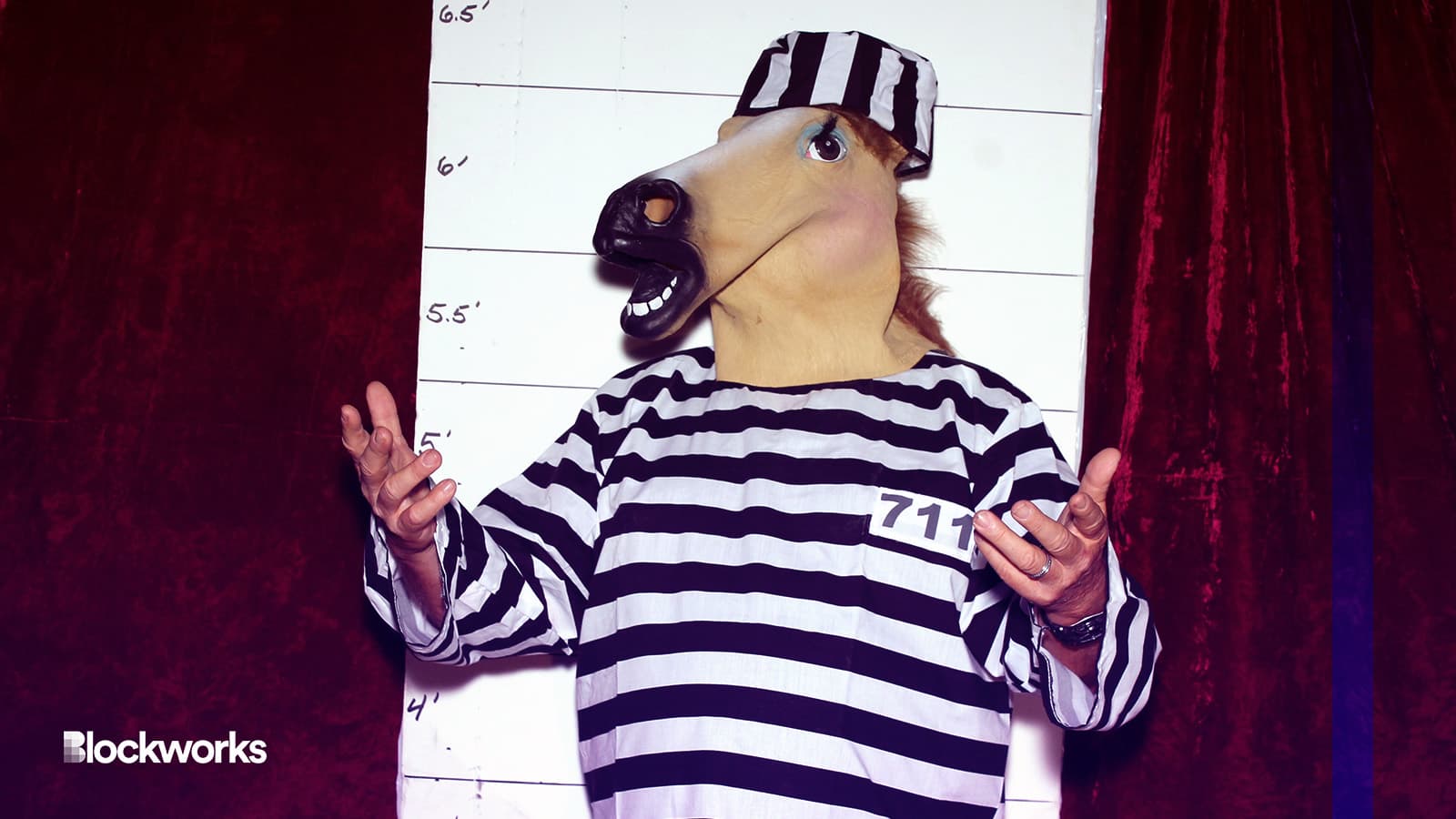

SBF’s trial has tinges of a “Jury Duty” parody — but it’s all too real

On why a fake TV show trial with purposefully incompetent lawyers and a sleepy jury has way too much in common with SBF’s real criminal trial

Midjourney modified by Blockworks

For those who haven’t seen the reality show “Jury Duty,” please watch it. If you don’t trust my taste in television, it is nominated for two Emmys.

Without spoilers, the comic reality show pretends to cover jury selection and a run-of-the-mill trial — what one juror doesn’t know, however, is that every single person in the courtroom, from the judge to the bailiffs to all of his fellow jurors, are actors. Jury selection is fake, the trial is fake, it’s all a set-up. Because it’s a reality-show-cum-documentary, the show keeps putting weirder and weirder scenarios in front of this one juror to see how he reacts.

The current criminal trial of FTX ex-CEO Sam Bankman-Fried has more in common with this reality show than you’d expect.

In one case, a lone, unaware juror is grappling with the absurdities that unseen producers keep throwing at him as he tries to keep his cool during trial.

In another, I’m trying to keep my cool as I grapple with the absurdities that the judge, defense and prosecution throw at each other during Bankman-Fried’s trial.

Comparisons between the two trials are almost too easy. In the fake trial show, one juror keeps falling asleep during important parts of witness testimony. The audience is supposed to laugh at the ridiculousness of the situation, but also understand that this is an abnormality. This trial, although fake, decides the outcome of a man’s freedom — and the jury is responsible for the verdict. Being awake for the trial is an obvious prerequisite.

But during Bankman-Fried’s trial, more than one juror has dozed off. By some counts, no fewer than three jurors have been fast asleep while the witnesses gave their testimony. This is real life, not reality TV, but the jurors still can’t keep their eyes open.

Another easy similarity — the inclusion of a celebrity guest with a big personality for the laughs. Reality show “Jury Duty” has James Marsden playing an obnoxious version of himself. And the Bankman-Fried trial has its own celebrity guest in the form of the OC’s Ben McKenzie.

Sure, he’s not as bad as Marsden (who plays a juror causing drama by calling the paparazzi on himself in an attempt to get himself recused). But McKenzie does somehow, magically, manage to bypass the journalist horde that waits for courtroom seats starting at 4:30 am to get his own cozy seat closer to the front. Very different celebrities, very different trials — yet both manage to infuriate everyone around them.

Then, the resemblance between comedy and reality gets more serious.

The defense lawyer on “Jury Duty” turns out to be so terrible that the defendant fires him, and he ends up representing himself. While Sam Bankman-Fried hasn’t fired his lawyers (yet), his defense team in general has made enough missteps that they’ve prompted a flurry of articles questioning their abilities.

Read more: Is Sam Bankman-Fried’s defense dropping the ball?

Judge Lewis Kaplan has continuously chastised Bankman-Fried’s team with snide remarks in a mocking tone that many journalists didn’t even know was allowed, leading to giggles from the gallery and more recently, shushing of the media section by the court bailiffs.

But it’s not just the defense dropping the ball in such a public and comedic manner. This week, Kaplan also chastised the prosecution for bringing in an expert in Google metadata from Texas — only for the defense to immediately get him to admit that he was not, in fact, an expert on metadata.

“Lawyers are supposed to do better than this, and I’m talking to both sides,” the judge told the room.

All of this is to say — while it’s a total coincidence that Bankman-Fried’s criminal trial so closely resembles a comedic fake trial for an Emmy-nominated reality show, it does speak to the absurdity of the entire FTX saga.

If the creators of “Jury Duty” seek comedic inspiration for their next story, they might not need to look further than the Southern District of New York.

I don’t care much about tech, I don’t care a whole lot about finance, either. I care about writing stories and watching weird things unfold. And that’s why I’ve ended up in crypto.

But because I’m missing that passion for what crypto and blockchain are all about — finance, tech, privacy, yadda yadda — I’m going to write instead about what I am actually interested in. Everything about crypto that has very little to do with crypto.

That’s what this column will be about. All the tangential stories that come out of the blockchain and crypto space, what I think about them, and how I navigate it all as a skeptical former Russian literature major.

It’s precisely my perch as an outsider that lets me do what I do: Opine on all sides of any crypto issue, no strings attached, no skin in the game.

If you want to talk crypto with me, let’s go off topic.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.