Silvergate Beats Earnings, SEN Volume Up Nearly 1,000% On-Year

Silvergate, the pipes that push around dollars between digital asset exchanges, shows no sign of slowing down as it holds $4.3 billion more deposits from crypto companies

Alan Lane, CEO, Silvergate Bank; Source: Elizabeth Ann Photography, Silvergate Bank

- Silvergate Capital reported earnings before the market open Tuesday, posting significant gains in deposits, and volume on its exchange network

- In a note, Compass Point Research cites regulatory risk buy gives the company a buy rating due to strength of deposit growth and network volume

Silvergate, the bank whose payment pipes fuel the digital assets revolution, reported strong earnings Tuesday morning on most metrics for its quarter ending June 30.

Silvergate is the banking partner of the majority of the world’s large digital asset exchanges. As a California state-chartered banking partner, it is the fiat ramp for American traders. The Silvergate Exchange Network (SEN) allows for nearly instant settlement of dollar-denominated transfers.

The bank reported net income for the quarter of $20.9 million, up from net income of $12.7 million from the first quarter of the year. Digital currency customer deposits grew by $4.3 billion to $11.1 billion as of June 30, 2021, compared to $6.8 billion as of the end of last quarter.

It should be noted that Silvergate reported the cost of these deposits to be exceptionally low, compared to the industry average. This is largely because Silvergate is one of the few bank’s that serves the sector at scale, and this market position means that they don’t really need to pay out competitive interest to attract cash.

Further, analysts point to the fact that traders and exchanges aren’t interested in shopping around for interest; their investments in DeFi products have double or triple digit returns, thus the effort to shop around and compare basis points in interest yield is a futile endeavor.

Silvergate said its average cost of deposits was 0% in the three months through June, compared with 0.37% in the year-earlier quarter. For a point of comparison, the average deposit costs for mid-cap commercial banks would usually be around 0.75% to 1.25%.

“It is an exciting time to be at Silvergate, and the second quarter was no exception. We nearly doubled pre-tax income compared to the prior quarter, driven by strong demand for our growing suite of digital currency related solutions powered by the Silvergate Exchange Network (SEN),” Alan Lane, president and chief executive officer of Silvergate, said in a statement. “In the second quarter of 2021, we continued to add new customers to the platform, grew network volume to a record $240 billion, and surpassed $10 million of transaction revenue for the first time. We also continued to prudently grow SEN Leverage, our differentiated bitcoin secured lending offering.”

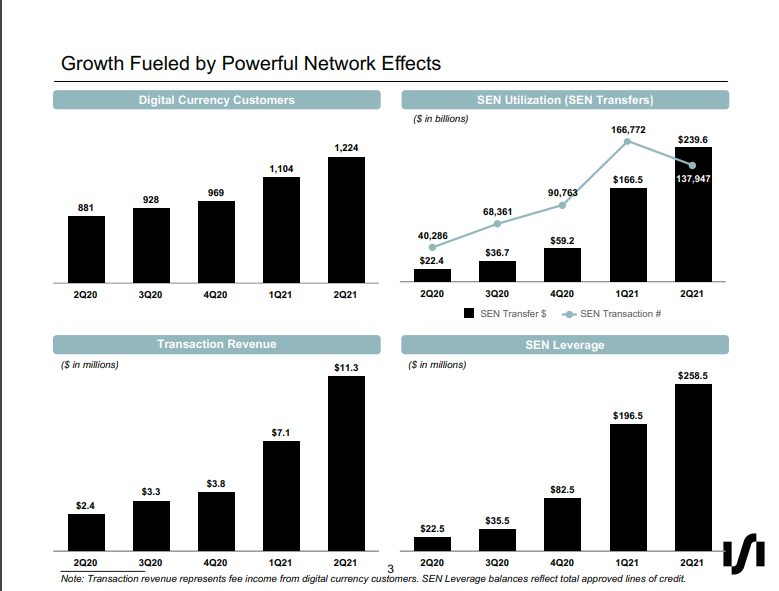

It said that SEN, the ‘FedWire’ of digital asset exchanges, handled $239.6 billion of US dollar transfers in the second quarter of 2021, an increase of 44% compared to $166.5 billion in the first quarter of 2021, and an increase of 968% compared to $22.4 billion in the second quarter of 2020.

n a note, Compass Point Research projects that SEN volumes are nearing the $1 trillion annualized mark. The number of unique transactions on SEN was down quarter-on-quarter, with 137,947 transactions in the second quarter of 2021, a decrease of 17% compared to 166,772 transactions in the first quarter of 2021.

Network volume on SEN is expected to increase next quarter as the bank announced its the exclusive issuer of Facebook’s Diem USD stablecoin.

SEN Leverage, the bank’s credit line for traders and digital asset exchanges, reported that approved lines of credit has jumped to $258.5 million, up $196.5 million quarter-over-quarter.

This growth in volume helped drive Silvergate’s $11.3 million in digital asset related fee income up $4.2 quarter-on-quarter.

In an early note, Compass Point research’s Michael Del Grosso pointed to a strong pipeline of new customer sign ups, 1,224 customers on the network up from 1,104, as proof of the strength of the stock.

Silvergate’s stock is currently trading at $94.50, up 10% on-day.