Singapore’s AscendEX Raises $50M Round Led by Polychain Capital, Hack VC

Additional participants include Jump Capital, Alameda Research, Uncorrelated Ventures, Eterna Capital, Acheron Trading, Nothing Research and Palm Drive Capital.

Singapore, Source: Shutterstock

- The company has raised $63 million in total, including a previous Series A round of $13 million in 2018, Shane Molidor, global head of business development at AscendEX told Blockworks

- AscendEx’s platform provides cross-collateralized staking products

Cryptocurrency financial platform AscendEX closed a $50 million Series B round led by Polychain Capital and Hack VC.

Other participants include Jump Capital, Alameda Research, Uncorrelated Ventures, Eterna Capital, Acheron Trading, Nothing Research and Palm Drive Capital.

Overall, the company has raised $63 million in total, including a previous Series A round of $13 million in 2018, Shane Molidor, global head of business development at AscendEX told Blockworks.

Shane Molidor, global head of business development at AscendEX

Shane Molidor, global head of business development at AscendEXAscendEX’s platform provides cross-collateralized staking products so users can generate yield while trading on leverage, and maximize their trading and earning potential. The company launched a little over three years ago under the name BitMax, but rebranded to AscendEX in the second quarter of 2021, Molidor said.

“That rebrand signaled a paradigm shift for us,” Molidor said. “We’re seeking to ascend, evolve and become more than just an exchange and I think alongside that rebrand we started embracing the platform as more than an exchange, and emphasizing our earning products that bridge CeFi to DeFi,” he added.

Today, AscendEX has hit over $200 million in average daily trade volume and operates as a validator and yield farming portal for over 60 token projects, according to the press release. The funds will be used to enter new markets globally and further product innovation, it said.

The company is a registered trading platform in Singapore, so it has a strong presence in Asia-Pacific countries for its retail demographic, Molidor noted. AscendEX is not available in the US, but has a strong institutional presence in Western and Eastern Europe, he added.

“We’re talking about penetrating new demographics in crypto-centric places like the Middle East, Africa, Latin America — areas where it’s being identified as more than a speculative instrument and a cornerstone of everyday life,” he said.

In general, there has been immense growth in the ecosystem, Molidor said. “Users want to be able to do more with their assets. When you park your bitcoin on a platform you want to earn on that platform,” he said.

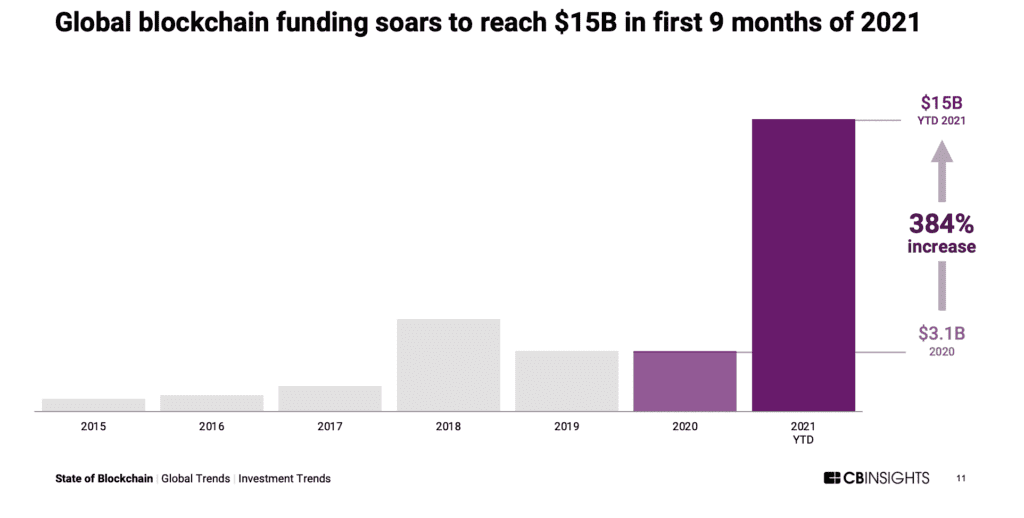

Funding for blockchain in the third quarter is at record heights, according to a recent research report from CB Insights.

This week alone saw major funding rounds for companies in the metaverse, NFT and GameFi space, including a $98 million round for The Sandbox led by SoftBank.