Solayer’s Solana restaking platform is live

Plus, PayPal stablecoin PYUSD has officially flipped Ethereum in terms of supply on Solana

Artwork by Crystal Le

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

If you haven’t yet heard, I’m now hosting the Lightspeed podcast as well as writing this newsletter.

I’ve babbled my way through a few episodes and am having a good time so far. Give it a listen wherever you get your podcasts. Anyways, interesting exclusive news today:

Solayer restaking platform heads to mainnet

Solana’s restaking era has begun.

Solayer is bringing its restaking network to mainnet, the team told Lightspeed exclusively. The months-old business garnered tens of millions in deposits within minutes during its early deposit periods, and those restaked assets can now be put to use, with Bonk, SonicSVM, and HashKey Cloud serving as partners for the launch.

For the uninitiated, restaking means using assets staked on proof-of-stake blockchains to secure a second layer of applications, which are often called actively validated services (AVSs). In theory, restaking makes DeFi more efficient, because it makes staked assets more useful.

EigenLayer pioneered the concept on Ethereum, and they landed a $100 million check from venture giant Andreessen Horowitz as a result. EigenLayer is currently the second largest DeFi protocol by total value locked (TVL), holding roughly $13 billion worth of assets, according to DeFiLlama.

EigenLayer’s success kicked off a race to bring restaking to Solana — which also makes use of proof-of-stake — and has come to rival Ethereum in terms of DeFi activity.

Solayer was incorporated in February of this year, and it reportedly raised a seed round led by Polychain. It briefly began accepting liquid staking token (LST) deposits in May, and investors stuffed $20 million into the protocol in 45 minutes. All told, Solayer garnered $155 million in deposits before today’s launch.

Solayer co-founder Jason Li told me in an interview that he was “very surprised” by how many early deposits the protocol brought in, adding that Solayer had to expand its server capacity a few times to accommodate all the inbound web traffic.

Solayer is the most notable Solana restaking project to see mainnet, and the launch puts it ahead of a venerable rival in Jito, which is also building a restaking product and is currently bringing on AVSs (which Jito calls NCNs). So far, it’s landed Switchboard, Squads and Renzo.

A source with direct knowledge of the matter said Jito aims to launch this calendar year unless things go “terribly wrong.”

Li told me in an interview that competition will be good for Solana restaking, and he tries not to focus too much on what others are building. However, he did note that since Jito is yet to launch, “there’s nothing concrete” behind its NCN announcements. “I’m not saying that’s not going to come, but I think it’s taking a while,” Li said.

Solayer separates AVSs into two categories: endogenous (meaning Solana-native apps) and exogenous (which is everything else). Bonk, SonicSVM, and HashKey are all endogenous AVSs, which comes with a few benefits: liquidity is shared between them, stake-weighted quality of service (SWQoS) is used to land transactions more easily, and slashing is disabled since endogenous AVSs have no “inherent risk,” Li told me.

Exogenous AVSs will have slashing enabled but only up to a maximum percentage to avoid foul play.

Solayer’s code still isn’t open source — a contrast to Jito, which published code for its yet-unreleased platform a couple weeks ago. Solayer co-founder Rachel Chu said the team “might” open source its code in the next couple of weeks, and the platform currently allows for permissionless setup for endogenous AVSs.

It looks like things are shaping up for a two-horse race between Solayer and Jito to become Solana’s dominant liquid staking provider. If EigenLayer’s success and Solayer’s early deposits are any indication, large sums of assets could be at stake.

Still, the ability of restaking platforms to create meaningful yield — which is kind of the whole ballgame — is something of an open question.

“It’s extremely unclear how [restaking] enables useful businesses [that] users are willing to pay fees for,” Blockworks Research analyst Dan Smith said.

— Jack Kubinec

Zero In

$2.73 billion

That’s roughly how much a Solana restaking platform would need in deposits to be proportionally as big as EigenLayer is on Ethereum, based on Ethereum and Solana’s market capitalizations.

A significant chunk of EigenLayer’s deposits came during a “points” craze where users sought to gain exposure to what was thought to be a lucrative series of airdrops. Jito already released a token, though Solayer seems to be running a points program of its own.

Only time will tell if the market has as much of an appetite for restaking on Solana as it did on Ethereum. But if it does, billions of dollars are on the line.

— Jack Kubinec

The Pulse

PayPal’s stablecoin, PYUSD, has officially flipped Ethereum in terms of supply on Solana.

In just two months, Solana seems to have pulled a full-blown Ocean’s 11 style heist, siphoning 51.47% of all PYUSD away from Ethereum with the promise of juicy APYs. We’re talking up to 20% on platforms like Kamino Finance, making Ethereum’s 3.59% on AAVE look like chump change. No wonder PYUSD supply on Solana skyrocketed by 740%, jumping from 45M to a whopping 378M.

Crypto Twitter is a fan — for the most part. @jussy_world said, “Personally I use only $PYUSD, without any problems, 19% APY is so good,” while @Koncepted called the flippening “a big win for the Solana ecosystem.” @Frankboccia_ chimed in, “This is incredible! Excited for the future of PayPal & Solana!” @FamousCloudzz couldn’t resist a dig at Ethereum, saying, “What hasn’t flipped ETH at this point?”

But not everyone’s throwing confetti. @ONealOmbu took a swipe at PayPal’s customer support, saying, “Despite my extreme disappointment with @PayPal for failing to assist me in retrieving my funds, locked in their database for over three years, due to an OTP issue, I still want to extend my congratulations to them on their recent achievement.” @solanapoet wasn’t impressed either, noting, “Only thing I don’t like is [that] technically @PayPal has the ability to freeze your assets. Only using USDC because of this.” And @MeGaBoAsT didn’t hold back, bluntly stating, “PayPal are crooks, sorry.”

Of course, with rapid growth comes inevitable scrutiny. Critics have pointed out that while Solana’s low fees and high APYs are enticing, the concentration of PYUSD on a single network could pose risks if issues arise with Solana’s infrastructure. Some are also concerned about the broader implications for decentralization, as PayPal’s influence grows in the crypto space.

— Jeffrey Albus

One Good DM

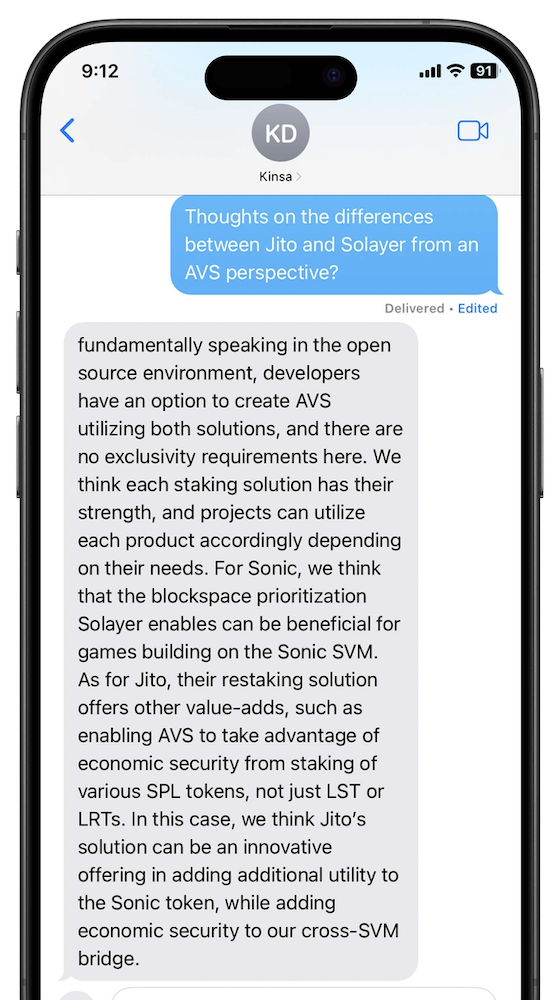

A message from Kinsa Durst, chief marketing officer at Sonic:

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.