Stagflation Worries Drag Down Equities; Bitcoin Shows Resilience: Markets Wrap

Bitcoin is trading near $49,200 despite equities selling off, Layer-1 battles continue to heat up, $AXS and $LUNA both enter price discovery.

Blockworks exclusive art by Axel Rangel

- Bitcoin posts strong gains despite turbulence in traditional financial markets

- Fed’s Bullard expects “more inflation than we are used to for some time”

The NASDAQ and Dow Jones closed the day down -2.14% and -0.94% respectively.

Facebook shares dropped 4.89% due to whistleblower revelations, and outages on Instagram, Facebook and WhatsApp.

The Fed is set to launch a review of a potential central bank digital currency (CBDC) as early as this week.

DeFi/NFTs/Gaming

- $AXS continues its incredible run-up, last trading near $140. With 12.5 million $AXS staked and roughly 18.3 million in the community treasury, more than 50% of the circulating supply is off the market.

- OpenSea monthly trade volume is down roughly $400 million, or 12%, from August to September.

- $LUNA enters price discovery on hype around Columbus-5 and the ecosystems’ first NFT projects, last trading around $49.

- Societe Generale, the third largest bank in France, submitted a proposal to the MakerDAO community.

TradFi

- Large commodity trading houses face margin calls as gas prices soar higher.

- Oil hits seven-year highs as OPEC+ leaves output hike policy unchanged.

- Many hedge funds are long the dollar and government notes, expecting slower growth.

Insight

“Due to Marathon’s positive track record, our growth trajectory, our position as one of the largest holders of bitcoin among publicly traded companies in the U.S., and the broader maturation of our industry, we were able to obtain a $100 million revolving line of credit with Silvergate Bank, which is secured by our bitcoin holdings and USD. This instrument is consistent with our strategy to focus on agility as it enhances our ability to act opportunistically and in a manner that is efficient for both our business and our shareholders. By having this line of credit in place, we believe Marathon is better positioned to continue growing over the coming quarters,” said Marathon Digital Holdings CEO, Fred Thiel

Bitcoin and Ethereum

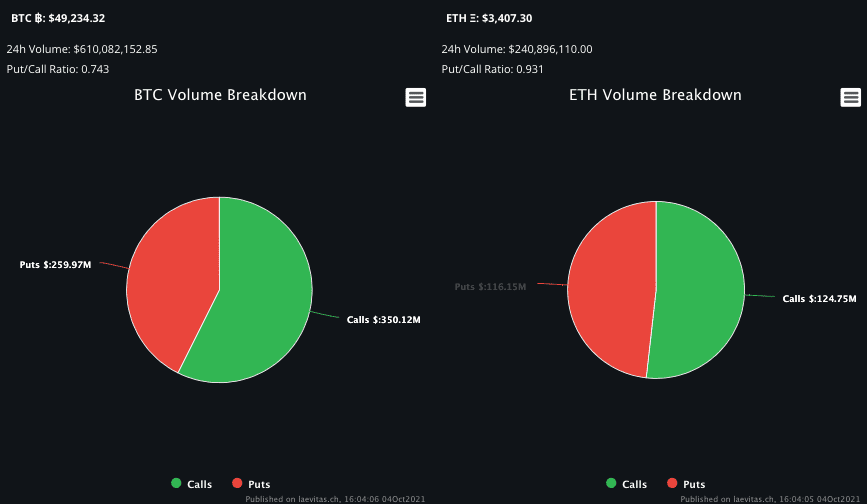

BTC and ether were last trading around $49,200 (+1.0%) and $3,400 (-1.0%), respectively. Options traders are taking a more bullish stance on BTC, with the put:call ratio sitting near .74.

Source: app.laevitas.ch

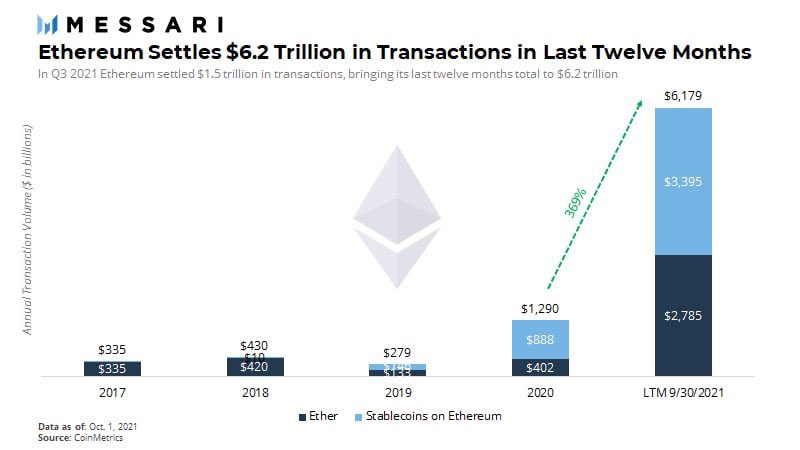

Source: app.laevitas.chEthereum has now settled nearly $6.2 trillion in trades over the last 12 months.

Source: Ryan Watkins of Messari

Source: Ryan Watkins of Messari

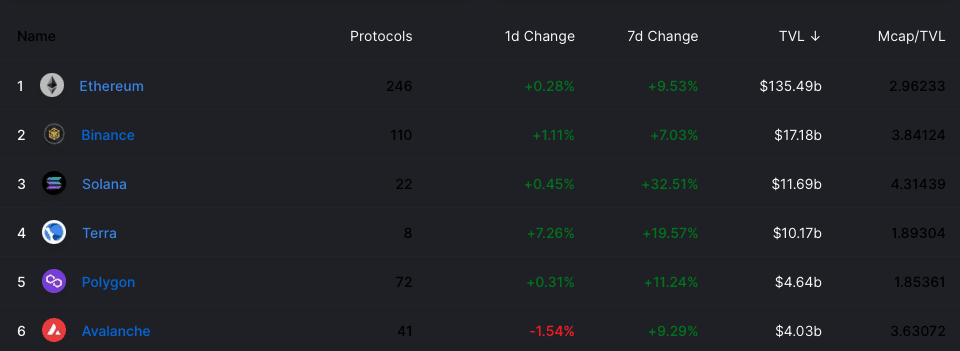

Layer 1 total value locked (TVL) comparisons

Source: Defi Llama

Source: Defi Llama

- Terra ($LUNA) crossed $10 billion in TVL overnight, possibly contributing to its rapid price appreciation. It also remains one of the cheapest coins when looking at the market cap/TVL metric.

- Solana ($SOL) looks rather expensive with a market cap/TVL of 4.31.

- While there is little debate that most of the innovation in the space occurs on top of Ethereum, its TVL dominance has dropped from 98.22% on January 1st, 2021 to 68.78% today. The L1 battles are in full swing.

Commodities and the dollar

- Natural gas was up 5.77% today due to the ongoing energy shortages around the world, per business insider.

- Coal was also up 5.13% due to energy shortages, per business insider.

- The DXY index is down -0.25%, according to MarketWatch.

What else we are looking out for…

- ADP employment numbers on Wednesday

- Initial and continuing jobless claims on Thursday

- Nonfarm payrolls, unemployment rate and average hourly earnings on Friday

That is all for today. Let’s do this again same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.