Visa Head of Crypto Says CryptoPunk Won’t Be Company’s Only NFT

“We plan to continue adding additional NFTs to our collection with the goal of supporting the diverse group of artists and creators working in this space,” Visa’s Head of Crypto Cuy Sheffield told Blockworks.

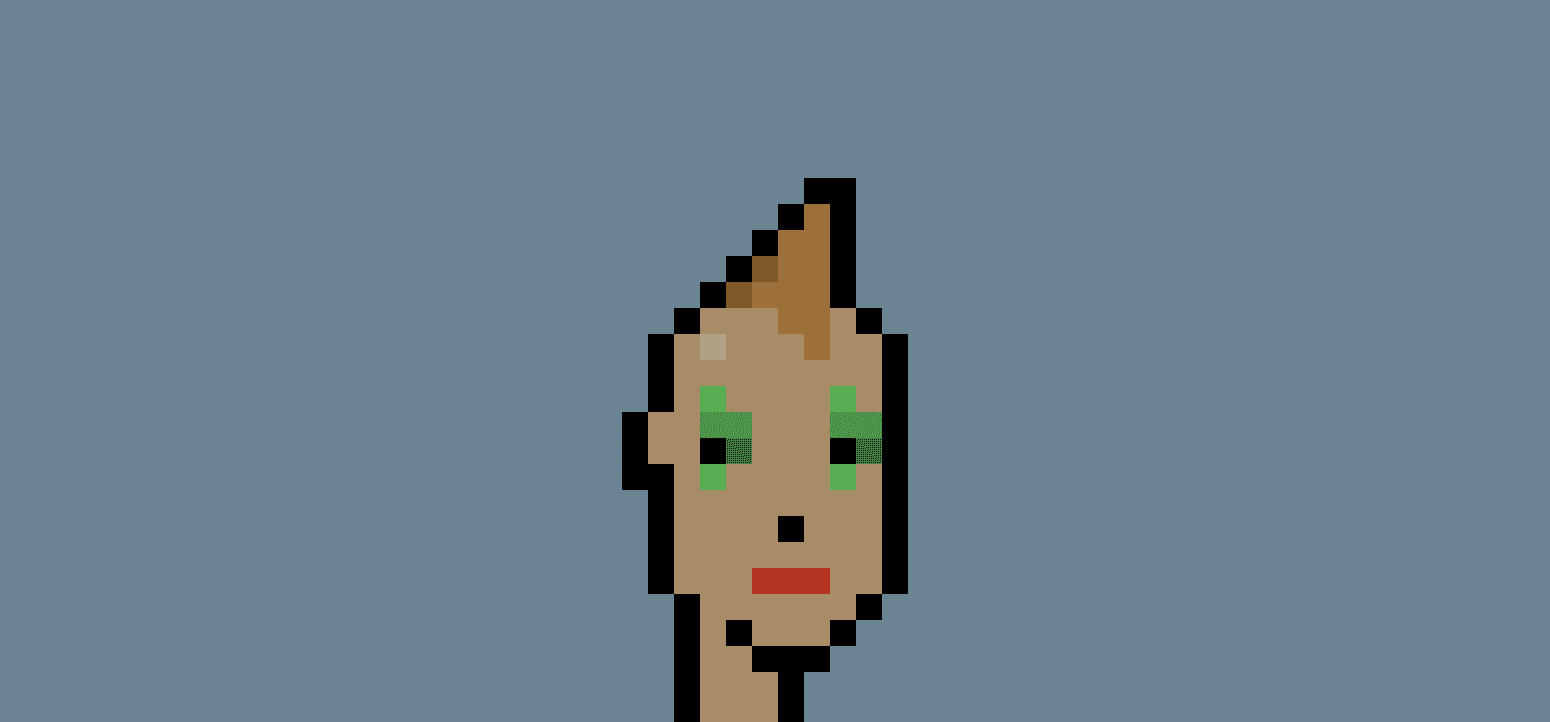

CRYPTOPUNK #7610

- Some market players saw the NFT purchase as a way for major corporations like Visa to show interest and support in the crypto-world, while others called it a marketing scheme

- “A question to ask is, What do NFTs have anything to do with Visa’s business model? I just don’t see it. But I do understand why they would do it to learn more about the industry and get closer to people,” Booth said.

Earlier this week, Visa made headlines for purchasing a $150,000 non-fungible token (NFT) of a CryptoPunk, a digital avatar with bright green eyes and red lips. While the news came and went, Visa’s Head of Crypto Cuy Sheffield told Blockworks this won’t be the company’s only NFT purchase.

“We plan to continue adding additional NFTs to our collection with the goal of supporting the diverse group of artists and creators working in this space,” Sheffield said.

The company’s excitement about this project was less about any ‘individual punk,’ and more about the CryptoPunk collection as a whole and what it represents, he said, which is the beginnings of a new chapter for digital commerce.

“We’re excited to add CryptoPunk 7610 to our collection of artifacts that chart and celebrate the past, present, and future of commerce,” Sheffield said.

The company worked with Anchorage, a digital asset platform for institutional players, to make the purchase happen. “We have been building this expertise and we’re better positioned to help our clients navigate this new category of commerce,” he added.

Visa’s Head of Crypto Cuy Sheffield

Visa’s Head of Crypto Cuy Sheffield Some market players saw the NFT purchase as a way for major corporations like Visa to show interest and support in the crypto-world, while others called it a marketing scheme. Sheffield didn’t address the alleged comments about whether or not the purchase was a marketing stunt when asked by Blockworks.

However, Sheffield said, “one of the reasons we purchased a CryptoPunk is because we want to understand, firsthand, what it takes to acquire, custody and interact with an NFT, from the infrastructure requirements, to the actual transactions, to the storage.”

Large companies often seek exposure across a lot of different things, Entrepreneur and Author of ‘The Price of Tomorrow’ Jeff Booth said. “A question to ask is, What do NFTs have anything to do with Visa’s business model? I just don’t see it. But I do understand why they would do it to learn more about the industry and get closer to people,” Booth said.

With that said, the NFT market has been booming in recent weeks, with over $900 million in sales for August, which is the largest month ever for the industry, according to NFT data tracker NonFungible.

Aside from Visa, the appeal of digital art has attracted major organizations like Budweiser and the National Basketball Association to Entrepreneurs and Billionaires like Mark Cuban.

“If a market is growing very fast, no matter why, there’s a lot of companies that want to know why and they’ll play into it,” Booth said.

All in all, the industry isn’t showing a shortage of cash or buyers, Blockworks has reported. Although Visa spoke about their recent purchase, Anheuser-Busch, the parent company of Budweiser, did not respond to requests by Blockworks for comment about its three NFT purchases.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.