Visa Proposes Interoperability Platform for Digital Currencies

Company details theoretical Universal Payment Channel (UPC) that would support cross-border payments between CBDCs.

Source: Shutterstock

- Visa’s research team, comprised of scientists and engineers focused on emerging technologies, began developing a framework for blockchain interoperability in 2018

- UPC hub can be a bridge connecting regulated stablecoins with CBDCs in the future, company says

Visa has shared insights on a theoretical system that would connect different blockchain networks to allow central banks, businesses and consumers to transfer digital currencies.

“As the number of [distributed ledger technology] networks increases, each with varying design characteristics, the likelihood that transacting parties are on the same network decreases,” Visa wrote in a recently published whitepaper. “Thus, it is crucial to facilitate payments that are universal across networks, scalable to massive loads and highly available.”

Dubbed by the company as the Universal Payment Channel (UPC), the digital hub seeks to solve the problem of transferring digital currencies that rely on various tech stacks and protocols, as well as different compliance standards and market requirements.

Visa’s research team began developing a framework for interoperability that would work across different blockchain networks in 2018, Catherine Gu, Visa’s global central bank digital currency (CBDC) product lead, wrote in a blog post published on Thursday.

“We believe digital currencies have the potential to extend the value of digital payments to a great number of people and places, but to achieve this vision, several key design challenges must be addressed,” a Visa spokesperson told Blockworks. “Given our history in building and scaling networks that move money reliably and securely, we have expertise to share in this space.”

The whitepaper is not a plan to launch a product or capability, but rather a theoretical contribution to the global community, the representative added.

“What excites us is UPC’s potential,” the spokesperson said, “and we are exploring how UPCs can solve the challenge of interoperability.”

How would it work?

The potential future payment network would be built on top of blockchains without being subject to the limitations on interoperability, scalability and availability that these types of payment solutions currently face.

A party looking to send funds through the UPC system would register with the hub by providing their public key, according to the whitepaper. A channel is opened between a registered client and the server when the server deploys an instance of the UPC smart contract on the ledger used by both parties and initializes the contract.

Source: Visa

Source: VisaThe channel is then pre-funded when the client and the server make deposits into the contract’s address. The channel is closed when either or both parties settle their off-chain balances. These channel operations require on-chain transactions by one or both parties, and finally, a UPC payment transaction between the two clients is performed purely off-chain.

The protocol requires the UPC hub to authorize every payment that happens between the parties off the ledger as a way to check its validity.

UPC would also offer quicker transaction speeds than the largest existing blockchain networks. In April 2021 the Ethereum network’s throughput was limited to 16.5 transactions per second, compared to VisaNet’s 65,000 transactions per second.

“UPC’s specialized payment channels would be established off the blockchain and leverage smart contracts to communicate back with the various blockchain networks, delivering high transaction throughput securely and reliably and improving speeds overall,” Gu explained.

The CBDC use case

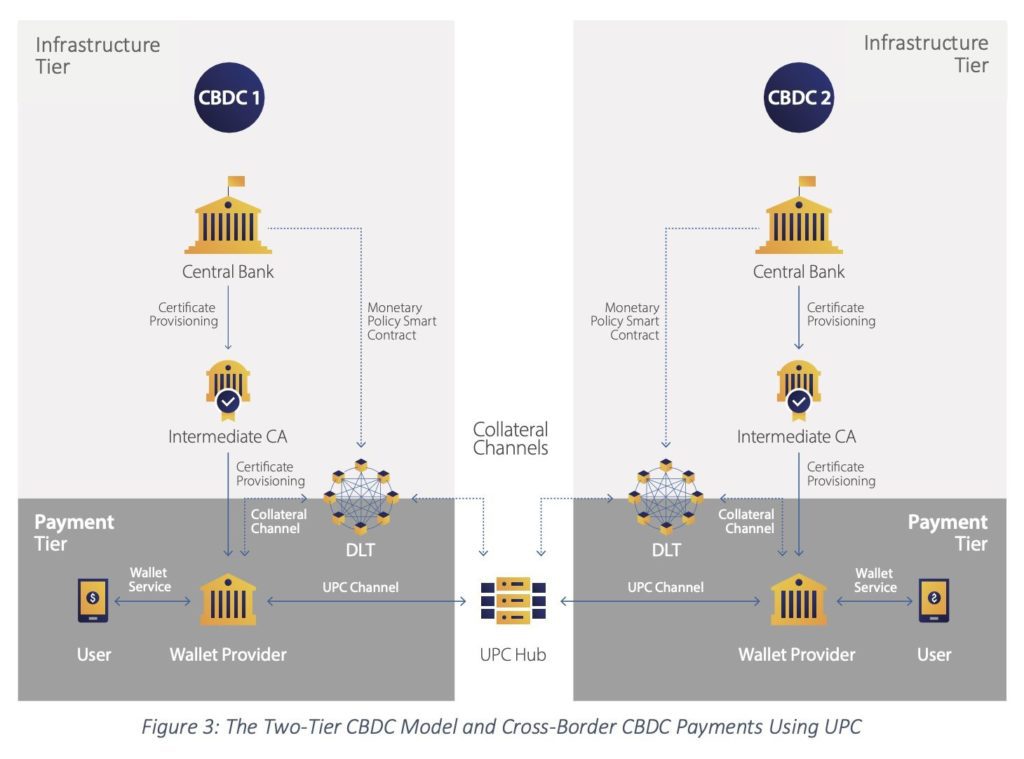

Among the use cases for this payment network is cross-border payments between independent CBDC networks. Central banks around the world have shown an increasing interest in exploring digital forms of central bank money that can be used directly by consumers, merchants and financial institutions, Gu noted, and many central banks in the coming years will likely implement some form of a digital ledger.

Federal Reserve chairman Jerome Powell noted last week that the Fed would soon publish a discussion paper about a CBDC. He said the agency was still evaluating whether to issue a CBDC, and if so, what form it would take. Powell noted that “it’s more important to do this right than to do it fast.”

For cross-border CBDC payments, such as international remittances, where the sender and receiver rely on their respective banks or wallet providers to send and receive funds on their behalf, UPC technology can be used as a bridge between the CBDC systems.

Source: Visa

Source: Visa“We believe that for CBDCs to be successful, they must have two essential ingredients: a great consumer experience and widespread merchant acceptance,” Gu wrote in the blog. “It means the ability to make and receive payments, regardless of currency, channel, or form factor.”

With the combination of scalability and interoperability features that the UPC technology provides, UPC hub can be a bridge connecting regulated stablecoins with CBDCs in the future, Visa said in the whitepaper.

Visa’s research is the latest example of the company’s participation in the crypto space. It announced in June new hires and promotions in an effort to help advance the adoption and use of bitcoin, stablecoins, non-fungible tokens (NFTs), DeFi and public blockchain networks.

Less than two weeks later, Visa revealed its partnerships with 50 crypto platforms on card programs that allow users to convert and spend digital currency at 70 million merchants. The company reported at the time that consumers spent more than $1 billion worth of cryptocurrency on goods and services through Visa’s crypto-linked cards during the first half of 2021.

Visa also made its first NFT purchase last month for $150,000 in Ethereum, and Cuy Sheffield, the company’s head of crypto, told Blockworks that Visa plans to continue adding NFTs to its collection.