Arbitrum Transaction Count Rises to 62% of Ethereum Transactions

Ethereum scaling solution Arbitrum has seen surging activity since deploying a network upgrade in August. Is an airdrop close?

Source: Shutterstock

Arbitrum, a layer-2 rollup for Ethereum, has seen its network activity spike to new heights as anticipation mounts for an airdrop.

The buzz has boosted the total value of digital assets locked on the network (TVL) by more than 13% over the past month. Arbitrum’s TVL is $1.05 billion as of press time, eclipsing Ethereum rival Solana and even direct competitor Optimism.

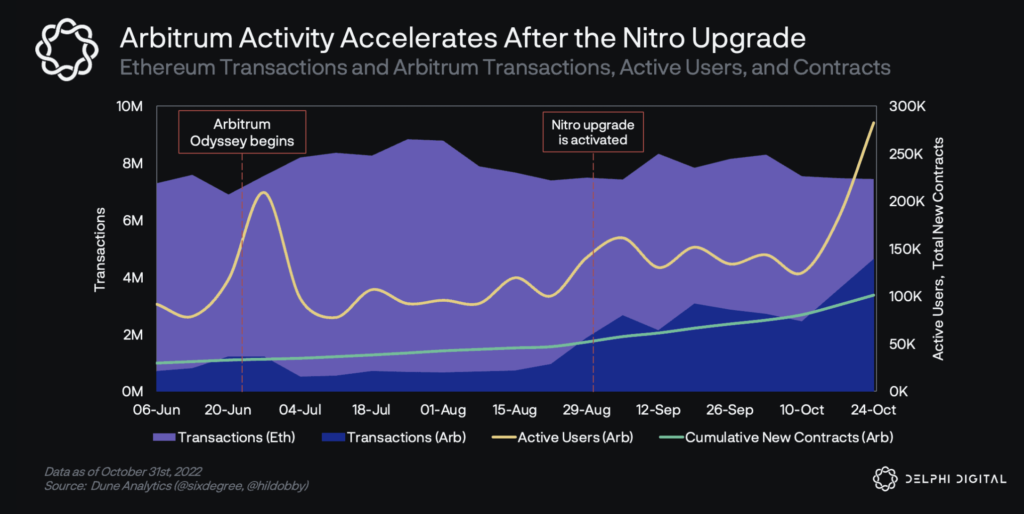

Not to mention, transactions have shot up more than 550% since the launch of its Nitro network upgrade in August, now representing 62% as many weekly transactions as the Ethereum blockchain, research firm Delphi Digital reported earlier this week. Before the surge, Arbitrum handled just 9% of Ethereum activity.

That has coincided with a spike in unique wallet addresses, which topped out at over 1.66 million for the first time on Monday. It should be noted that figure counts multiple addresses owned by individuals.

“Much of the activity is likely from speculators trying to boost their on-chain activity in the hopes of receiving a larger airdrop,” Delphi said.

Arbitrum hosts many of DeFi’s popular decentralized applications including exchange liquidity pool Curve Finance, decentralized exchange Uniswap and lending protocol Aave.

Arbitrum activity chart | Source: Delphi Digital

Arbitrum activity chart | Source: Delphi Digital

The protocol is yet to launch its own native token, but Steven Goldfeder, co-founder of Arbitrum developer Offchain Labs, has cryptically hinted that an airdrop could eventually occur, following in Optimism’s footsteps.

Arbitrum’s growth can be partly attributed the Nitro upgrade, which introduced lower fees, increased capacity and smoother development, Goldfeder told Blockworks in an email.

“At the same time, the Arbitrum ecosystem has been steadily growing, and this increase in adoption is largely a reflection of this continued organic growth,” Goldfeder said.

Arbitrum scales Ethereum to defy bear market

Australia-based blockchain infrastructure provider Mycelium debuted its perpetual swaps on Arbitrum in August under the guidance of former BitMEX executive Arthur Hayes.

“When Mycelium first deployed derivative smart contracts in September 2021, Arbitrum was a natural choice,” Mycelium co-founder Patrick McNab told Blockworks. “Their growth since then is a success story that has defied the bear market odds.”

McNab added the network effects of access to liquidity, as well as protocols expanding synergistically, have led to large growth and innovation in Ethereum protocols over the past two years. “That is now playing out on layer-2s like Arbitrum.”

Offchain Labs has raised some $147 million in funding from the likes of Lightspeed Ventures, Coinbase Ventures, Pantera Capital and billionaire Mark Cuban, among others, data from Pitchbook shows. Offchain’s post-money valuation is more than $1.2 billion.

Article and headline were updated at 3:40 am, Nov. 3, to clarify transaction count statistic.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.