Macro Backdrop Favors Bitcoin: Markets Wrap

The macroeconomic backdrop, on-chain fundamental data and regulatory outlook are making bitcoin an easy buy and hold.

Blockworks exclusive art by Axel Rangel

key takeaways

- Macro backdrop, on-chain fundamentals and regulatory outlook are making bitcoin an easy buy and hold

- It’s important to remember the environment we are in and not forget about the digital pet rock: bitcoin

Markets Wrap Highlights

- The macro backdrop is very favorable for bitcoin.

- On-chain fundamentals look great for Bitcoin.

- Regulators seem less concerned with bitcoin and more worried about stablecoins and other tokens that are function in similar ways to securities.

Latest in Macro:

- S&P 500: 4,391, -.19%

- NASDAQ: 14,579, -.51%

- Gold: $1,757, +.05%

- WTI Crude Oil: $79.52, +1.56%

- 10-Year Treasury: 1.61%, +.041%

Latest in Crypto:

- BTC: $54,378, +0.27%

- ETH: $3,599, -.73%

- ETH/BTC: .0662, -.69%

- BTC.D: 43.88%, +.18%

- DPI (DeFi Pulse Index): $341.62, +.66%

Macro Backdrop

While other protocols such as Ethereum offer incredible innovation and interesting applications, it is important to remember the environment we are in and not forget about the digital pet rock: bitcoin.

“There is no ability for the Fed to tighten. They can’t. And the reason they can’t is because if you look at US treasury spending plus US entitlement payments, it’s over 100% of tax receipts. So the US’ real interest expense is still more than 100% of tax receipts with tax receipts at all time highs and with bubbles in every freaking market. So if they tighten, they’re going to drive tax receipts lower, and then unless the Fed prints the difference the US will default on entitlements or treasuries.” – Luke Gromen, founder and president of FFTT

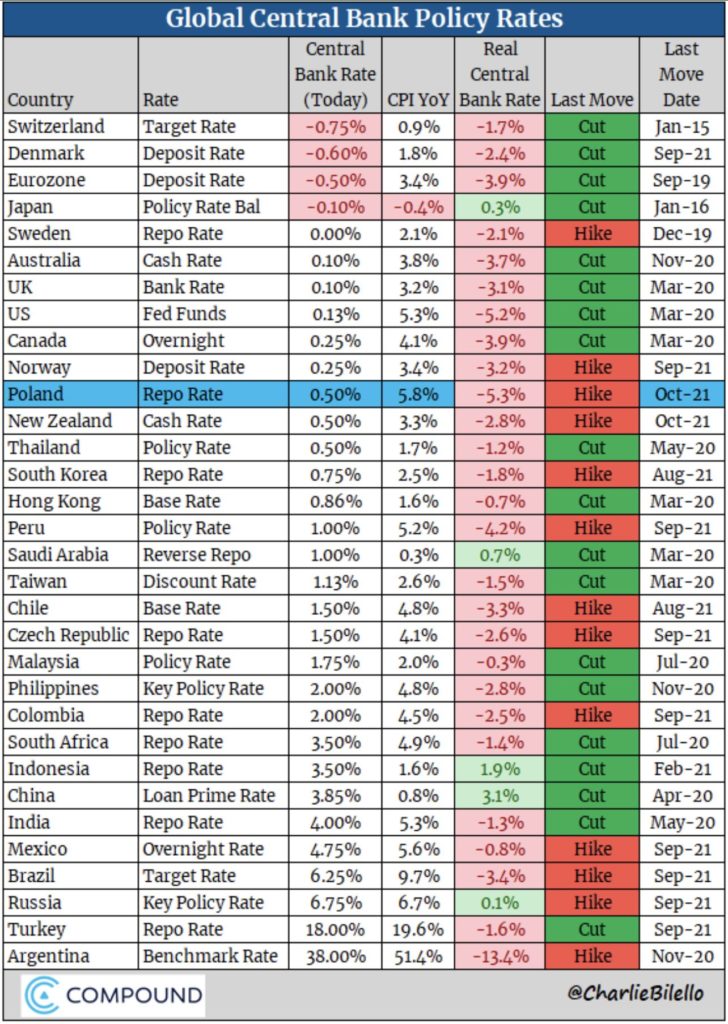

The following chart shows real central bank rates, or the difference between nominal rates and the prevailing inflation rate:

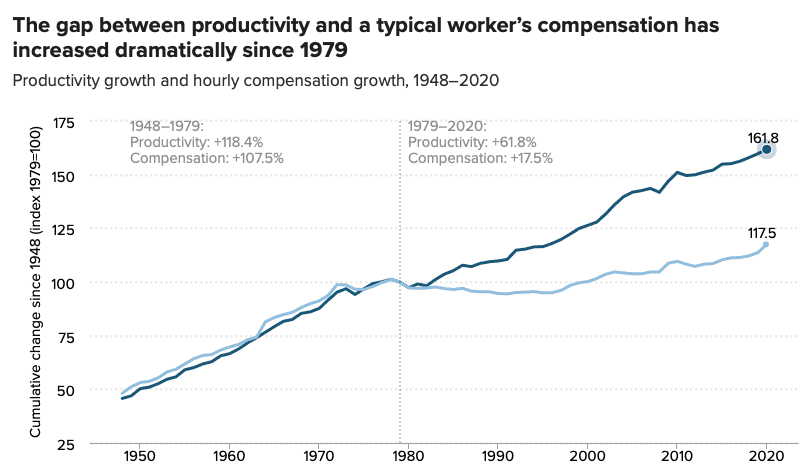

“The United States, with the global reserve currency, hollowed out its industrial base at a far faster pace than our peers, as we shut down domestic factories and opened them up abroad (to take advantage of cheaper labor).” – Lyn Alden, macroeconomist and equities strategist.

One can easily spot the decoupling between productivity and wage growth in the 1970s when President Nixon announced the greenback would no longer be exchangeable for gold, thus giving birth to the petrodollar system.

Source: EPI

Source: EPI

To summarize, we have increasing inequality within the US due to the lack of wage growth and increasing asset prices, combined with negative yielding debt instruments on a real basis and a whole lot of capital in the system with no where to hide.

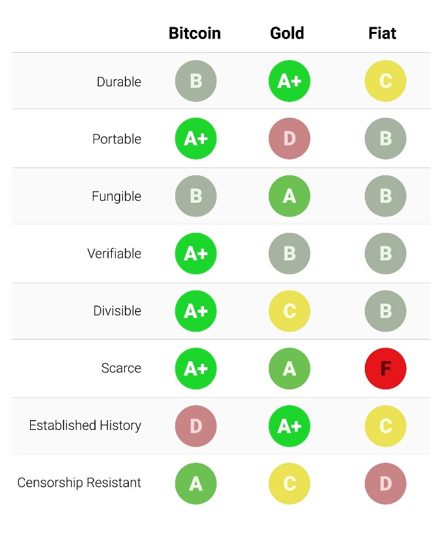

Historically speaking, gold was the place to park your money in these environments. But in a digital era, Bitcoin has become a viable alternative. It’s worth noting that gold’s established history and the fact that it sits on central bankers balance sheets are two important factors worth considering.

Source: Medium

Source: MediumBitcoin Fundamentals

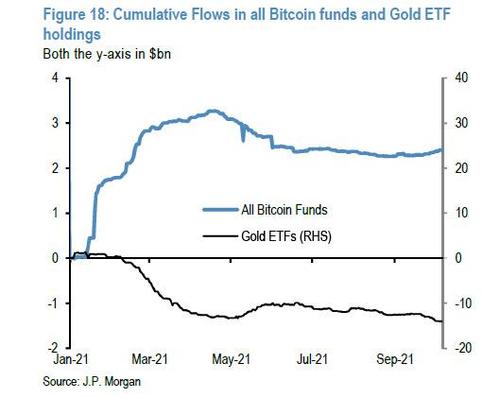

Per JPMorgan, there are tentative signs that the previous shift away from gold into bitcoin seen during most of Q4 2020 and the beginning of 2021 has begun to re-emerge in recent weeks.

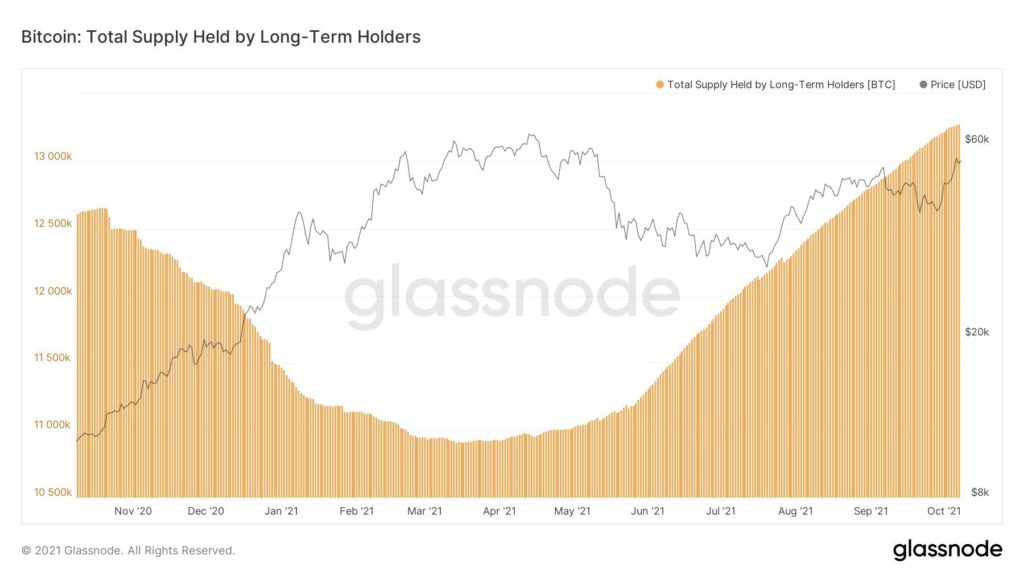

Long term holders (LTHs), or entities who have held onto their coins without moving them for 155 days or more, continue to accumulate. Over two million coins have aged into LTHs since the May correction.

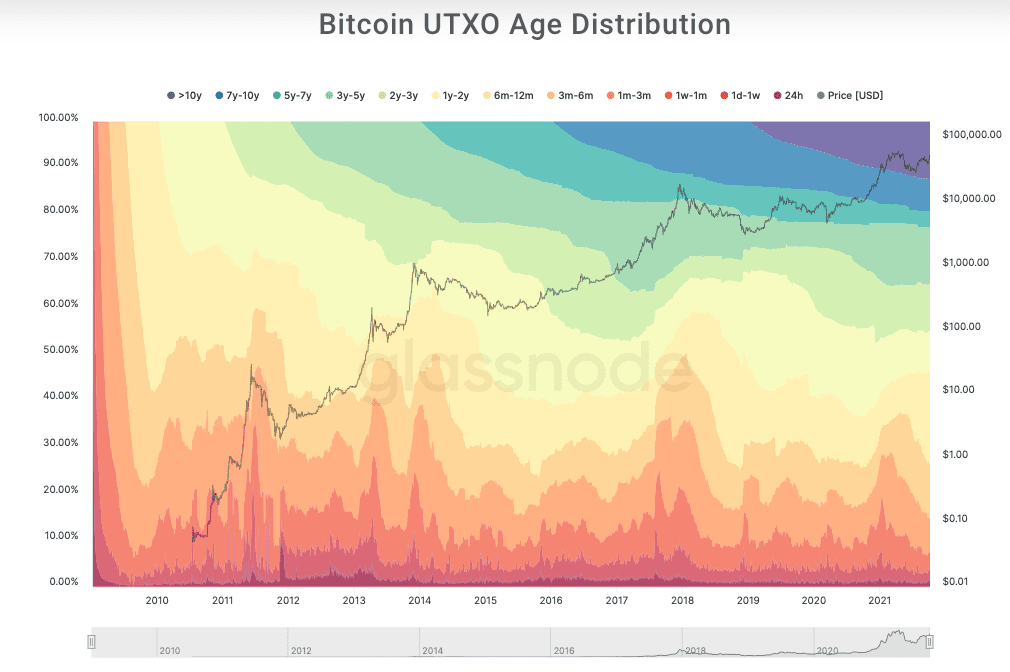

With every cycle, there are momentum traders/speculators who hop on board, but there are also a number of people who dive deep into bitcoin and decide they agree with the philosophical ideas behind its existence, thus creating more lifetime holders who do not plan to sell. This point is best illustrated by the chart below. Bitcoin UTXO (unspent transaction output) age distribution is a fancy way of saying ‘the last time bitcoins were moved’.

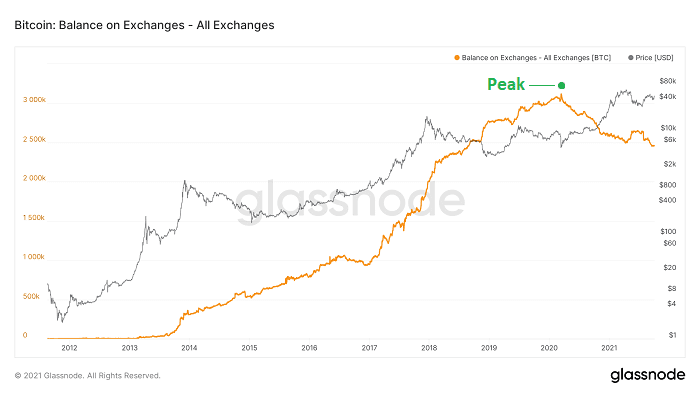

We also see the number of bitcoin on exchanges such as Coinbase, Binance, etc., decreasing in a dramatic way since the crash in March of 2020. This indicates that retail investors are buying cold storage wallets and taking custody of their bitcoin. Often times, people who take the time to learn about self-custody have no intentions of selling their bitcoin.

Source: Lyn Alden / Glassnode

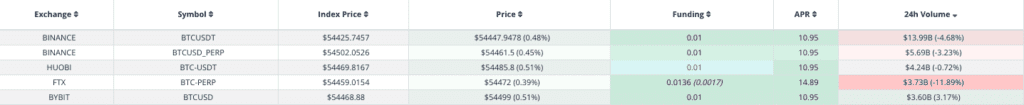

Source: Lyn Alden / GlassnodePerpetual funding rates have eased on the highest volume exchanges over the last few days. This indicates that traders aren’t frantically attempting to take a long position. Emotions do not represent healthy moves, regardless of their direction.

Source: https://app.laevitas.ch/dashboard/btc/derivs

Source: https://app.laevitas.ch/dashboard/btc/derivs

Lastly, bitcoin is the only cryptocurrency that has been repeatedly stated as the least of regulators’ concerns. In the past week, we saw Fed chairman Jerome Powell clarify that he does not want to ban the use of digital assets but that regulation on stablecoins is necessary. We have also seen Gary Gensler classify bitcoin as a commodity. When compared to other digital assets, bitcoin undoubtedly carries the least amount of regulatory risk.

That’s all for this week, my friends. Have a great weekend!

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.