Blockchain Valley Ventures: DeFi Projects Beat VCs, Market for Returns

Report shows that $1 billion of funding has created a market cap of close to $100 billion, or a 100x return

Sebastian Markowsk, partner at BVV

- Blockchain Valley Ventures report shows DEXs provided the highest returns for investors followed by liquidity aggregators

- DeFi has reached a market capitalization of $90 billion in less than 18 months but still only represents 5-7% of the total digital asset industry, per BVV’s report

The explosive growth of DeFi over the last two years means that the sector has produced some of the most consistent returns for venture capitalists that have dared to stick their toes in, according to a new report from Blockchain Valley Ventures.

According to the report, lean, distributed teams lead to a high degree of capital efficiency. In fact, analysts at BVV found that 60% of projects on the market delivered at least 3x returns — putting them in the top quartile of traditional VC returns — with close to 30% earning a 10x return or more.

Of all the types of projects on the market, decentralized exchanges (DEX) came in at an average of 46x return while liquidity aggregators brought in a 22x return.

Consider the case of Coinbase, with its $547 million in VC funding over 13 rounds, nearly 1200 employees, and estimated revenue of $6 billion to $8 billion. Compare that to Uniswap with its $1.13 billion in revenue and just over two dozen employees. What’s the more lucrative investment for VCs?

Source: Blockchain Valley Ventures

Source: Blockchain Valley Ventures

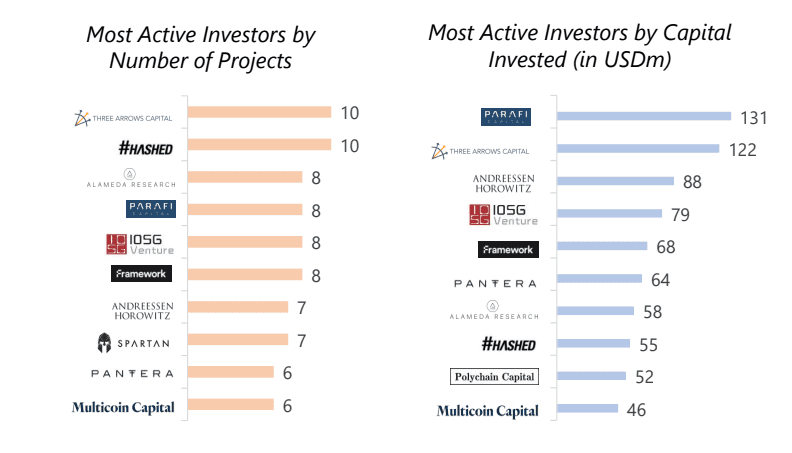

With the spectacular and consistent returns of DeFi, more and more VCs have taken interest in the space. Given the nature of DeFi projects, investors are after tokens not company equity.

However, as Blockworks has previously reported, challenges in how limited partners in VC funds can treat returns from tokens from a tax perspective has trimmed institutional investor interest in the space.

“There is limited but growing adoption of institutions in DeFi yet, but as crypto companies are offering primarily their retail clients also professional clients exposure to DeFi and attractive yields in the space, it will not take institutions as long to react as with Bitcoin,” Sebastian Markowsky, a partner at BV Ventures, told Blockworks in an interview.

Markowsky said that a paradigm shift of regulation and consumer protection is coming, even as dealing with regulators might be a challenge.

And certainly traditionally minded investors have noticed and are hungry for these DeFi style returns. While we are a long way from being able to purchase Uniswap or Chainlink in a Charles Scwab brokerage account, there’s a lot of work in progress to bridge the two worlds.

Blockforce Capital, for instance, is building a regulatory compliant “wrapper” that will allow its clients to own and take the Vesper Liquidy Pool, a DeFi token, in a vehicle that would be familiar to many hedge fund investors.

“Many of the investors in the fund understand that this is inevitably the future. They want to have a dynamic partner with in-depth expertise and a comprehensive network to leading players in the field, so they can benefit from the return profile but also educate themselves about this next frontier in finance,” Markowsky told Blockworks.

And it looks like this isn’t too far away.