Survey: Financial Advisors Increasingly Allocating to Crypto

More respondents report concerns about regulatory uncertainty and volatility compared to a year ago

Source: Blockworks

- A report by Bitwise Asset Management and ETF Trends found that 94% of financial advisors fielded crypto questions from clients in 2021

- There was a roughly even split between advisers considering an investment in crypto equities versus direct crypto investments this year

Financial advisors increasingly included crypto in client portfolios last year, according to a recent survey — and even more money managers plan to deploy capital in the space this year.

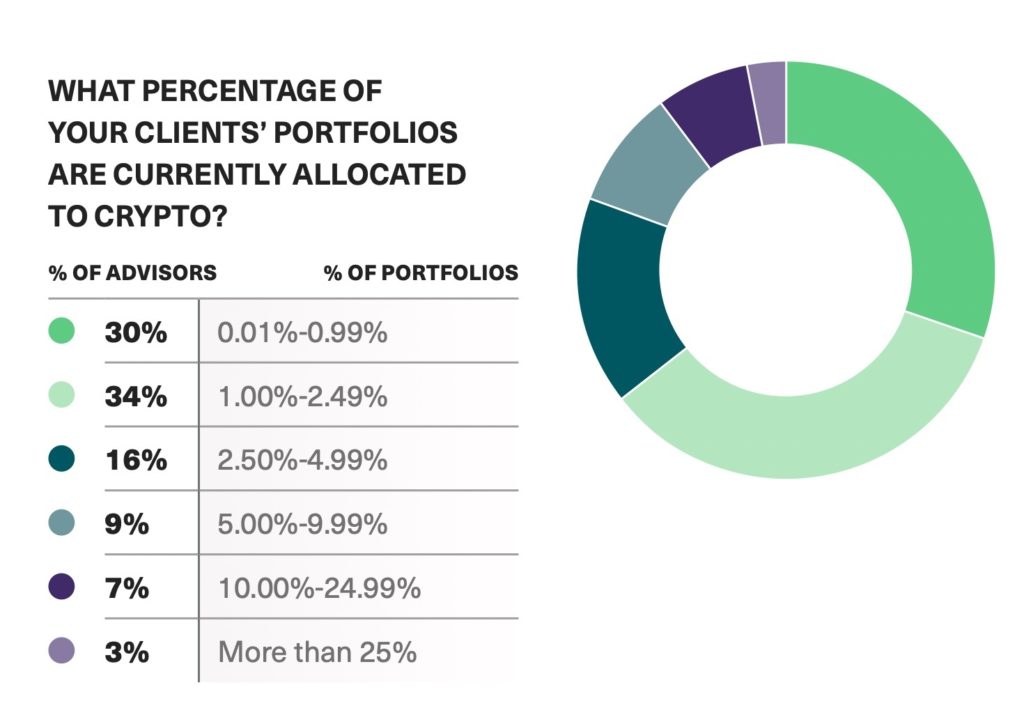

The findings, released by Bitwise Asset Management and ETF Trends on Thursday, indicate that the percentage of financial professionals investing client funds in crypto rose from 9% to 15% over the past year. Most holdings, for now, are small, with 80% of respondents capping digital assets to 5% of a given portfolio.

“Crypto has gone from a tulip craze-style fad to a real, lasting phenomenon,” ETF Trends Managing Editor Lara Crigger told Blockworks. “Advisors can’t just ignore the questions anymore. They must be proactive about crypto education, not just for their clients but for themselves.”

The survey included 619 responses from independent registered investment advisors, broker-dealer representatives and financial planners in the US.

Allocations to the space grow

To go along with the 15% of advisors that invested in crypto last year, an additional 14% said they will “probably” or “definitely” have crypto holdings this year.

The expected increase comes as 94% of advisors reported receiving questions from clients about crypto in 2021, up from 81% the year before

Crigger said she expects advisors adding crypto to their clients’ investment mix to rise sharply, noting that 47% of advisors said they have personal crypto holdings — a near-doubling from the year before.

“Seems like an odd mismatch, perhaps, but I think advisors aren’t willing to put their clients in something that they haven’t experienced for themselves,” she said. “Right now, they’re conducting hands-on research, using their own accounts. If it makes sense, they’ll apply that knowledge to their clients’ portfolios.”

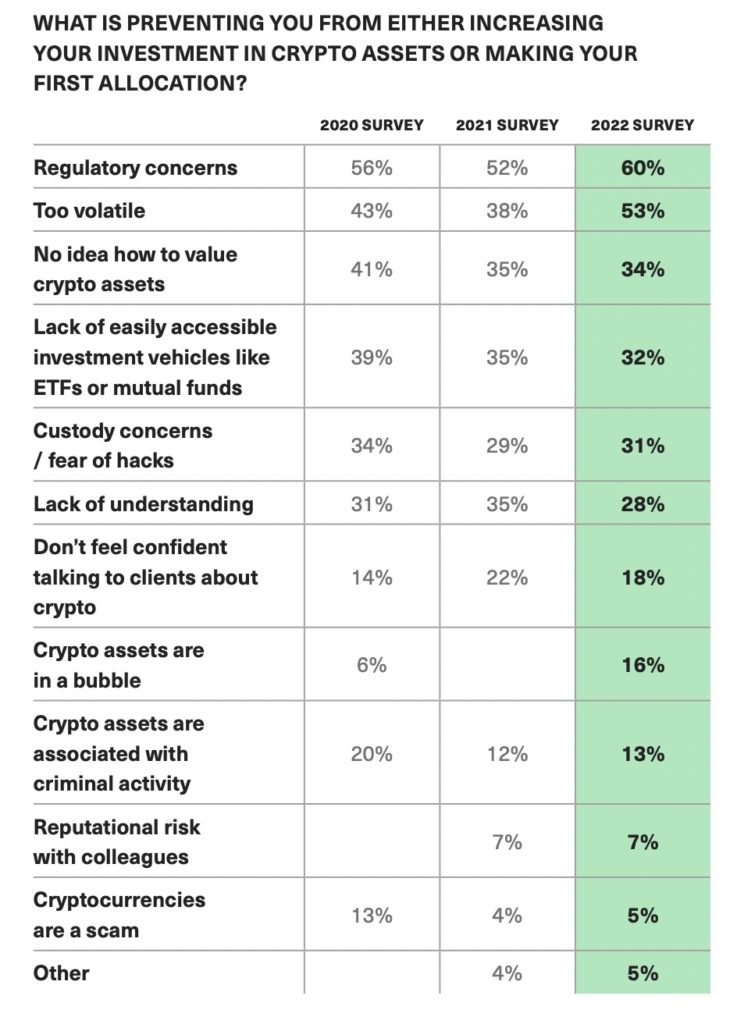

More advisors than now, however, are remaining on the sidelines, citing volatility concerns, plus a lack of regulatory clarity.

Though more than half of respondents said they’re concerned about volatility, the same number believe that bitcoin will top $100,000 within five year. Just 15% last year estimated the cryptocurrency would rise that high over the same period.

Bitcoin traded around $42,600 at 4 p.m. ET on Thursday, up 1.8% over the last 24 hours.

Ways to invest in crypto

Though the US Securities and Exchange (SEC) approved bitcoin futures-based ETFs to hit the market in October, the agency has not yet approved an ETF that would invest in bitcoin directly.

The SEC on Thursday denied a bitcoin ETF proposed by First Trust and SkyBridge Capital, according to a filing.

The survey found that 82% of advisors said they’d prefer investing in a spot bitcoin ETF versus a futures-based alternative — which could be a long ways off in the U.S.

Meanwhile other advisors are focused on investing in the stocks of companies with exposure to digital assets. About 46% were bullish on buying crypto-related equities, compared to 45% interested in buying crypto outright.

The outlook on blue-chip crypto stocks such as Coinbase has become more rosey lately as companies look to diversify their revenue streams. Bank of America Research Analyst Jason Kupferberg said in a research note earlier this month that he’s upgraded Coinbase to a buy rating as the company plans to add products this year.

Research professionals at Ark Invest have said that Coinbase’s position as a crypto on-ramp and its additional planned launches make it an attractive long-term play. The firm bought about 200,000 shares of Coinbase across three of its ETFs over a two-day span earlier this month.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.