Mining Mutualism: Renewable Energy and Crypto Mining

Cryptocurrency mining has the potential to address the obstacles to more widely adopting renewable energy

Blockworks Exclusive Art by Axel Rangel

- Bitcoin mining can effectively act as a revenue diversification against curtailment, and allows wasted power to be turned into a second source of income

- While having the best technology available is important, the scale that energy projects would mine at is already advantageous in an increasingly competitive mining environment

The proliferation of renewable energy presents opportunities for cheap and sustainable power. However, numerous obstacles, including intermittency, energy storage, and grid interconnection currently jeopardize the widespread or exclusive adoption of these cheap energy resources that are now below the prices of traditional fossil fuels.

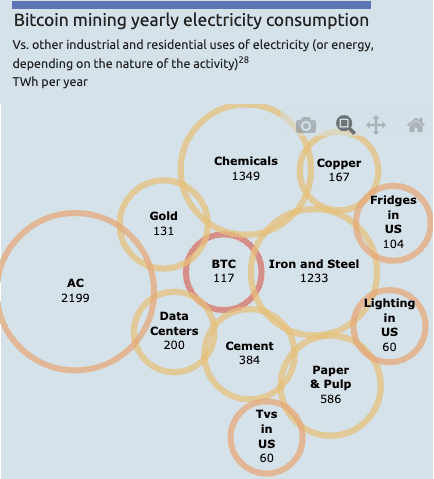

While cryptocurrency mining is often seen as a scapegoat for rising energy usage, it has the potential to boost energy project feasibility, increase electricity access and power energy intensive cryptocurrency networks with renewable power.

Promises and problems

Over the past decade, the landscape of renewable energy has rapidly changed, and solar and wind power, in particular, have greatly expanded across the US.

The levelized cost of energy has fallen substantially for numerous renewable energy sources, and many options are cheaper than the existing fossil fuels that still yield the majority of our power. These sources offer a practical, green and more efficient alternative to the status quo.

Solar energy, in particular, has followed a Moore’s law-type trajectory. Since 2010, costs have dropped by a factor of 10, and in the last decade, solar has seen an average annual growth rate of 42%.

In sun-rich geographies, seemingly improbable low prices are becoming common, as recent bids on energy contracts in Portugal and the UAE have been as low as 1.6 cents and 1.3 cents per Kwh respectively, leaving the traditional fossil fuel range of 5 cents to 12 cents in the dust.

As technology further improves, so will efficiency and scalability. Relatively minimal upkeep costs coupled with production-based tax credits have the potential to spur greater adoption, and this reality is already playing out across the US.

The near-zero marginal cost of energy can also greatly increase supply to the grid during peak-energy generation events as increased power can be generated from near-zero additional production costs (eg: cloudless or windy days).

Even without incorporating subsidies into the picture, the US Energy Information Administration sees new onshore wind and solar photovoltaic projects as cheaper alternatives to both natural gas and coal-fired power plants.

With subsidies expected through 2030 under the Biden administration’s climate and infrastructure plans, the future is ripe for renewable solutions.

Adoption obstacles

A number of obstacles impede widespread and complete adoption of these technologies, however.

Baseload power pricing of utilities encourages the use of coal and natural gas because of their ability to produce a consistent and fully-reliable energy load or baseload energy.

Grid congestion results from the intermittent nature of wind and solar energy. The outdated electricity grid across the US is often unable to handle these surges, and, in turn, congestion issues often increase energy prices, even when it is produced in excess.

Curtailment — the economic disincentivization of energy production by grid operators to balance supply and demand — underscores the monopsonistic power that energy producers are forced to contend with, impeding the widespread use of intermittent renewable energy.

Finally, the near monopsony possessed by utility providers forces solar and wind projects to sell energy at low and in some cases financially unsustainable prices because of the lack of associated options or competition with other projects.

On top of these efficacy oriented problems, the US, in particular, has an archaic framework for adopting and boosting the output of renewable energy. New entrants are forced to pay the necessary sums to upgrade grid capacity.

It is nearly impossible to receive approval for new transmission lines because of geographical regulation. Since most utility providers are regulated monopolies, they see little need for change to the status quo.

Overcoming obstacles

Cryptocurrency mining has the potential to address the obstacles to more widely adopting renewable energy. By incorporating cryptocurrency mining operations into renewable energy projects, developers can increase their profitability and pricing power.

Contrary to popular belief, large portions of the Bitcoin network’s hash rate rely on renewable energy sources. Miners are attracted to sources with extremely low levelized costs of energy, which often are solar, wind, hydroelectric and geothermal power.

Source: Pareto Technologies “Mining Mutualism“, November 2021

Source: Pareto Technologies “Mining Mutualism“, November 2021Crypto mining operations are therefore frequently tied to renewable sources, particularly in regions such as Texas and New York.

When a solar or wind project becomes operational, auxiliary bitcoin mining operations can be housed either on site or nearby. The energy that cannot be sold to the grid can be routed instead to on-site mining operations.

Electricity generation that would otherwise increase grid congestion and disincentivize production can become a second source of profit for power producers.

This alternate revenue stream also creates a price floor, giving energy providers increased bargaining power with buyers. If utilities insist on charging exceptionally low rates, energy projects could turn to low-cost cryptocurrency mining for profitability.

A scenario that incorporates mining into new projects increases the energy production from renewable sources, which can even begin to address the challenge of baseload energy because a greater number of renewable sources will allow for increased electricity production throughout the day.

More projects and innovation increases access to continual power derived from renewable sources, and a greater supply of renewable energy further accelerates the transition to a smart-grid-based energy distribution network in the US. A smart-grid system further compounds the impact renewable energy can make through both environmental and economic channels as the issues of grid congestion and transmission costs subside.

Bitcoin mining challenges

Critics argue that it is a stretch to connect bitcoin mining to the increased success and expansion of renewable energy. Both the energy and cryptocurrency industries are rapidly changing, and the uncertainties about the regulation of both fields coupled with volatile prices, uncertain liquidity and changing mining difficulty can jeopardize project success.

Bitcoin possesses volatility that can massively magnify or limit returns. At the same time, the market often does not have the liquidity to accommodate large transactions without price impact. Profit has the potential to fluctuate significantly by day as seen over the summer of 2021 when Chinese miners were forced into mass sell-offs.

Another common concern is the unpredictability of subsidies for renewable energy in the future, and how a mining-focused renewable energy producer may not be able to capitalize on the same tax breaks that generators who sell to the public receive.

Mining difficulty also poses a risk. Over the past decade, mining a bitcoin, (effectively being the first to process a complex transaction verification) has become increasingly difficult. Retail miners are struggling to compete with higher-powered industrial players. While having the best technology available is important, the scale that energy projects would mine at is already advantageous in an increasingly competitive mining environment. Additionally, the number of bitcoin received from processing a transaction drops in half approximately every four years in events referred to as halvings.

Long-term prospects

As innovation continues, renewable energy will undoubtedly have a larger global presence, both in cryptocurrency mining and electricity production.

With mining operations hosted alongside the energy production source, the increase in renewable energy generation that is supported by cryptocurrency mining creates a greater abundance of low-cost, clean sources of power.

Recently, there has been an increased focus on the role bitcoin can play as a reserve asset, and countries including El Salvador, Venezuela, and Iran have taken steps in this direction.

The ongoing improvement and adoption of renewable energy sources continue to lower the levelized cost of energy — and cryptocurrency mining will only speed up this process. Energy prices will decrease for consumers and energy-intensive businesses will become more feasible. An asset that was once accused of accelerating climate change may play a role in stopping it by helping to empower clean and low-cost solutions.