Axie Infinity Program Lead: 2022 Will Be ‘All About Gameplay’

The popular play-to-earn game intends to launch its battle experience, Origins, and a land-based gaming experience, Project K, as well as update graphics, animations and gameplay

Axie: Origins. Source: Axie Infinity

- Axie Infinity was anticipating an “aggressive target” of 250,000 users by the end of 2021, but finished the year with a community of 2.9 million members

- Campbell estimates that less than 20% of Axie Infinity’s universe has been deployed and told Blockworks that there is a lot more work to be done

Axie Infinity, a popular play-to-earn (P2E) game, experienced serious growth — and serious growing pains — in 2021. But this year, its focus will be all about gameplay, according to Andrew Campbell, an Axie Infinity program lead who spoke to Blockworks.

2022 is all about launching its battle experience, Origins, and a land-based gaming experience, Project K, said Campbell, whose official title is program lead for Esports and content creator programs at Sky Mavis (the company that develops Axie Infinity).

In addition to updating game graphics, animations and gameplay, Campbell said, “We’re creating more options, more complexity and less random elements,” he said.

Each of these games will include a number of new features that will affect the economy balance, the company said in a post. Origins is targeted for a second quarter 2022 release, Campbell noted.

Growing pains

Sky Mavis launched Axie Infinity in May 2018 as a virtual world P2E game where users earn cryptocurrency rewards that can be sold on centralized exchanges like Binance or can be swapped for ether, USDC or Axie governance tokens (AXS) on Axie Infinity’s decentralized exchange.

Specifically, players can trade, battle and breed NFT pets called Axies — which is similar to a Pokémon-style investment opportunity. The big difference is that there is a market for in-game resources, such as Axie’s body parts and appearances, that are open and controlled by players, the company said.

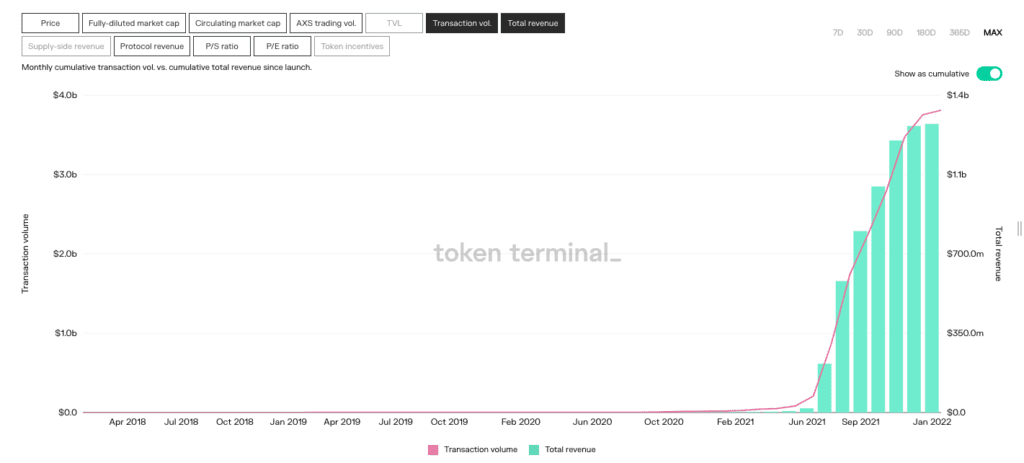

During the second half of 2021, Axie Infinity saw an unexpected jump in players and transaction volume with a monthly cumulative transaction volume of about $3.8 billion in December 2021, up from $206 million in transaction volumes in June 2021, according to data from Token Terminal.

By the end of 2021, the game’s total revenue reached about $1.3 billion, compared to $18.8 million six months earlier.

Monthly cumulative transaction volume vs. cumulative total revenue since launch.

Monthly cumulative transaction volume vs. cumulative total revenue since launch.Source: Token Terminal

The Axie team was not prepared for its success, according to Campbell. Originally, it was anticipating an “aggressive target” of 250,000 users by the end of 2021, but finished the year over 1,000% higher with a community of 2.9 million members.

“We never expected to have this many users, so we were not prepared for that,” he said. “Our servers couldn’t handle it.”

Managing the growth

Due to its massive growth in such a short timeframe, Axie developers had to focus on scaling its infrastructure to accommodate demand, Campbell said. This focus slowed down the launch of the next phase of the game, which is Origins.

Instead the Axie team spent the better part of a year building out blockchain components made specifically for the game, which consisted of staking as well as an Ethereum-linked sidechain Ronin and its DEX Katana.

“Now we’re set for the foreseeable future in terms of scaling in that regard, but it really slowed down our progress of launching Origins and [Project K].”

In October 2021, Axie Infinity launched a staking program for its governance tokens, Axie Infinity Shards (AXS) and Smooth Love Potion (SLP), which introduced a new component to its gaming ecosystem. As a result, AXS holders can stake their tokens and, in the process, earn rewards over a five-and-a-half-year span, Blockworks previously reported.

The ‘tip of the iceberg’

2021 was an eye-opening year for the team, according to Campbell — not just in the growth of the game’s user base but also in expansion plans for Axie beyond gameplay.

On top of the game’s growth story, its parent company Sky Mavis closed $152 million in a Series B funding round, bringing its valuation to $3 billion at the time of the raise. The capital will be used for staff expansion, scaling infrastructure and to build its own distribution platform, according to Sky Mavis.

“We see this whole world being very user-generated in some way and really has a huge ceiling in terms of different things you can use your Axies for,” said Campell. “I think it gets really exciting when you start thinking about the different games that people could build around Axies and the different applications that people will be able to build on Ronin and plug into the blockchain universe.”

Campbell estimates that less than 20% of Axie Infinity’s universe has been deployed and said there is a lot more work to be done.

“This is really just the tip of the iceberg of how we think about this project and this giant universe we’re trying to deploy,” he said. “We say this a lot, but this is just the beginning,” he added.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.