Bitcoin bull market nears 800th day, altcoin season still far away

The past three bull markets have lasted around 1,000 days on average

Artwork by Crystal Le

This is a segment from the Empire newsletter. To read full editions, subscribe.

Today marks day 799 of the bitcoin bull market.

That’s about 26 and a half months of positive price action. A little more than two years. Cheers to that!

It’s tough to say exactly when bull markets start and end in crypto. Old-world definitions — based on 20% retracements from local highs and so on — have no power here.

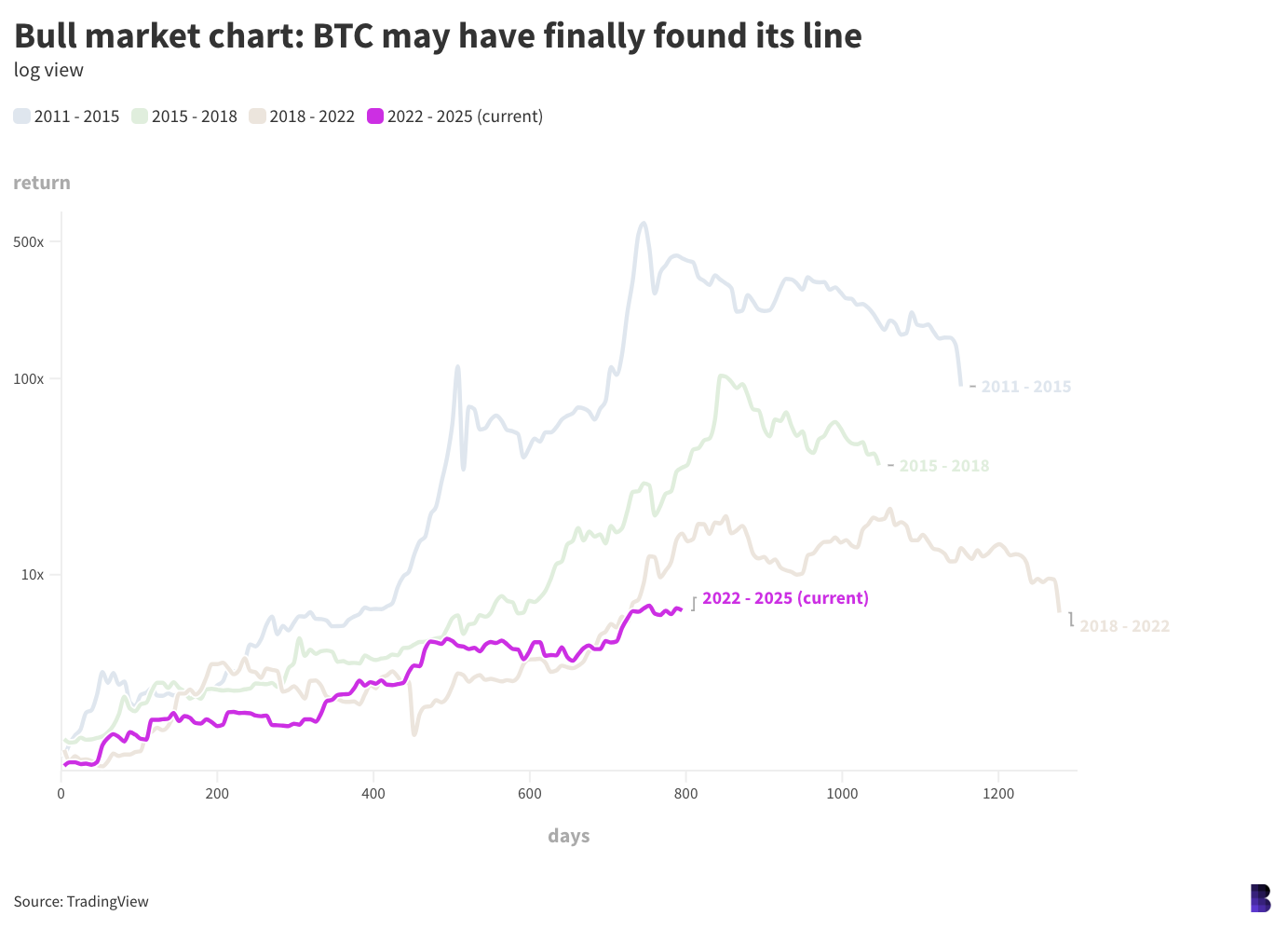

Drawdowns of that size just happen way too often on the way up. Still, by my very rough estimates, the past three bitcoin bull markets going back to 2011 have lasted, on average, somewhere in the region of 1,000 days.

So, usually it goes that it takes less than three years for bitcoin to go from the bottom of the previous bear market, through to cycle peaks, down to a crash that in retrospect clearly put an end to any upward trajectory.

The good news: Bitcoin is looking super healthy this cycle when mapped to the previous three. Even after this correction.

Bitcoin’s performance during this bull market — which started at the end of 2022 — to date is shown on the chart above in log view. It’s done 6.6x so far, going from $15,474 to $99,000 as of this morning.

Notice how, for most of the cycle, BTC has tracked ahead or just below the brown line, which plots its performance during the prior bull cycle between 2018 and 2022.

BTC diverged below around 50 days ago, at the start of December. But that’s okay: We already know bitcoin returns are diminishing every cycle.

Its current trajectory better fits the pattern — all bull market cycles have followed a similar trajectory, it’s just less pronounced each time.

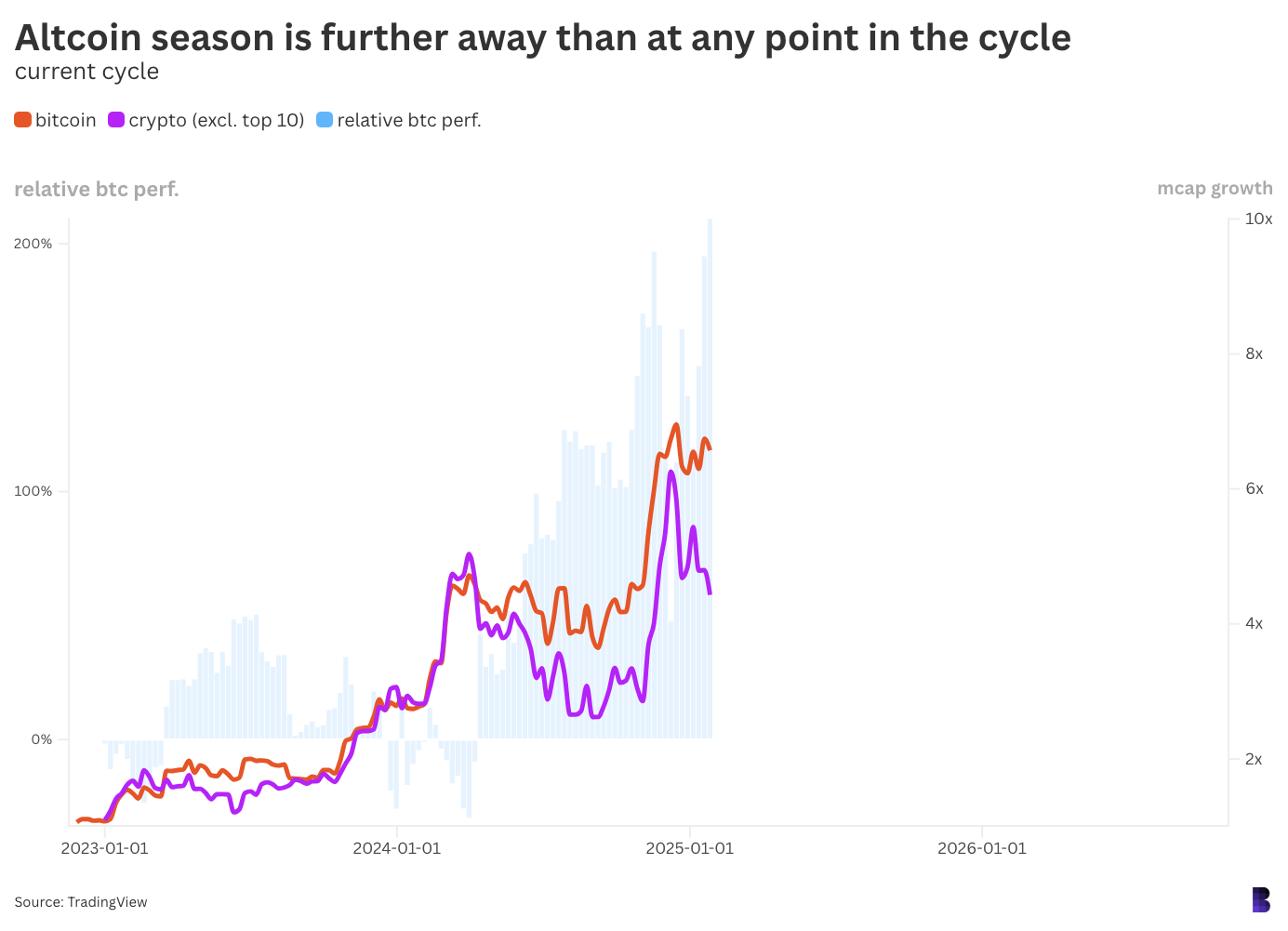

The bad news: We are no closer to a bonafide altcoin season, even after big rallies in coins such as XRP and TRUMP.

This one charts the market cap growth of bitcoin (in orange) and the altcoin market (purple) for this bull market. As you can see, altcoins are suffering deeper losses but have still done 4.4x.

The blue columns in the back show the relative performance of bitcoin to altcoins — bitcoin is now more than 210% ahead of altcoins, the largest distance of the cycle. That’s too much for any real altcoin season.

Like bull and bear markets, “altcoin season” has no formal definition. It’s more of a vibe.

Empire has done its best to quantify it: Altcoin seasons potentially begin when the market cap growth of the altcoin market, over the bull market to date, exceeds that of bitcoin’s.

An altcoin season is only confirmed when altcoins have outpaced bitcoin for 90 consecutive days or more.

Ninety days sounds like a lot, but backtesting with those conditions provides three distinct altcoin seasons throughout crypto’s history:

- the early innings of the Ethereum ICO era between mid-2016 and early 2018,

- the first half of 2019 when many altcoins outperformed bitcoin, and

- most of 2020’s DeFi Summer through to crypto’s all-time high in November 2021.

Perhaps the next altcoin season will look a lot different. For now, it’s still all about bitcoin.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.