Bitcoin And Ethereum Maximalism: Silly And Self-Defeating

Maximalists rejoice! This article will deeply trigger you, leading to indignant tweets with tons of engagement!

Planet Crypto for Blockworks

Maximalism is one of the least attractive philosophies in crypto.

It’s the belief that any given blockchain is fit for all purposes, and that other blockchains are therefore inherently useless and of no value.

This is as dumb as it sounds.

The original maximalists were Bitcoiners, many of whom predate the era of smart contracts.

According to Bitcoin maxis, the Bitcoin blockchain is capable of almost any functionality that later chains have added; or they assert, bizarrely, that any functionality not supported by the Bitcoin blockchain is not useful, and is therefore unnecessary.

Never mind that Bitcoin is often slow, and somewhat expensive for everyday transactions.

I’m a pretty big fan of Bitcoin. It has many strengths, not least the fact that it’s decentralized, secure, an excellent way to store value, and pretty much censorship-resistant. This makes it useful for all manner of things; some anticipated and desirable, some less so.

I’m also a major admirer of Ethereum. It is also highly decentralized, and it has a fantastic community of developers and builders who have created thousands of useful and utterly new applications on Ethereum.

It’s also a little expensive, scaling it has involved a lot of compromises and a confusing array of solutions, its governance is tricky, and the manner of its launch made a few people who probably deserved it very rich (as well as a couple of folks who were just lucky enough to be in the room at the time).

And I’m excited about lots of other foundational blockchains, some of which have features they don’t really share with Ethereum or Bitcoin, some of which are optimized for transaction cost, or volume, or some other metric.

I try to imagine what it must be like to assert, contrary to logical analysis, that MY blockchain is the ONLY blockchain.

And I guess it must be the equivalent of having just one tool in your garage, a drill, and wanting to use that drill for every home improvement project.

Hanging some drywall? Drill it! Repairing the stucco? Drill it! Fixing the plumbing? Drill it!

Of course, we can’t necessarily have exactly the right tool for every single situation. Your car, for example, may be a compromise car.

Maybe you own a Toyota Camry. It’s not designed to go extremely fast around corners. It wouldn’t be much good off-road. It doesn’t haul half a ton of lumber.

Essentially the Camry is the Ethereum of cars. It does a bit of everything, which makes it a great solution for people who need their car to do a bit of everything.

But let’s say you need your blockchain to be very, very good at one thing.

For instance, you are designing for the billion or so gamers out there.

Gamers don’t want to pay little fees every time they mint an NFT achievement like clearing a level in record time, or collect an item they might use in a sequel.

So maybe you need a blockchain that has no fees.

That takes some pretty specialist design. Ethereum can’t, by its very nature, support that precise need.

Maybe you need your blockchain to be more private, or more secure, or much faster, or infinitely scalable, or to support some novel quantum-resistant cryptography. There are lots of reasons you might be prepared to trade all the usefulness of Ethereum for something very, very specific to your needs.

In which case, maximalism is exposed as a fraud.

Sure, clever folks have figured out lots of workarounds to make Ethereum more useful. In much the same way that Toyota figured out a nicer set of features to appeal to the customer who orders the loaded Camry – a better stereo, a more powerful engine, quad exhaust tips (don’t get me started).

But a very nicely-equipped Camry is still not a Mercedes.

No matter how you slice it, Ethereum is a general use blockchain suitable for most general uses.

It is not the answer to every single real-life use case.

Which is why maximalism, in all its forms, no matter what blockchain the maximalist is maximizing, is an indication of a minimalist level of intellectual curiosity and honesty.

Not to mention: We’re ostensibly all in this together, right? We all want roughly the same thing: A better way of doing things, for the betterment of our experience on this planet?

We get there by collaborating, cooperating, working to find the right tool for the right job. Not by screaming at each other for daring to suggest that a general-purpose blockchain may not fit every use case.

Ethereum is a great innovation, it has a wonderful community and almost endless uses. Bitcoin is a remarkable and world-changing accomplishment, one that has opened countless minds to new possibilities.

Neither of them is perfect. And that’s okay.

A version of this op-ed first appeared in Blockworks’ newsletter. Signup below.

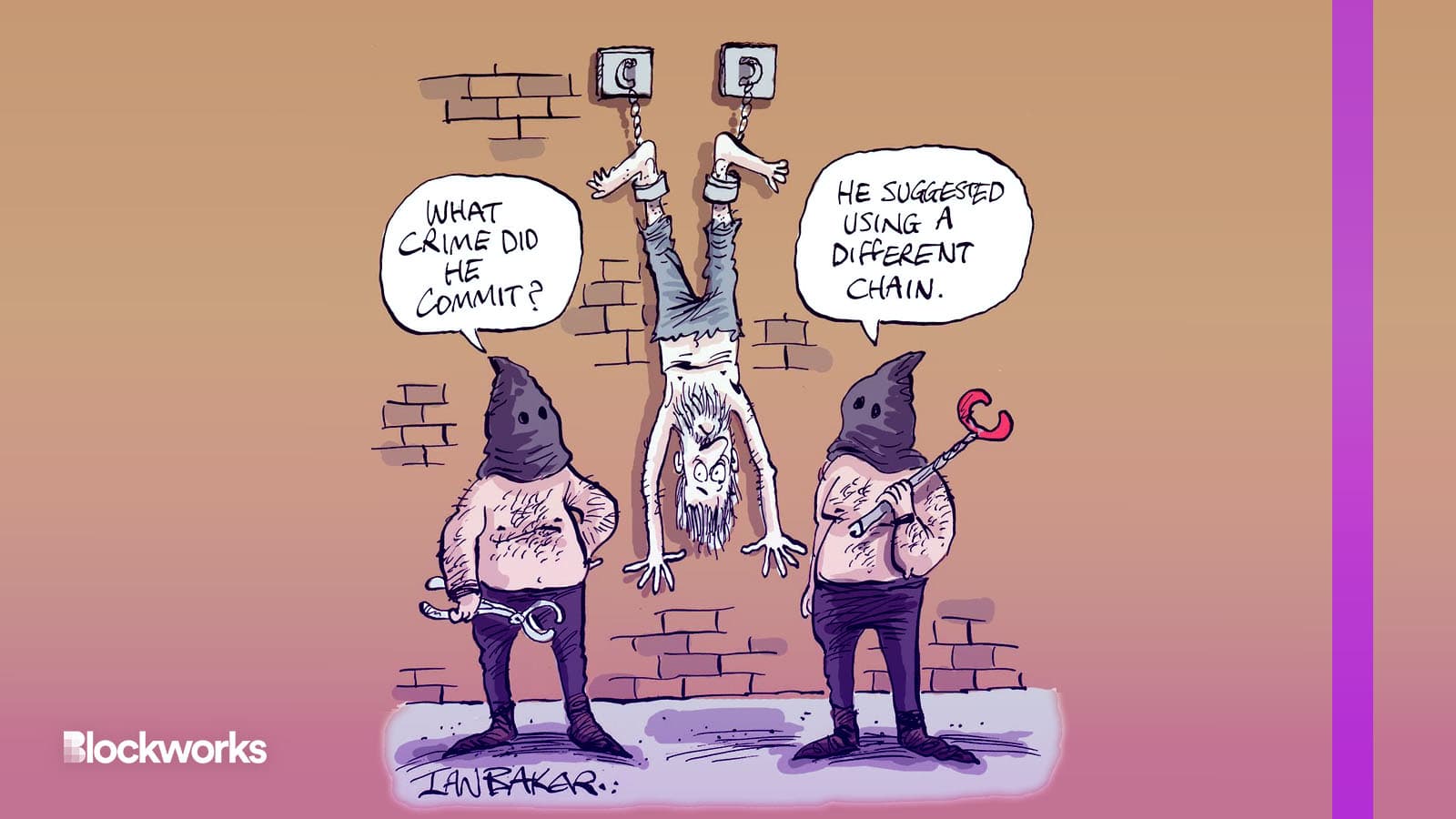

Illustration by Planet Crypto for Blockworks.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.