Bitcoin Miner Argo To Sell Largest Facility to Stay Afloat, Stock Doubles

Argo Blockchain is selling its Texas facility to Galaxy and will use bitcoin mining rigs as collateral for a $35 million loan

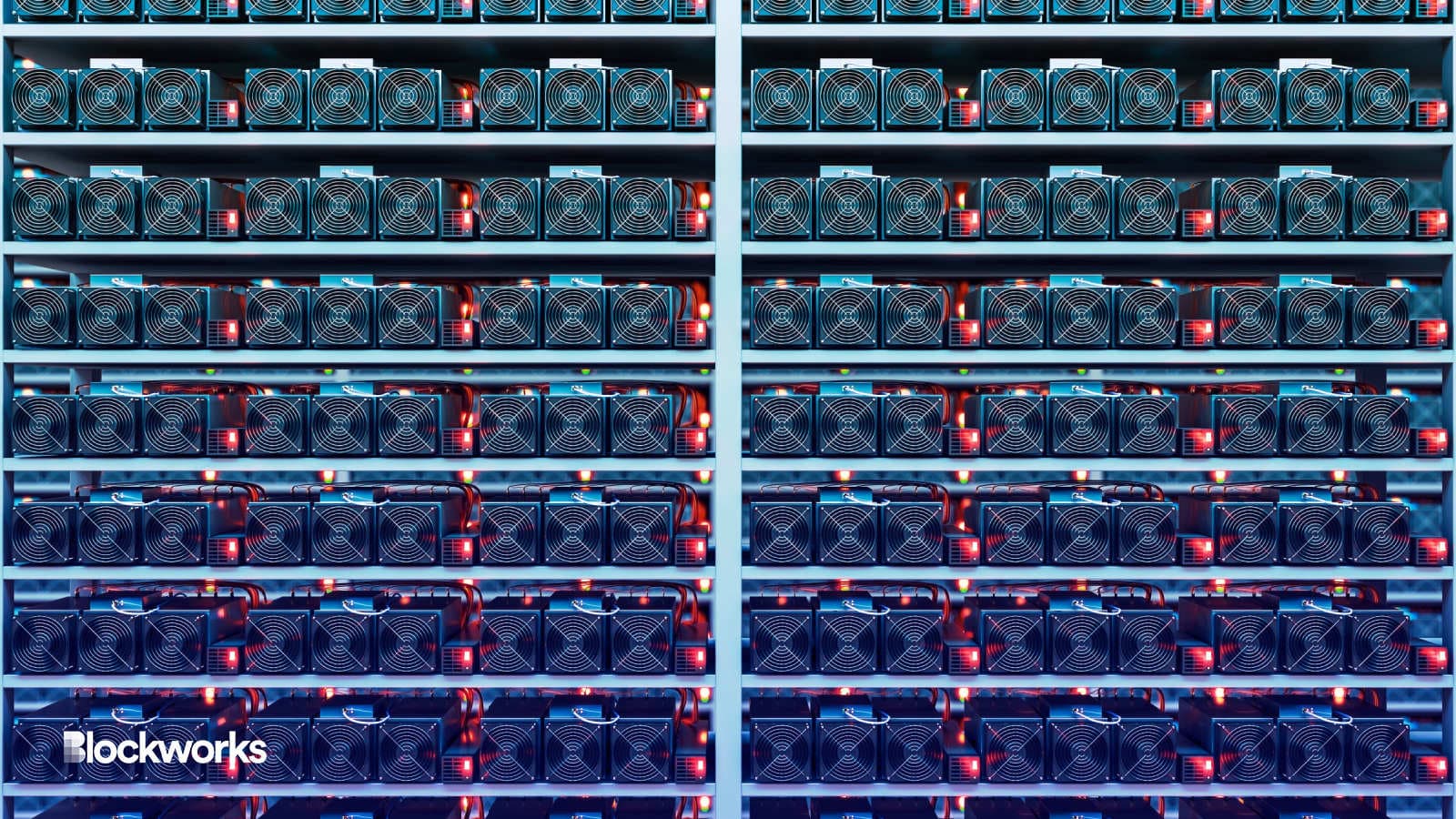

GreenBelka/Shutterstock, modified by Blockworks

Bitcoin miner Argo Blockchain is letting go of its largest mining facility to avoid going bust, but will retain ownership of its rigs.

Argo is selling its flagship Helios plant located in Dickens County, Texas to Galaxy Digital for $65 million, it said in a release on Wednesday.

Helios, which spans 135,000 square feet, is the world’s largest immersion-cooled mining facility and has access to 800 megawatts (MW) of electricity, according to its website.

Galaxy will host Argo’s bitcoin rigs moving forward under a two-year agreement. The transaction is set to close on Wednesday, Dec. 28.

The London-headquartered firm says the deal will reduce Argo’s overall debt load by $41 million and simplify its operating structure.

Under the deal, Galaxy will additionally extend an asset-backed loan worth $35 million to Argo. This loan will be secured by collateral including the 23,619 Bitmain S19J rigs located at Helios, as well as other machines located at Argo’s data centers in Canada.

Cash proceeds from the sale of the Dickens County facility will be used to repay debt, prepayment interest and other fees, including $84 million owed to NYDIG.

“Although we have sold the Helios facility, we haven’t sold any of our mining machines,” CEO Peter Wall said in a video message. “Those are going to continue to mine at the Helios facility.”

Earlier this month, Argo warned investors it may not have funds to last until the end of the year. The miner hinted it was in advanced negotiations to sell some assets under an equipment financing transaction, and that it hoped to secure a deal without filing for bankruptcy.

The firm now says it will refocus its efforts on its Canadian operations, which it says are unaffected by the Galaxy deal “except for the use of certain mining machines and other assets located in Quebec as collateral for the asset-backed loan.”

“Initially, Argo plans to refocus its efforts on growing and optimizing operations at its two data centers in Quebec, which are powered fully by low-cost hydroelectricity.”

Argo’s farms in Quebec, Canada are smaller. The one in Base Comeau, Quebec is spread over 40,000 square feet and wields 15 MW of capacity while the one in Mirabel covers 20,000 square feet with 5 MW.

Argo CEO hopes to see other side of the bitcoin bear

Still, markets responded positively to news that Argo could avoid bankruptcy in the short term, more than doubling on the London Stock Exchange (LSE).

Argo shares also jumped 50% during pre-market Nasdaq trade, although it’s still down more than 90% year to date.

Argo had requested its Nasdaq-listed stock be suspended for trading on Tuesday leading up to the announcement. The firm’s LSE shares were briefly suspended earlier this month.

The miner said it won’t report third-quarter results this year. The stock is overseen by the UK Financial Conduct Authority, which requires the company to announce results only twice a year.

Alongside Argo, bitcoin miners have taken a beating from high energy prices, low token prices and unmanageable debt obligations. Core Scientific, one of North America’s largest mining operations, filed for bankruptcy last week.

Argo CEO Wall said the company has been through bear markets before and learned that these cycles must be navigated to survive.

“The key is to do well when things are good, and then to make sure that you’re able to continue through the hard ones so you can get to the other side,” he said.

Updated Dec. 28, 2022 at 6:30 am ET: Clarified date of Argo’s LSE suspension.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.