Bitcoin Mining Shifts to N. America Amid Fee Compression

Transaction fees are at historical lows, but block subsidies are still attractive.

Bitcoin ASIC miners

- Transaction fees paid to miners have dropped to a low not seen since March 2020

- Investors in the industry remain confident in North American infrastructure shift trend

Transaction fees paid to bitcoin miners are at a low not seen since the Covid crash of March 2020, but experts think the decline is unlikely to affect the industry’s mining push into North America due to block subsidies which will remain in place until sometime in the spring of 2024.

As of writing, bitcoin can be sent for 5 “satoshis” per byte (currently about $0.35), even at a high priority, meaning the transaction will be processed in the next block, or 1 satoshi per byte (about $0.07) if you’re willing to wait for 20-30 minutes. The fee is not linked to the value of the transaction, so a person could even send $1 billion for 7 cents and have settlement essentially guaranteed within a couple of hours.

How it works

The Bitcoin blockchain is made up of “blocks” of transaction data, cryptographically linked together. Blocks can vary in size (think of them as a page of a ledger or record book), based on a variety of factors. Currently, each block is approximately 1MB in size.

Block subsidies are rewards given to miners for their effort in securing the network and are determined by an algorithm in the protocol’s source code. Subsidies are distributed upon the completion of a new block after the preceding one is finished, which occurs — on average — every 10 minutes.

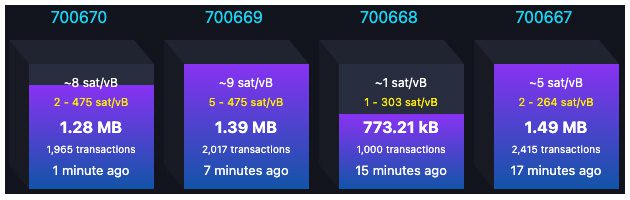

Recently mined Bitcoin blocks; Source: mempool.space

Recently mined Bitcoin blocks; Source: mempool.spaceCurrently, the block subsidy is 6.25 bitcoins per block completed. Block subsidies comprise one part of the revenue miners generate from their activities. The remainder is transaction fees — the fees users of the blockchain pay to send bitcoin over the network.

Transaction fees matter

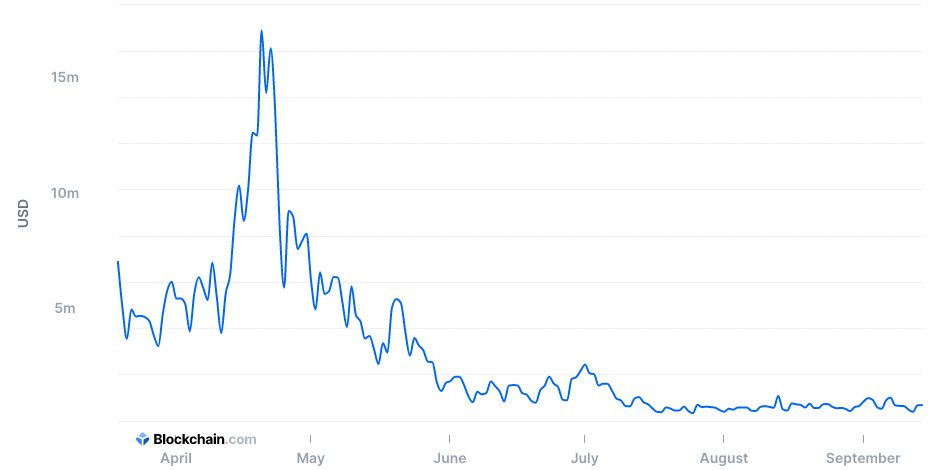

Transaction fees have fallen sharply since mid-April, due to a combination of lower network activity and growing capacity on the Bitcoin layer-2 Lightning Network.

Fee revenue since April 2021; Source: blockchain.com

Fee revenue since April 2021; Source: blockchain.com

“Although fees declining isn’t great for miners, I don’t see this as a long-term issue. We are still so early in the digital asset adoption curve that I think this will iron itself out over time,” Brian Dixon, Chief Operating Officer of Digital Currency and Blockchain asset management firm Off the Chain Capital, told Blockworks. “Most well-known mining operations are very profitable and can sustain themselves during this period of volatility.”

Indeed, in an August 3 note, Compass Point Research analyst Michael Del Grosso gave publicly listed miner Marathon Digital a buy rating, and called Riot Blockchain, another miner, a buy in an August 24 note.

Kevin Zhang, vice president of business development at Foundry, a Digital Currency Group subsidiary that provides financing for bitcoin and other mining equipment, also agrees that fee compression isn’t a huge deal for miners and won’t be making a “direct impact into the investment thesis or expansion plans in North America.”

“That being said, longer term, if the price of bitcoin in USD doesn’t continue to appreciate along the same pace as hashrate and network difficulty then the fee’s will need to increase to offset the lost revenue over time,” he added.

The hashrate factor

Bitcoin is programmed such that subsidies become easier or harder to achieve depending on the amount of hashrate available, and is updated roughly every two weeks to keep the average block time consistent. Increased hashrate improves the security of the network and is correlated with the $BTC price.

Despite some market volatility, generally speaking the mining industry has been on a bit of a bull run as it moves to North America from China given the recent crackdowns in-country on the industry.

“It’s been a huge net positive for the market,” said Dixon, noting that as an investor he’s seen significant interest from energy companies looking at how bitcoin mining can use off-peak power making the grid more efficient overall.

Several of the largest US-listed bitcoin mining firms with operations predominantly in North America have collectively mined over 10,500 BTC year-to-date with nearly 40% of the output coming from the past two months, according to Off the Chain Capital. Five of the largest bitcoin mining firms have added almost all of their mined bitcoin to their balance sheets — adding up to 17,960 BTC as of August, valued at around $820 million, the firm also noted.

Dixon said that it’s going to take some time before companies are able to ramp up to full capacity. Generally, bitcoin miners don’t use data centers, but prefer to build out their own hosting facilities, which will take some time given the tight labor market in the US. And then there’s the monumental task of getting all the dedicated mining machines to North America, in spite of the challenging freight market.

“This isn’t going to happen tomorrow,” Dixon said. “Covid continues to be a challenge when you are moving this much freight between countries.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.