Bitcoin Slides Below $46,000 on Its 13th Birthday: Markets Wrap

BTC briefly trades below $46,000 on the 13th anniversary of the genesis block being mined

Source: Shutterstock

- BTC briefly trades below $46,000 on its 13th birthday

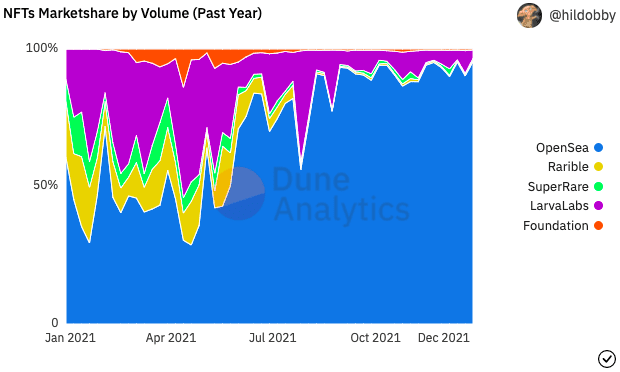

- OpenSea dominates secondary NFT marketshare

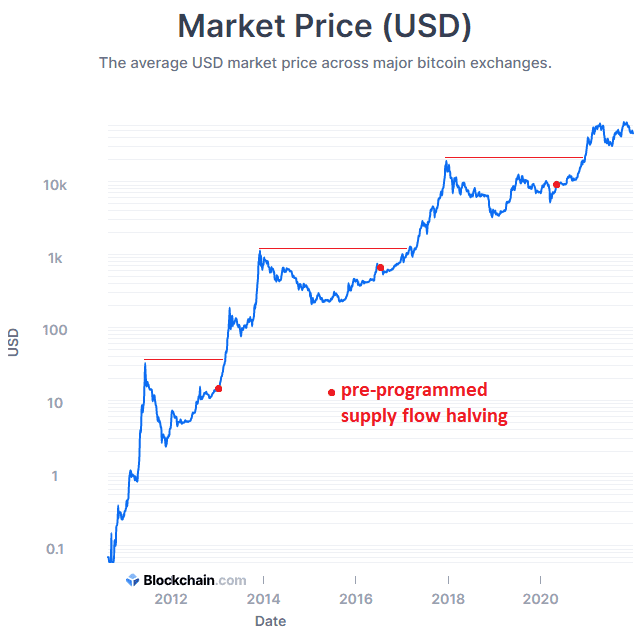

Today marks the 13th anniversary since the genesis block was mined on the Bitcoin network on Jan. 3, 2009.

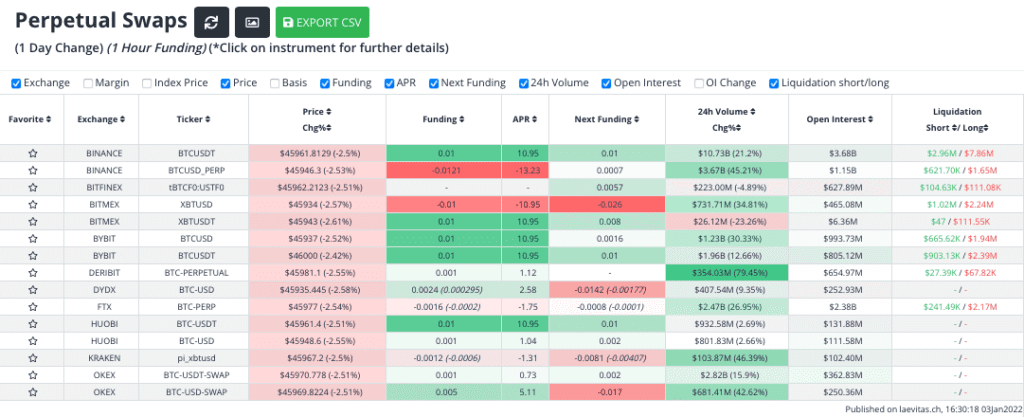

Perpetual funding rates remain mixed as traders place their bets on BTC price action.

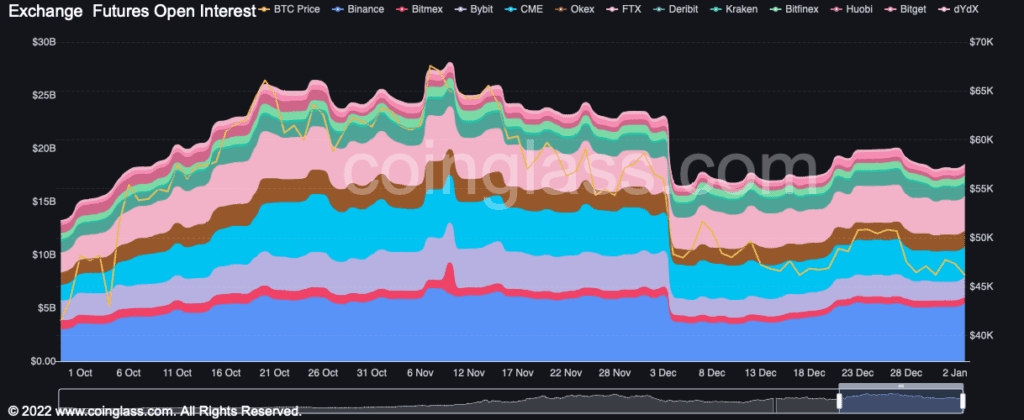

Futures open interest increased to $18.45 billion from $18.11 billion yesterday.

OpenSea dominated the Ethereum secondary NFT market share throughout 2021.

Latest in Macro:

- S&P 500: 4,796, +0.64%

- NASDAQ: 15,832, +1.20%

- Gold: $1,801, -1.49%

- WTI Crude Oil: $76.03, +1.09%

- 10-Year Treasury: 1.637%, +0.139%

Latest in Crypto:

Bitcoin turns 13 years old

Today marks the 13th anniversary since the genesis block was mined on the Bitcoin network on Jan. 3, 2009, according to Investopedia.

Lyn Alden, founder of Lyn Alden Investment Strategy, wrote on Twitter, “Bitcoin is 13 years old today, the anniversary of the genesis block. It’s an angsty teenager now, I suppose, which actually kind of fits. The US dollar in its current fiat form is 50 years old, born in 1971. Bitcoin is now more than 1/4th as old as the current US dollar”.

Source: @LynAldenContact

Source: @LynAldenContactBTC slips below $46,000

Despite the anniversary, BTC price action has been sluggish. BTC briefly traded below $46,000 after trading near $47,500 in the middle of the day, according to data from CoinGecko.

Perpetual funding rates remain mixed, according to information for laevitas.ch, which implies a lack of consensus on price direction amongst perp traders.

Source: Laevitas.ch

Source: Laevitas.chMinimal liquidations

Although BTC has trended towards the downside today, there has been an underwhelming amount of long liquidations: $29.57 million according to Coinglass.com.

Futures open interest has increased to start out the new year. As seen in the following chart from Coinglass, this is slightly abnormal behavior to see futures open interest increase on a red day. Increased open interest implies more leverage in the market, which increases the probability of an explosive move to the upside or downside as traders are forced to close their positions if it isn’t going their way.

Source: Glassnode

Source: GlassnodeNFTs

OpenSea dominated Ethereum secondary NFT trading volume in 2021, according to data from Dune Analytics.

Source: Dune Analytics

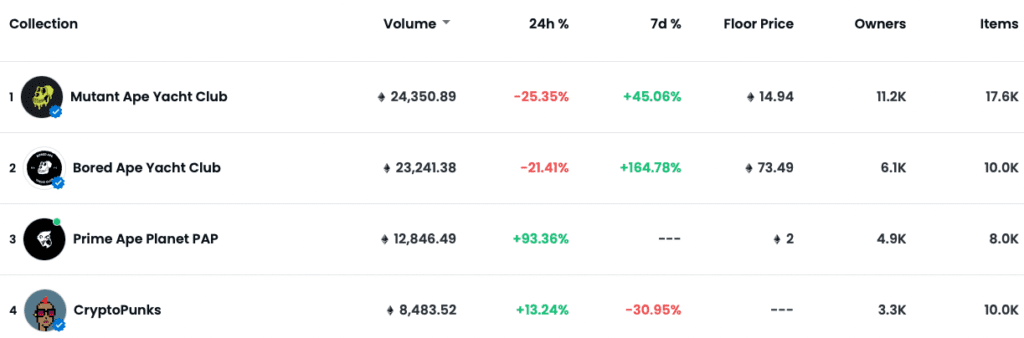

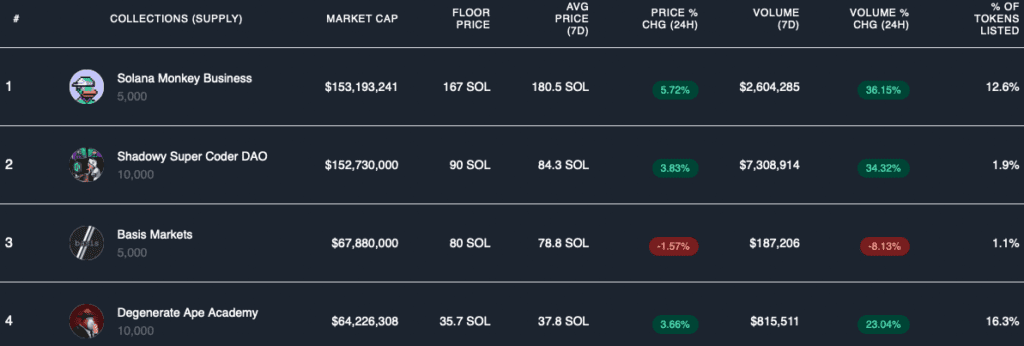

Source: Dune AnalyticsTrading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.